Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer in step by step with explanation.

Don't use Ai and chatgpt

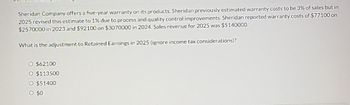

Transcribed Image Text:Sheridan Company offers a five-year warranty on its products. Sheridan previously estimated warranty costs to be 3% of sales but in

2025 revised this estimate to 1% due to process and quality control improvements. Sheridan reported warranty costs of $77100 on

$2570000 in 2023 and $92100 on $3070000 in 2024. Sales revenue for 2025 was $5140000.

What is the adjustment to Retained Earnings in 2025 (ignore income tax considerations)?

O $62100

O $113500

O $51400

0 $0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forwardCarla Vista Company offers a five-year warranty on its products. Carla Vista previously estimated warranty costs to be 3% of sales but in 2025 revised this estimate to 1% due to process and quality control improvements. Carla Vista reported warranty costs of $77700 on $2590000 in 2023 and $92700 on $3090000 in 2024. Sales revenue for 2025 was $5180000. What is the adjustment to Retained Earnings in 2025 (ignore income tax considerations)? O $62700 O $51800 O $114500 O $0arrow_forwardCullumber Company offers a five-year warranty on its products. Cullumber previously estimated warranty costs to be 3% of sales but in 2025 revised this estimate to 1% due to process and quality control improvements. Cullumber reported warranty costs of $79200 on $2640000 in 2023 and $94200 on $3140000 in 2024. Sales revenue for 2025 was $5280000. What is the adjustment to Retained Earnings in 2025 (ignore income tax considerations)? $0 $117000 $64200 $52800arrow_forward

- Pharoah Company offers a five-year warranty on its products. Pharoah previously estimated warranty costs to be 3% of sales but in 2025 revised this estimate to 1% due to process and quality control improvements. Pharoah reported warranty costs of $80100 on $2670000 of sales in 2023 and $95100 on $3170000 in 2024 . Sales revenue for 2025 was $5170000. What is the adjustment to retained earingings in 2025?arrow_forwardCupola Awning Corporation introduced a new line of commercial awnings in 2024 that carry a two-year warranty against manufacturer's defects. Based on their experience with previous product introductions, warranty costs are expected to approximate 4% of sales. Sales and actual warranty expenditures for the first year of selling the product were: Sales $ 5,770,000 Actual Warranty Expenditures $ 59,500 Required: 1. Does this situation represent a loss contingency? 2. Prepare journal entries that summarize sales of the awnings (assume all credit sales) and any aspects of the warranty that should be recorded during 2024. 3. What amount should Cupola report as a liability at December 31, 2024? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Loss contingency Required 3 Does this situation represent a loss contingency?arrow_forwardHardevarrow_forward

- Can you please help me with this problem with step by step explanation, please? Thank you :)arrow_forwardIn 2024, Carla Vista Co. introduced a new line of machines that carry a three-year warranty against manufacturer's defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of the sale, 3% in the year after the sale, and 4% in the second year after the sale. Sales revenue and actual warranty expenditures for the first three year period were as follows: (assume the accrual method) Sales Revenue Actual Warranty Expenditures 2024 $1598000 $41000 2025 2496000 66000 2026 2107000 136000 $6201000 $243000 What amount should Carla Vista report as a liability under the warranty at December 31, 2026? $84280 $72080 $315090 0 $0arrow_forwardCupola Awning Corporation introduced a new line of commercial awnings in 2024 that carry a two-year warranty against manufacturer’s defects. Based on their experience with previous product introductions, warranty costs are expected to approximate 3% of sales. Sales and actual warranty expenditures for the first year of selling the product were: Sales Actual Warranty Expenditures $ 5,000,000 $ 37,500 Required: Does this situation represent a loss contingency? Prepare journal entries that summarize sales of the awnings (assume all credit sales) and any aspects of the warranty that should be recorded during 2024. What amount should Cupola report as a liability at December 31, 2024?arrow_forward

- Please Correct solution with Explanation and Do not Give image formatarrow_forwardCupola Awning Corporation introduced a new line of commercial awnings in 2021 that carry a two-year warranty against manufacturer's defects. Based on their experience with previous product introductions, warranty costs are expected to approximate 2% of sales. Sales and actual warranty expenditures for the first year of selling the product were: Actual Warranty Expenditures $60,000 Sales $5,510,000 Required: 1. Does this situation represent a loss contingency? 2. Prepare journal entries that summarize sales of the awnings (assume all credit sales) and any aspects of the warranty that should be recorded during 2021. 3. What amount should Cupola report as a liability at December 31, 2021? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Does this situation represent a loss contingency? Loss contingency Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries that…arrow_forwardCan you explain this problem with step by step explanation, please? Thank you:)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning