FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

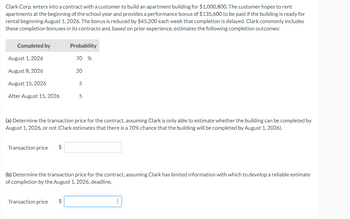

Transcribed Image Text:Clark Corp. enters into a contract with a customer to build an apartment building for $1,000,800. The customer hopes to rent

apartments at the beginning of the school year and provides a performance bonus of $135,600 to be paid if the building is ready for

rental beginning August 1, 2026. The bonus is reduced by $45,200 each week that completion is delayed. Clark commonly includes

these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:

Completed by

August 1, 2026

August 8, 2026

August 15, 2026

After August 15, 2026

Transaction price $

Probability

Transaction price

70 %

$

20

(a) Determine the transaction price for the contract, assuming Clark is only able to estimate whether the building can be completed by

August 1, 2026, or not (Clark estimates that there is a 70% chance that the building will be completed by August 1, 2026).

5

5

(b) Determine the transaction price for the contract, assuming Clark has limited information with which to develop a reliable estimate

of completion by the August 1, 2026, deadline.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- YellowStone Construction is constructing an office building under contract for LimeStone Company and uses the percentage-of-completion method. The contract calls for progress billings and payments of $1300000 each quarter. The total contract price is $15600000 and YellowStone estimates total costs of $17500000. YellowStone estimates that the building will take 3 years to complete, and commences construction on January 2, 2021. At December 31, 2022, YellowStone Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $17750000 due to unanticipated price increases.YellowStone Construction completes the remaining 25% of the building construction on December 31, 2023, as scheduled. At that time the total costs of construction are $18500000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that YellowStone will recognize for the year ended December 31, 2023? Revenue Expenses…arrow_forwardMetlock Corp. enters into a contract with a customer to build an apartment building for $1,061,500. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $147,900 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $49,300 each week that completion is delayed. Metlock commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2021 August 8, 2021 August 15, 2021 After August 15, 2021 Probability Transaction Price $ 70 % 20 5 5 (a) Determine the transaction price for the contract, assuming Metlock is only able to estimate whether the building can be completed by August 1, 2021, or not (Metlock estimates that there is a 70% chance that the building will be completed by August 1, 2021). (If answer is 0, please enter 0. Do not leave any fields blank.) (b) Determine the transaction price for…arrow_forwardWhispering Corp. enters into a contract with a customer to build an apartment building for $1,300,000. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $195,000 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $65,000 each week that completion is delayed. Whispering commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes. August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price LA 70% $ 20 Determine the transaction price for this contract. 5 5arrow_forward

- C&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28, 2021, to advance Jeff $35,000 on a one-year, 7 percent note, with interest to be paid at maturity on February 28, 2022. CSM prepares financial statements on June 30 and December 31. Required: Prepare the journal entries that CSM will make: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to whole dollar amount.) When the note is established To record the interest accruals at each quarter-end and interest payments at each payment date to record the principal payment at the maturity datearrow_forwardA company enters into a contract with a customer to build a building, with a performance bonus of $33,500 if the building is completed by September 30, 2021. The bonus is reduced by $5,000 each week that completion is delayed. The company commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by ProbabilitySeptember 30, 2021 70%October 7, 2021 15%October 14, 2021 10%October 21, 2021 5%The amount of revenue the company should recognize related to this bonus is $_______________.arrow_forwardSince 1970, Super Rise, Incorporated, has provided maintenance services for elevators. On January 1, 2024, Super Rise obtains a contract to maintain an elevator in a 90-story building in New York City for 10 months and receives a fixed payment of $98,000. The contract specifies that Super Rise will receive an additional $49,000 at the end of the 10 months if there is no unexpected delay, stoppage, or accident during the year. Super Rise estimates variable consideration to be the most likely amount it will receive. Required: Assume that, because the building sees a constant flux of people throughout the day, Super Rise is allowed to access the elevators and related mechanical equipment only between 3 a.m. and 5 a.m. on any given day, which is insufficient to perform some of the more time-consuming repair work. As a result, Super Rise believes that unexpected delays are likely and that it will not earn the bonus. Prepare the journal entry Super Rise would record on January 1. Assume…arrow_forward

- The actuary for the pension plan of Indigo Inc. calculated the following net gains and losses. Incurred during the Year 2020 2021 2022 2023 As of January 1, Other information about the company's pension obligation and plan assets is as follows. 2020 2021 2022 (Gain) or Loss $302,200 476,600 2023 (210,400) (291,300) Projected Benefit Obligation $4,029,300 4,515,400 5,019,900 4,255,600 Plan Assets (market-related asset value) $2,423,700 2,180,800 2,580,100 3,067,900 Indigo Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total service-years for all participating employees is 4,400. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2020. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization. Compute the minimum amount of accumulated OCI (G/L) amortized as a component of net periodic pension…arrow_forwardRakesharrow_forwardhelp mearrow_forward

- William Corp. enters into a contract with a customer to build an apartment building for $1,056,300. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $136,200 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,400 each week that completion is delayed. William commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability LA 70 % 20 Determine the transaction price for this contract. 5 5 SUPPORTarrow_forwardVelocity, a publicly traded corporation with a calendar fiscal year, entered into an agreement with Wedding Planners, Inc. a wedding event planning company on February 14, 2022. The contract specifies that the services will begin on March 1, 2022. Velocity will design a marketing strategy to increase “hits” on Wedding Planners website by 40%. The contract will last for 3 months (though May 31, 2022). Wedding Planners promises to pay $25,000 at the beginning of each month for Velocity’s services with the first payment on March 1, 2022. At the end of the contract, Velocity will be entitled to an additional $15,000 bonus, depending on whether traffic on Wedding Planners’ website has increased by the desired 40%. At the inception of the contract, Velocity estimated there is an 85% chance that they will earn the $15,000 bonus and 15% likelihood they will not. These probabilities are based on past experience with similar projects and the company has significant experience in these…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education