FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

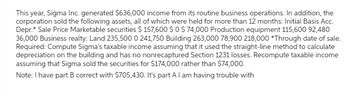

Transcribed Image Text:This year, Sigma Inc. generated $636,000 income from its routine business operations. In addition, the

corporation sold the following assets, all of which were held for more than 12 months: Initial Basis Acc.

Depr.* Sale Price Marketable securities $ 157,600 $0 $ 74,000 Production equipment 115,600 92,480

36,000 Business realty: Land 235,500 0 241,750 Building 263,000 78,900 218,000 *Through date of sale.

Required: Compute Sigma's taxable income assuming that it used the straight-line method to calculate

depreciation on the building and has no nonrecaptured Section 1231 losses. Recompute taxable income

assuming that Sigma sold the securities for $174,000 rather than $74,000.

Note: I have part B correct with $705,430. It's part A I am having trouble with

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating income was $270,000 before taxes. On September 1, Pronghorn disposed of the Mexico facility at a pretax loss of $670,000. The applicable tax rate is 30%. Show the discontinued operations section of Pronghorn’s income statement. PRONGHORN CORPPartial Income Statement select an opening section name enter an income statement item $enter a dollar amount enter an income statement item $enter a dollar amount $enter a total dollar amountarrow_forwardThe owners of a company are planning to sell the business to new interests. The cumulative net earnings for the past 4 years were P6,000,000 including casualty loss of P200,000. The current value of net assets of the company was P16,000,000. Goodwill is determined by capitalizing average earnings at 8%. What is the amount of goodwill? a. P1.450.000 b. P1.550.000 c. P2,215.000 d. P3.375.000arrow_forwardMans Company is about to purchase the net assets of Eagle Incorporated, which has the following balance sheet: Assets Accounts receivable $ 60,000 Inventory 100,000 Equipment $ 90,000 Accumulated depreciation (50,000) 40,000 Land and buildings $300,000 Accumulated depreciation (100,000) 200,000 Goodwill 60,000 Total assets $460,000 Liabilities and Stockholders' Equity Bonds payable $ 80,000 Common stock, $10 par 200,000 Paid-in capital in excess of par 100,000 Retained earnings 80,000 Total liabilities and equity $460,000 Mans has secured the following fair values of Eagle's accounts: Inventory $130,000 Equipment 60,000 Land and buildings 260,000 Bonds payable 60,000 Acquisition costs were $20,000. Required: Record the entry for the purchase of…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] As a long-term investment, Painters' Equipment Company purchased 20% of AMC Supplies Incorporated's 530,000 shares for $610,000 at the beginning of the fiscal year of both companies. On the purchase date, the fair value and book value of AMC’s net assets were equal. During the year, AMC earned net income of $380,000 and distributed cash dividends of 30 cents per share. At year-end, the fair value of the shares is $648,000. 2. Assume significant influence was acquired. Prepare the appropriate journal entries from the purchase through the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardNFP, a nongovernmental not-for-profit entity, reported a change in net assets of $300,000 for the current year. Changes occurred in several balance sheet accounts as follows: Equipment $25,000 increase Accumulated depreciation 40,000 increase Note payable 30,000 increase Additional Information: • During the current year, NFP sold equipment costing $25,000, with accumulated depreciation of $12,000,for a gain of $5,000.• In December of the current year, NFP purchased equipment costing $50,000 with $20,000 cash and a12% note payable of $30,000.• Depreciation expense for the year was $52,000.11. In NFP's current-year statement of cashflows, net cash provided by operatingactivities should bearrow_forwardManjiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education