Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Question

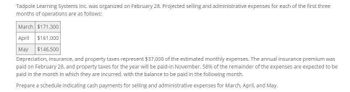

Transcribed Image Text:Tadpole Learning Systems Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three

months of operations are as follows:

March $171,300

April $161,000

May $146,500

Depreciation, insurance, and property taxes represent $37,000 of the estimated monthly expenses. The annual insurance premium was

paid on February 28, and property taxes for the year will be paid-in November. 58% of the remainder of the expenses are expected to be

paid in the month in which they are incurred, with the balance to be paid in the following month.

Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Drainee purchases direct materials each month. Its payment history shows that 65% is paid in the month of purchase with the remaining balance paid the month after purchase. Prepare a cash payment schedule for January using this data: in December through February, it purchased $22,000, $25,000, and $23,000 respectively.arrow_forwardTadpole Learning Systems Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $171,300 April $161,000 May $146,500 Depreciation, insurance, and property taxes represent $37,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid-in November. 58% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May.arrow_forwardSafeMark Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $102,200 April 96,100 May 87,500 Depreciation, insurance, and property taxes represent $22,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 59% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. SafeMark Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses: Paid in March $fill in the blank 1 Paid in April $fill in the blank 2 April expenses: Paid in April fill in the…arrow_forward

- Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $171,100 April 157,400 May 143,200 Depreciation, insurance, and property taxes represent $36,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 58% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May. Horizon Financial Inc.Schedule of Cash Payments for Selling and Administrative ExpensesFor the Three Months Ending May 31 March April May March expenses: Paid in March $fill in the blank 1 Paid in April $fill in the blank 2 April expenses: Paid in April fill in the blank 3 Paid…arrow_forwardHorizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $129,300 April 119,000 May 108,300 Depreciation, insurance, and property taxes represent $27,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 70% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month.arrow_forwardOakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $107,200 April 99,700 May 90,700 Depreciation, insurance, and property taxes represent $23,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 67% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses: Paid in March Paid in April April expenses: Paid in April Paid in May May expenses: Paid in May Total cash paymentsarrow_forward

- 10. SafeMark Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $156,800 April 144,300 May 131,300arrow_forwardJenny Inc. has the following projected costs for the second quarter of 20YY: Projected Costs Expenses April May June Selling and marketing expenses (i) $200,000 $250,000 $300,000 Office insurance expense (ii) 800 800 800 Office depreciation expense 500 500 500 Property tax expense (iii) 700 700 700 Jenny’s payment policy for selling and administrative expenses is as follows: Of the selling and marketing expenses, 50% is paid in the month they are incurred; the remaining 50% to be paid in the following month. The selling and admin expense payable at the end of March was $70,000, which represents 50% of March’s selling expenses. Insurance expense is $800 a month; however, the insurance is paid quarterly in the first month of each quarter, (i.e., in January, April, July, and October). Property taxes are paid once a year in December. The projected total selling and admin expenses for April are: Group of answer choices None of the above $172,400 $202,000 $204,400arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May $157,000 $192,000 Manufacturing costs* Insurance expense** Depreciation expense Property tax expense*** *Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $920 a month; however, the insurance is paid four times yearly in the first month of the quarter, (i.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments for Finch Company expected in the month of June are a. $249,750 Ob. $201,750 Oc. $153,750 Od. $48,000 920 1,890 440 920 1,890 June 440 $205,000 920 1,890 440arrow_forward

- Aston Corporation performs year-end planning in November of each year before its calendar year ends in December. The preliminary estimated net income is $4,800,000. The CFO, Rita Warren, meets with the company president, J. B. Aston, to review the projected numbers. She presents the following projected information. Aston Corporation Projected Income Statement For the Year Ended December 31, 2020 Sales $28,995,000 Interest revenue 5,000 Cost of goods sold $14,000,000 Depreciation 2,600,000 Operating expenses 6,400,000 23,000,000 Income before income tax 6,000,000 Income tax 1,200,000 Net income $ 4,800,000 Aston Corporation Selected Balance Sheet Information At December 31, 2020 Estimated cash balance $ 5,000,000 Available-for-sale debt investments (at cost) 10,000,000 Fair value adjustment (1/1/20) —0— Estimated fair value at December 31, 2020: Security Cost…arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June $155,600 $192,800 $213,600 Manufacturing costs* Insurance expense** 880 Depreciation expense 2,180 Property tax expense*** 590 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $880 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. 880 2,180 590 880 2,180 590 The cash payments expected for Finch Company in the month of May are O a. $183,500 O b. $144,600 Oc. $38,900 O d. $222,400arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June Manufacturing costs* $159,300 $195,800 $203,600 Insurance expense** 1,140 1,140 1,140 Depreciation expense 1,820 1,820 1,820 Property tax expense*** 500 500 500 * Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.**Insurance expense is $1,140 a month; however, the insurance is paid four times yearly in the first month of the quarter, (i.e., January, April, July, and October).***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of April are a.$122,895 b.$119,475 c.$159,300 d.$141,098arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning