College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

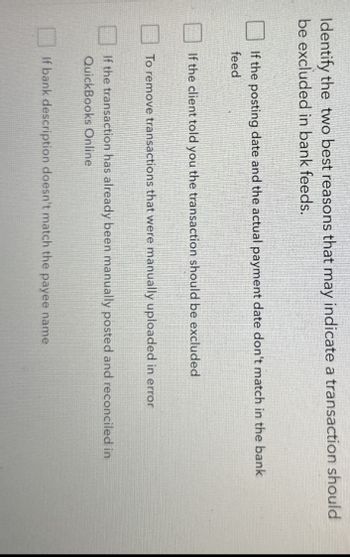

Transcribed Image Text:Identify the two best reasons that may indicate a transaction should

be excluded in bank feeds.

If the posting date and the actual payment date don't match in the bank

feed

If the client told you the transaction should be excluded

To remove transactions that were manually uploaded in error

If the transaction has already been manually posted and reconciled in

QuickBooks Online

If bank description doesn't match the payee name

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Subject - account Please help me . Thankyou.arrow_forwardYour customer has paid their bill, yet the Accounts Receivable balance has not changed. Which of the following could have caused this error? A Bypassing the Pay Bills window and writing a check to the vendor B Deleting the deposit before reconciliation C Running the Open Invoices report before accepting payment D Bypassing the Receive Payments window and entering the payment directly in the Bank Deposits windowarrow_forwardIn sap, Which of the following outgoing payments will not require manual entry of bank account?a. Cashb. Credit Cardc. Checkd. Bank Transferarrow_forward

- In QuickBooks Online, what is the purpose of entering transactions manually in the register? Select an answer: to reconcile bank statements with QuickBooks Online records to track sales with detailed product/service items and at the customer level, without tracking accounts receivables to enter both money in and money out type of transactions directly in the register, particularly useful for entering multiple transactions in bulk to record a transfer of funds between bank accountsarrow_forwardWhat is the difference between a bank feed transaction and a manually entered transaction in QuickBooks Online? Select an answer: A bank feed transaction is a fixed asset, while a manually entered transaction is a current asset. A bank feed transaction is imported automatically from your bank or credit card company, while a manually entered transaction is entered manually by the user. A bank feed transaction is a liability, while a manually entered transaction is an asset. A bank feed transaction is an expense, while a manually entered transaction is income.arrow_forwardIn QuickBooks Online, what is the purpose of creating a deposit as income? Select an answer: to record income deposited in the business accounts that is not related to a specific customer transaction to reconcile bank statements with QuickBooks Online records to record a transfer of funds between bank accounts to track customer payments received for open invoicesarrow_forward

- A voucher is an internal document or file: Multiple Choice Used as a substitute for an invoice if the supplier fails to send one. Used to prepare a bank reconciliation. Used to collect information needed to control cash payments and to ensure that transactions are properly recorded. Takes the place of a bank check. Used by large companies to control cash receipts.arrow_forwardOn the Excel worksheet are the T- accounts for cash and other accounts need to record the bank reconciliation. Also, the format for the bank reconciliation is provided. Complete the bank reconciliation, using formulas when possible.arrow_forwardSelect the banking terms from drop down to match with the correct definition. Definitions Banking Terms a. A check that has been paid by the bank on behalf of the depositor. select a banking term Automated teller machine (ATM)Electronic funds transfer (EFT)MakerDepositorDebit memorandumPayeeBank statementPayerCredit memorandumDeposit slipCheckCanceled checkSignature cardEndorsement b. A disbursement system that uses wire, telephone, or computers to transfer cash balances from one location to another. select a banking term EndorsementBank statementDeposit slipDebit memorandumCheckDepositorElectronic funds transfer (EFT)PayeeSignature cardPayerCanceled checkCredit memorandumAutomated teller machine (ATM)Maker c. A document provided by the bank that requires the signature of all authorized signers of checks. select a banking term…arrow_forward

- Match definitions with vocabulary terms) Use theseterms to complete the statements that follow. You can use a term more than once or not at all.Bank reconciliation Firewall Misappropriation of assetsCash equivalents Fraud triangle Outstanding checkController Fraudulent financial reporting PhishingDeposits in transit Imprest system Remittance adviceFidelity bond Internal control Treasurerg. A/An _____________is an electronic barrier that prevents unauthorized access to an organization’s computer networkarrow_forwardA bank reconciliation takes time and must balance. An employee was struggling in balancing the bank reconciliation. Her supervisor told her to plug (make an unsupported entry for) the difference, record to Miscellaneous Expense, and simply move on. Discuss the internal controls problem with this directive.arrow_forwardWhich of the following are found on the bank side of the bank reconciliation? A. NSF check B. interest income C. wire transfer into clients account D. deposit in transitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College