Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use AI.

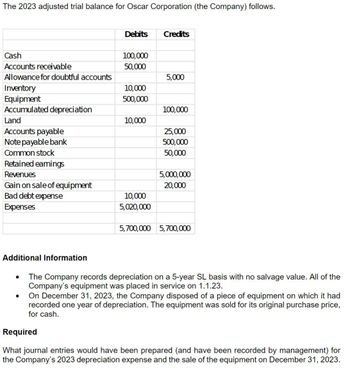

Transcribed Image Text:The 2023 adjusted trial balance for Oscar Corporation (the Company) follows.

Debits

Credits

Cash

100,000

Accounts receivable

50,000

Allowance for doubtful accounts

5,000

Inventory

10,000

Equipment

500,000

Accumulated depreciation

100,000

Land

10,000

Accounts payable

25,000

Note payable bank

500,000

Common stock

50,000

Revenues

Retained earnings

Gain on sale of equipment

5,000,000

20,000

Bad debt expense

Expenses

10,000

5,020,000

5,700,000 5,700,000

Additional Information

. The Company records depreciation on a 5-year SL basis with no salvage value. All of the

Company's equipment was placed in service on 1.1.23.

•

On December 31, 2023, the Company disposed of a piece of equipment on which it had

recorded one year of depreciation. The equipment was sold for its original purchase price,

for cash.

Required

What journal entries would have been prepared (and have been recorded by management) for

the Company's 2023 depreciation expense and the sale of the equipment on December 31, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…arrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forwardThe following information was taken from the accounts receivable records of Monty Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $156,000 0.5% 31 – 60 days outstanding 65,400 2.5% 61 – 90 days outstanding 40,000 4.0% 91 – 120 days outstanding 20,800 6.5% Over 120 days outstanding 5,100 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,280 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $4,010 prior to the…arrow_forward

- The following information was taken from the accounts receivable records of Pina Colada Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $154,000 0.5% 31 – 60 days outstanding 63,200 2.5% 61 – 90 days outstanding 39,100 4.0% 91 – 120 days outstanding 21,600 6.5% Over 120 days outstanding 5,300 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,170 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,990 prior to…arrow_forwardFDN Company reported the following on December 31, 2021, before adjustments: Accounts Receivable P11,000,000 Allowance for Doubtful Accounts P300,000 Sales P50,000,000 The entity estimated that 5% of accounts receivable may prove uncollectible. How much should be reported as doubtful accounts expense for the year ended December 31, 2021?arrow_forwardThe following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for baddebts of $9,750 and $15,336, respectively $179,866 $225,851 Required:a. If $11,849 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint: Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) b. The December 31, 2020, Allowance account balance includes $3,034 for a past due account that is not likely to be collected. This account has not been written off.(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If it had been written off, will there be any effect of the write-off on net income and ROI for the year ended December 31, 2020? Yes No c. The…arrow_forward

- An entity provided the following trial balance on June 30, 2020: Cash overdraft (200,000)Accounts receivable, net 700,000Inventory 1,200,000Prepaid expenses 200,000Land held for resale 2,000,000Property, plant and equipment, net 1,900,000Accounts payable 700,000Share capital 3,000,000Share premium 500,000Retained earnings 1,600,000Checks amounting to P600,000 were written to vendors and recorded on June 30 resulting in cash overdraft of P200,000. The checks were mailed on July 9. Land held for resale was sold for cash on July 15. The financial statements were issued on July 31. What total amount should be reported as current assets?arrow_forwardWarriors Company prepared an aging of its accounts receivable at December 31, 2023 and determined that the estimated uncollectible on that date was P85,200. During 2023, some customers' accounts were written off. Additional information is available as follows:Allowance for Bad Debts, December 31, 2022 P 63,000Bad debts expense reported in profit or loss 18,000Accounts Receivable, December 31, 2023 607,500Uncollectible accounts recovery during 2023 12,000 Question:21. How much were the accounts written off during 2023? A. P6,000 B. P7,800 C. P18,000 D. P22,200arrow_forwardPlease answer ASAP.arrow_forward

- Please show solution in getting the answer. Thank you!arrow_forwardThe following Is a portion of the current assets section of the balance sheets of Avantl's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for bad debts of $9,884 and $18,755, respectively $178,387 $223,883 Requlred: a. If $11,579 of accounts recelvable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint. Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) Bad debt expense b. The December 31, 2020, Allowance account balance Includes $3,017 for a past due account that is not likely to be collected. This account has not been written off. |(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If It had been written off, will there be any effect of the write-off on net Income and ROI for the year ended December 31, 2020? Yes No c. The level of Avantı's sales…arrow_forwardThe following information is available for Reagan Company: Allowance for doubtful accounts at December 31, 2020 (beginning balance) $ 8,000 Accounts receivable deemed worthless and written off during 2021 9,000 As a result of a review and aging of accounts receivable it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2021. What amount should Reagan record as "bad debt expense" for the year ended December 31, 2021? $4.500 $5.500 $6.500 13.500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College