FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

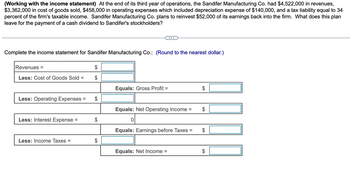

Transcribed Image Text:(Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,522,000 in revenues,

$3,362,000 in cost of goods sold, $458,000 in operating expenses which included depreciation expense of $140,000, and a tax liability equal to 34

percent of the firm's taxable income. Sandifer Manufacturing Co. plans to reinvest $52,000 of its earnings back into the firm. What does this plan

leave for the payment of a cash dividend to Sandifer's stockholders?

Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.)

Revenues =

Less: Cost of Goods Sold =

Less: Operating Expenses

Less: Interest Expense

Less: Income Taxes =

=

$

$

$

$

Equals: Gross Profit =

...

Equals: Net Operating Income =

0

Equals: Earnings before Taxes

Equals: Net Income =

=

$

GA

GA

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Macon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $43 million. Included in the income was interestexpense of $2,500,000. The company's tax rate was 40%. Total assets were $475 million, current liabilities were $108,000,000, and $69,000,000 of thecurrent liabilities are noninterest bearing.What are the invested capital and RO1 for Macon? Enter your answer in whole dollar. Round "ROI" answer to two decimal places. Invested Capital: ?ROI: ?arrow_forwardDuring the year, Belyk Paving Co. had sales of $2,600,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,535,000, $465,000, and $520,000, respectively. In addition, the company had an interest expense of $245,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) (Enter your answer as directed, but do not round intermediate calculations.) Required: (a) What is Belyk's net income? (Negative amount should be indicated by a minus sign.) Net income (b) What is Belyk's operating cash flow? Operating cash flow Aarrow_forwardDuring the year, Belyk Paving Company had sales of $2,485,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,349,000, $660,000, and $462,000, respectively. In addition, the company had an interest expense of $287,000 and a tax rate of 24 percent. The company paid out $412,000 in cash dividends. Assume that net capital spending was zero, no new investments were made in net working capital, and no new stock was issued during the year. (Ignore any tax loss carryforward provision and assume interest expense is fully deductible.) Calculate the firm's net new long-term debt added during the year.arrow_forward

- During the year, Belyk Paving Co. had sales of $2,350,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,310,000, $585,000, and $435,000, respectively. In addition, the company had an interest expense of $260,000 and a tax rate of 25 percent. The company paid out $385,000 in cash dividends. Assume that net capital spending was zero, no new investments were made in net working capital, and no new stock was issued during the year. (Ignore any tax loss or carryforward provision and assume interest expense is fully deductible.) Calculate the firm's net new long-term debt added during the year. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Net new long-term debtarrow_forwardVanderheiden Press Inc. and Herrenhouse Publishing Company had the following balance sheets as of December 31, 2008 (thousands of dollars Earnings before interest and taxes for both firms are $30 million, and the effective federal-plus-state tax rate is 40%. Vanderheiden Press Harrenhouse Publishing Current Assets $ 100,000 $ 80,000 Fixed Assets $ 100,000 $120,000 Total Assets $ 200,000 $ 200,000 Current Liabilities $ 20,000 $ 80,000 Long-Term Liabilities $ 80,000 $ 20,000 Common Stock $ 50,000 $ 50,000 Retained Earning $ 50,000 $ 50,000 Total Liabilities & Equity $ 200,000 $ 200,000 What is the return on equity for each firm if the interest rate on current liabilities is 10% and the rate on long-term debt is 13%? Assume that the short-term rate rises to 20%. While the rate on new long-term debt rises to 16%, the rate on existing long-term debt remains unchanged. What would…arrow_forwardTSW Inc. had the following data for last year: Net income = $800; Net operating profit after taxes (NOPAT) = $700; Total assets = $3,000; and Total operating capital = $2,000. Information for the just-completed year is as follows: Net income = $1,000; Net operating profit after taxes (NOPAT) = $925; Total assets = $2,600; and Total operating capital = $2,500. How much free cash flow did the firm generate during the just-completed year?arrow_forward

- The 2021 income statement for Duffy's Pest Control shows that depreciation expense was $203 million, EBIT was $516 million, and the tax rate was 35 percent. At the beginning of the year, the balance of gross fixed assets was $1,586 million and net operating working capital was $423 million. At the end of the year, gross fixed assets was $1,839 million. Duffy's free cash flow for the year was $429 million. Calculate the end-of-year balance for net operating working capital. (Enter your answer in millions of dollars rounded to 1 decimal place.) Net operating working capital millionarrow_forwardAt the end of 2021, Schrutte Inc. in its first year of operations, had pretax financial income of $650,000. The company had extra depreciation taken for tax purposes in the amount of $975,000. Estimated expenses that were deducted for financial income but not yet paid amounted to $425,000. It is estimated that the expenses will be paid in 2022. The tax rate for all years is 25% In the journal entry at the end of the year that records income tax expense, deferred taxes and income taxes payable, what is the entry to the Income Tax Payable account? Question 19 options: a) credit Income Tax Payable account by $162,500 b) credit Income Tax Payable account by $300,000. c) credit to Income Tax Payable account by $25,000. d) credit Income Tax Payable account by $512,500.arrow_forward12-7 A firm's annual revenues are $850,000. Its expenses for the year are $615,000, and it claims $135,000 in depreciation expenses. What does it pay in taxes, and what is its after-tax income?arrow_forward

- This year, FCF Inc. has earnings before interest and taxes of $9,630,000, depreciation expenses of $1,200,000, capital expenditures of $1,700,000, and has increased its net working capital by $600,000. If its tax rate is 35%, what is its free cash flow?arrow_forwardAt the end of its third year of operations, the Sandifer Manufacturing Co. had $4,559,000 in revenues, $3,555,000 in cost of goods sold, $458,000 in operating expenses which included depreciation expense of $154,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year?arrow_forwardMercury Limited reported earnings of $75,000 in 20X9. The company has $55,000 of depreciation expense this year, and claimed. CCA of $90,000. The tax rate was 25%. At the end of 20X8, there was a $10,000 loss carryforward reported in a deferred tax asset. account valued at $2,200, and a deferred tax liability of $35,200 caused by capital assets with a net book value of $500,000 and UCC of $340,000. Required: What is the amount of income tax expense in 20X9? Tax expense $ Prepare the income tax entry or entries. View transaction list No 1 2 Date 20X9 23,250 20X9 View journal entry worksheet Income tax expense General Journal Deferred income tax asset Income tax payable Income tax payable Income tax expense Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education