Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attempt in Progress

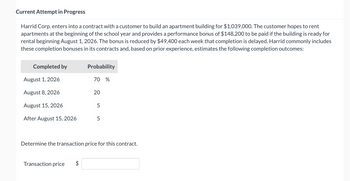

Harrid Corp. enters into a contract with a customer to build an apartment building for $1,039,000. The customer hopes to rent

apartments at the beginning of the school year and provides a performance bonus of $148,200 to be paid if the building is ready for

rental beginning August 1, 2026. The bonus is reduced by $49,400 each week that completion is delayed. Harrid commonly includes

these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:

Completed by

August 1, 2026

Probability

70 %

August 8, 2026

20

August 15, 2026

5

After August 15, 2026

5

Determine the transaction price for this contract.

Transaction price

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.arrow_forwardas show in the picarrow_forwardRobinson Corp. enters into a contract with a customer to build an apartment building for $990,500. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $147,300 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $49,100 each week that completion is delayed. Robinson commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability Transaction price 70 % $ 20 (a) Determine the transaction price for the contract, assuming Robinson is only able to estimate whether the building can be completed by August 1, 2026, or not (Robinson estimates that there is a 70% chance that the building will be completed by August 1, 2026). 5 5 (b) Determine the transaction price for the contract, assuming Robinson has limited…arrow_forward

- Whispering Corp. enters into a contract with a customer to build an apartment building for $1,300,000. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $195,000 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $65,000 each week that completion is delayed. Whispering commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes. August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price LA 70% $ 20 Determine the transaction price for this contract. 5 5arrow_forwardAnderson Corp. enters into a contract with a customer to build an apartment building for $995,600. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $145,500 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $48,500 each week that completion is delayed. Anderson commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2026 70 % August 8, 2026 20 August 15, 2026 5 After August 15, 2026 5 Determine the transaction price for this contract. Transaction pricearrow_forwardClark Corp. enters into a contract with a customer to build an apartment building for $1,000,800. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $135,600 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,200 each week that completion is delayed. Clark commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability Transaction price 70 % $ 20 (a) Determine the transaction price for the contract, assuming Clark is only able to estimate whether the building can be completed by August 1, 2026, or not (Clark estimates that there is a 70% chance that the building will be completed by August 1, 2026). 5 5 (b) Determine the transaction price for the contract, assuming Clark has limited information…arrow_forward

- Indarrow_forwardNair Corp. enters into a contract with a customer to build an apartment building for $1,000,000. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $150,000 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $50,000 each week that completion is delayed. Nair commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2021 70% August 8, 2021 20 August 15, 2021 5 After August 15, 2021 5 Determine the transaction price for this contract.arrow_forwardRakesharrow_forward

- Valaarrow_forwardTaylor Corp. enters into a contract with a customer to build an apartment building for $1,061,500. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $147,900 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $49,300 each week that completion is delayed. Taylor commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price Probability $ 70 % 20 5 Determine the transaction price for this contract. 5 1061500arrow_forwardCulver Corp. enters into a contract with a customer to build an apartment building for $970,000. The customer hopes to rent apartments at the beginning of the school year and offers a performance bonus of $171,000 to be paid if the building is ready for rental beginning August 1, 2020. The bonus is reduced by $57,000 each week that completion is delayed. Culver commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2020 70 % August 8, 2020 20 August 15, 2020 5 After August 15, 2020 5 Determine the transaction price for this contract, assuming Culver is only able to estimate whether the building can be completed by August 1, 2020, or not. (Culver estimates that there is a 70% chance that the building will be completed by August 1, 2020.) Transaction price $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning