Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

bhs

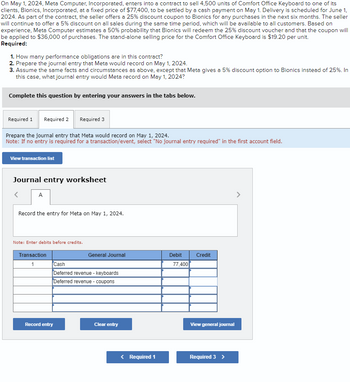

Transcribed Image Text:On May 1, 2024, Meta Computer, Incorporated, enters into a contract to sell 4,500 units of Comfort Office Keyboard to one of its

clients, Bionics, Incorporated, at a fixed price of $77,400, to be settled by a cash payment on May 1. Delivery is scheduled for June 1,

2024. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller

will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on

experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher and that the coupon will

be applied to $36,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.20 per unit.

Required:

1. How many performance obligations are in this contract?

2. Prepare the journal entry that Meta would record on May 1, 2024.

3. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to Bionics instead of 25%. In

this case, what journal entry would Meta record on May 1, 2024?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Prepare the journal entry that Meta would record on May 1, 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

A

Record the entry for Meta on May 1, 2024.

Note: Enter debits before credits.

Transaction

1

Cash

General Journal

Debit

Credit

77,400

Deferred revenue - keyboards

Deferred revenue-coupons

Record entry

Clear entry

View general journal

Required 1

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.arrow_forwardOn May 1, 2024, Meta Computer, Incorporated, enters into a contract to sell 6,000 units of Comfort Office Keyboard to one of its clients, Bionics, Incorporated, at a fixed price of $106,800, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2024. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher and that the coupon will be applied to $12,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.80 per unit. Required: 1. How many performance obligations are in this contract? 2. Prepare the journal entry that Meta would record on May 1, 2024. 3. Assume the same facts and circumstances as above, except that Meta gives a 5%…arrow_forwardOn May 1, 2021, Meta Computer, Inc., enters into a contract to sell 6.100 units of Comfort Office Keyboard to one of its clients, Bionics Inc., at a fixed price of $103,700, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2021. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $61,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.00 per unit. Required: 1. How many performance obligations are in this contract? 2. Prepare the journal entry that Meta would record on May 1, 2021 3. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to…arrow_forward

- On May 1, 2018, Meta Computer, Inc., enters into a contract to sell 5,000 units of Comfort Office Keyboard toone of its clients, Bionics, Inc., at a fixed price of $95,000, to be settled by a cash payment on May 1. Deliveryis scheduled for June 1, 2018. As part of the contract, the seller offers a 25% discount coupon to Bionics for anypurchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same timeperiod, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probabilitythat Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $20,000 of purchases.The stand-alone selling price for the Comfort Office Keyboard is $19.60 per unit.Required:1. How many performance obligations are in this contract?2. Prepare the journal entry that Meta would record on May 1, 2018.3. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to…arrow_forwardOn May 1, 20x6, Chrome Computer Inc., enters into a contract to sell 5,000 units of keyboard to one of its clients, Website Inc., at a fixed price of P95,000, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 20x6. As part of the contract, the seller offers a 25% discountcoupon to Website for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Chrome Computer estimates a 50% probability that Website will redeem the 25%discount voucher, and that the coupon will be applied to P20,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is P19.60 per unit. Assume the facts and circumstances as above, except that Chrome gives a 5% discount option to Website instead of 25%. In this case, what journal entry would Chrome record on May 1, 20x6? a. DR Cash 95,000 CR Deferred revenue – keyboards…arrow_forwardOn November 1, 2021 a customer enters into a contract with MyWatch, Inc. to purchase an eWatch plus a one year internet data plan for the watch for a combined price of $700. Each item may be purchased separately from MyWatch, Inc. The standalone selling price of the eWatch is $500 and the standalone selling price of the one year internet data plan is $300. The customer pays MyWatch, Inc. $400 when the contract is signed. MyTWatch, Inc. bills the remaining $300 balance evenly over the contract period of one year. What is the correct accounting for the sale of the ewatch and the data plan? Question 19 options: a) MyWatch would record unearned revenue of $200 when the customer takes control of the ewatch. b) MyWatch would record sales revenue of $500 when the customer takes control of the ewatch. c) MyWatch would recored sales revenue of $438 when the customer takes control of the ewatch.…arrow_forward

- ssarrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.7 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 24%. Required: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $25.1 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%. Required: 1. & 2. Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024? Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. Note: Enter your answers in whole dollars. If no entry is required for a…arrow_forward

- LCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.4 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 24%. Required: 1. & 2. Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Req 1 and 2 Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. Note: Enter your answers in whole dollars. If no entry is required for a…arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $25.1 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%. Questions: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardPina Universe charges an initial franchise fee of $ 234,000. Upon the signing of the agreement, a payment of $ 26,000 is due. Thereafter, 5 annual payments of $ 41,600 are required. The credit rating of the franchisee is such that it would have to pay interest at 9% to borrow money. The franchise agreement is signed on August 1, 2020, and the franchise commences operation on October 1, 2020. Prepare the journal entries in 2020 for the franchisor under the following assumptions. a. No future services are required by the franchisee once the franchise starts operations. b. The franchisor has substantial services to perform, once the franchise begins operations, to maintain the value of the franchise. c. The total franchise fee includes training services (with a value of $ 6,900) for the period leading up to the franchise opening and for 2 months following openingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning