College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please Solve this one

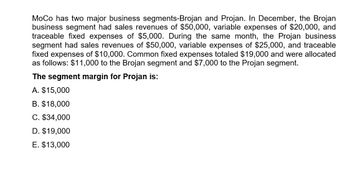

Transcribed Image Text:MoCo has two major business segments-Brojan and Projan. In December, the Brojan

business segment had sales revenues of $50,000, variable expenses of $20,000, and

traceable fixed expenses of $5,000. During the same month, the Projan business

segment had sales revenues of $50,000, variable expenses of $25,000, and traceable

fixed expenses of $10,000. Common fixed expenses totaled $19,000 and were allocated

as follows: $11,000 to the Brojan segment and $7,000 to the Projan segment.

The segment margin for Projan is:

A. $15,000

B. $18,000

C. $34,000

D. $19,000

E. $13,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Tubaugh Corporation has two major business segments--East and West. In December, the East business segment had sales revenues of $690,000, variable expenses of $352,000, and traceable fixed expenses of $104,000. During the same month, the West business segment had sales revenues of $140,000, variable expenses of $56,000, and traceable fixed expenses of $24,000. The common fixed expenses totaled $162,000 and were allocated as follows: $89,000 to the East business segment and $73,000 to the West business segment. The contribution margin of the West business segment is: Multiple Choice $84,000 $145,000 $422,000 $234,000arrow_forwardTubaugh Corporation has two major business segments--East and West. In December, the East business segment had sales revenues of $690,000, variable expenses of $352,000, and traceable fixed expenses of $104,000. During the same month, the West business segment had sales revenues of $140,000, variable expenses of $56,000, and traceable fixed expenses of $24,000. The common fixed expenses totaled $162,000 and were allocated as follows: $89,000 to the East business segment and $73,000 to the West business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is: Multiple Choice $132,000 $422,000 $294,000 $(30,000)arrow_forwardStryker corp. Has two major business segments- east and west. In April, the east business segment had sales revenue of 500,000, variable expenses of 280,000 and traceable fixed expenses of 80,000. During the same month, the west business segment had sales revenues of 970,000, variable expenses of 514,000 and traceable fixed expenses of 184,000. The common fixed expenses total 280,000 and were allocated as follows: 112,000 to the east business segment and 168,000 to the west business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the east business segment is: 108,000 28,000 140,000 280,000arrow_forward

- Spiess Corporation has two major business segments--Apparel and Accessories. Data concerning those segments for December appear below: Sales revenues, Apparel $ 735,000 Variable expenses, Apparel $ 342,000 Traceable fixed expenses, Apparel $ 174,000 Sales revenues, Accessories $ 777,000 Variable expenses, Accessories $ 426,000 Traceable fixed expenses, Accessories $ 125,000 Common fixed expenses totaled $433,000 and were allocated as follows: $187,000 to the Apparel business segment and $246,000 to the Accessories business segment. Required: Prepare a segmented income statement in the contribution format for the company.arrow_forward7-14arrow_forwardData for September concerning Greenberger Corporation's two major business segments-Fibers and Feedstocks-appear below. Sales revenues, Fibers Sales revenues, Feedstocks Variable expenses, Fibers Variable expenses, Feedstocks Traceable fixed expenses, Fibers Traceable fixed expenses, Feedstocks Common fixed expenses totaled $377,000 and were allocated as follows: $191,500 to the Fibers business segment and $185,500 to the Feedstocks business segment. $ 860,000 $ 785,000 $ 390,000 $ 320,000 $ 120,000 $ 156,000 Required: Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts. Net operating income (loss) Total Company Fibers Feedstocksarrow_forward

- Ieso Corporation has two stores: J and K. During November, Ieso Corporation reported a net operating income of $30,000 and sales of $450,000. The contribution margin in Store J was $100,000, or 40% of sales. The segment margin in Store K was $30,000, or 15% of sales. Traceable fixed expenses are $60,000 in Store J, and $40,000 in Store K. Ieso Corporation's total fixed expenses for the year were:arrow_forwardMunoz Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Segment Sales Cost of goods sold Sales commissions MUNOZ COMPANY Income Statements for Year 2 Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss) Complete this question by entering your answers in the tabs below. A $ 171,000 (123,000) Required A Required B Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A $251,000 $256,000 (91,000) (81,000) (24,000) (23,000) 152,000 (40,000) 0 136,000 (17,000) 31,000 (34,000) (42,000) (6,000) (16,000) $ (9,000) $ 78,000 Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment…arrow_forwardData for September concerning Greenberger Corporation's two major business segments--Fibers and Feedstocks--appear below: Sales revenues, Fibers $ 750,000 Sales revenues, Feedstocks $ 620,000 Variable expenses, Fibers $ 368,000 Variable expenses, Feedstocks $ 254,000 Traceable fixed expenses, Fibers $ 98,000 Traceable fixed expenses, Feedstocks $ 112,000 Common fixed expenses totaled $344,000 and were allocated as follows: $175,000 to the Fibers business segment and $169,000 to the Feedstocks business segment. Required: Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts.arrow_forward

- Walsh Corporation has two divisions: East and West. Data from the most recent month appear below: East West Sales $ 330,000 $144,000 Variable expenses $ 132,000 $ 76,320 Traceable fixed expenses $ 140,000 $ 43,000 The company's common fixed expenses total $52,140, If the company operates at exactly the break even sales of the East Division and West Diveion, what would be the company's overall net operating income? Select one: O a $30,540 O b. 50 OC ($52,140) Od. ($235,140)arrow_forwardClouthier Corporation has two divisions: Home Division and Commercial Division. The following report is for the most recent operating period: Total Company Home Division Commercial Division Sales $ 572, 000 $ 268, 000 $ 304, 000 Variable expenses $ 205, 790 $ 88, 360 $ 117, 430 Traceable fixed expenses $ 203, 000 $ 91, 000 $ 112, 000 The company's common fixed expenses total $62, 700. Required: What is the Home Division's break - even in sales dollars? What is the Commercial Division's break - even in sales dollars? What is the company's overall break - even in sales dollars? Note: Round intermediate calculations to three decimal places.arrow_forwardSamsun company operates with two divisions, sam and sun. The results of the operations last year showed the company earning a net operating income of P468,000 while allocating P1,040,000 ccommon fixed expenses. The contribution margin of Sam was P780,000 while contribution margin ratio for sun ws 40%. Sun was able to generate sales of P3,250,000, and its segment margin was P832,000. The segment margin for sam was: A. P676,000 B. 1,508,000 C. P208,000 D. P832,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning