Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

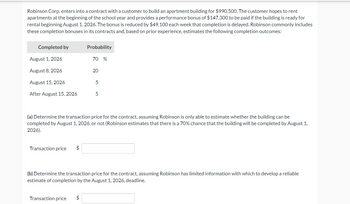

Transcribed Image Text:Robinson Corp. enters into a contract with a customer to build an apartment building for $990,500. The customer hopes to rent

apartments at the beginning of the school year and provides a performance bonus of $147,300 to be paid if the building is ready for

rental beginning August 1, 2026. The bonus is reduced by $49,100 each week that completion is delayed. Robinson commonly includes

these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:

Completed by

August 1, 2026

August 8, 2026

August 15, 2026

After August 15, 2026

Transaction price $

Probability

Transaction price

70 %

$

20

(a) Determine the transaction price for the contract, assuming Robinson is only able to estimate whether the building can be

completed by August 1, 2026, or not (Robinson estimates that there is a 70% chance that the building will be completed by August 1,

2026).

5

5

(b) Determine the transaction price for the contract, assuming Robinson has limited information with which to develop a reliable

estimate of completion by the August 1, 2026, deadline.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Part B is incorrect please provide correct answer. I provided feedback long ago and it still hasn't been fixed.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Part B is incorrect please provide correct answer. I provided feedback long ago and it still hasn't been fixed.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?arrow_forwardVolleyElite runs a volleyball program consisting of camps, tournaments, and specialized coaching. VolleyElite charges customers 500 per year for access to its facilities and programs. In addition, VolleyElite charges each customer a 100 registration fee. The fee is not refundable and must be paid at the initiation of the contract. Should the registration fee be considered a separate performance obligation from the yearly dues?arrow_forwardWhispering Corp. enters into a contract with a customer to build an apartment building for $979,400. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $144,300 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $48,100 each week that completion is delayed. Whispering commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2021 70 % August 8, 2021 20 August 15, 2021 5 After August 15, 2021 5 Determine the transaction price for this contract. Transaction Price $enter the transaction price for this contractarrow_forward

- Sweet Corp. enters into a contract with a customer to build an apartment building for $1,037,600. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $155,400 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $51,800 each week that completion is delayed. Sweet commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2021 70 % August 8, 2021 20 August 15, 2021 4 After August 15, 2021 6 Determine the transaction price for this contract.arrow_forwardIndigo Corp. enters into a contract with a customer to build an apartment building for $1,061,800. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $139,200 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $46,400 each week that completion is delayed. Indigo commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2021 August 8, 2021 August 15, 2021 After August 15, 2021 Transaction Price Probability 70 % Transaction Price $ 20 6 (a) Determine the transaction price for the contract, assuming Indigo is only able to estimate whether the building can be completed by August 1, 2021, or not (Indigo estimates that there is a 70% chance that the building will be completed by August 1, 2021). (If answer is O, please enter O. Do not leave any fields blank.) 4 (b) Determine the…arrow_forwardClark Corp. enters into a contract with a customer to build an apartment building for $1,000,800. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $135,600 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,200 each week that completion is delayed. Clark commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability Transaction price 70 % $ 20 (a) Determine the transaction price for the contract, assuming Clark is only able to estimate whether the building can be completed by August 1, 2026, or not (Clark estimates that there is a 70% chance that the building will be completed by August 1, 2026). 5 5 (b) Determine the transaction price for the contract, assuming Clark has limited information…arrow_forward

- Swifty Corp. enters into a contract with a customer to build an apartment building for $1,046,900. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $148,500 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $49,500 each week that completion is delayed. Swifty commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2021 70 % August 8, 2021 20 August 15, 2021 4 After August 15, 2021 6 Determine the transaction price for this contract.arrow_forwardWhispering Corp. enters into a contract with a customer to build an apartment building for $1,300,000. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $195,000 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $65,000 each week that completion is delayed. Whispering commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes. August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price LA 70% $ 20 Determine the transaction price for this contract. 5 5arrow_forwardTeal Corp. enters into a contract with a customer to build an apartment building for $1,031,300. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $144,300 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $48,100 each week that completion is delayed. Teal commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2021 70 % August 8, 2021 20 August 15, 2021 4 After August 15, 2021 6 (a) Determine the transaction price for the contract, assuming Teal is only able to estimate whether the building can be completed by August 1, 2021, or not (Teal estimates that there is a 70% chance that the building will be completed by August 1, 2021). (If answer is 0, please enter 0. Do not leave any fields blank.) Transaction Price $enter the…arrow_forward

- Metlock Corp. enters into a contract with a customer to build an apartment building for $1,061,500. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $147,900 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $49,300 each week that completion is delayed. Metlock commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2021 August 8, 2021 August 15, 2021 After August 15, 2021 Probability Transaction Price $ 70 % 20 5 5 (a) Determine the transaction price for the contract, assuming Metlock is only able to estimate whether the building can be completed by August 1, 2021, or not (Metlock estimates that there is a 70% chance that the building will be completed by August 1, 2021). (If answer is 0, please enter 0. Do not leave any fields blank.) (b) Determine the transaction price for…arrow_forwardWilliam Corp. enters into a contract with a customer to build an apartment building for $1,056,300. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $136,200 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,400 each week that completion is delayed. William commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability 70 % Transaction price $ 20 (a) Determine the transaction price for the contract, assuming William is only able to estimate whether the building can be completed by August 1, 2026, or not (William estimates that there is a 70% chance that the building will be completed by August 1, 2026). 5 5 115770 (b) Determine the transaction price for the contract, assuming William has…arrow_forwardIvanhoe Corp. enters into a contract with a customer to build an apartment building for $1,061,800. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $139,200 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $46,400 each week that completion is delayed. Ivanhoe commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2021 70 % August 8, 2021 20 August 15, 2021 6 After August 15, 2021 4 Determine the transaction price for this contract. Transaction Pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning