FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

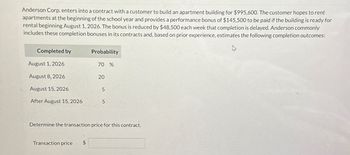

Transcribed Image Text:Anderson Corp. enters into a contract with a customer to build an apartment building for $995,600. The customer hopes to rent

apartments at the beginning of the school year and provides a performance bonus of $145,500 to be paid if the building is ready for

rental beginning August 1, 2026. The bonus is reduced by $48,500 each week that completion is delayed. Anderson commonly

includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:

Completed by

Probability

August 1, 2026

70 %

August 8, 2026

20

August 15, 2026

5

After August 15, 2026

5

Determine the transaction price for this contract.

Transaction price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC Co. began constructing a condominium on January 1, 2017 for a contract price of P1,250,000. The entity has assured collection of its contract and the costs can be reliably estimated. For the year ended December 31, 2018, ABC Co billed its client an additional 60% of the contract price. Data relating to the construction are as follows: 2017 2018 2019 Construction Progress 300,000 ? ? Estimated Cost to Complete ? ? - Costs Incurred 250,000 600,000 112,500 Excess of CIP over PB 25,000 (125,000) HOW MUCH IS THE GROSS PROFIT/LOSS REALIZED IN 2018? Kindly show your solution in a good accounting form. Thank you!arrow_forwardOn September 30, 2019, STONE REACH Co., Inc. was awarded the contract to build a 1,000 room hotel for P24,000,00O0. Among others, the parties agreed to the following:1.Ten percent mobilization fee (deductible from "final billing") payable within ten days from the signing of the contract.2.Retention of ten per cent on all billings (to be paid with the final billing, upon completion and acceptance of the project); and 3.Progress billings are to be paid within 2 weeks upon acceptance. By the end of 2019, the company had presented one progress billing, corresponding to 10% completion, which was evaluated and accepted by the client on December 29, 2019 for payment in January of the next year. In 2019, assuming use of the percentage-of-completion method of accounting STONE REACH Co., Inc. received a total fee ofarrow_forwardMetlock Corp. enters into a contract with a customer to build an apartment building for $1,061,500. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $147,900 to be paid if the building is ready for rental beginning August 1, 2021. The bonus is reduced by $49,300 each week that completion is delayed. Metlock commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2021 August 8, 2021 August 15, 2021 After August 15, 2021 Probability Transaction Price $ 70 % 20 5 5 (a) Determine the transaction price for the contract, assuming Metlock is only able to estimate whether the building can be completed by August 1, 2021, or not (Metlock estimates that there is a 70% chance that the building will be completed by August 1, 2021). (If answer is 0, please enter 0. Do not leave any fields blank.) (b) Determine the transaction price for…arrow_forward

- SMDC Construction is constructing an office building under contract for Onyx Company and uses the percentage-of-completion method. The contract calls for progress billings and payments of P1,550,000 each quarter. The total contract price is P18,600,000 and SMDC Construction estimates total costs of P17,750,000. SMDC Construction estimates that the building will take 3 years to complete, and commences construction on January 2, 2018. SMDC Construction completes the remaining 25% of the building construction on December 31, 2020, as scheduled. At that time the total costs of construction are P18,750,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that SMDC Construction will recognize for the year ended December 31, 2020? Revenue Expenses A. P18,600,000 P18,750,000 B. P4,650,000 P 4,687,500 C. P4,650,000 P 5,250,000 D. P4,687,500 P 4,687,500 Group of answer choices D C B Aarrow_forwardRomano Services provides room cleaning arrangements for hotels in Ohio. On April 1, Silvia Hotels & Resorts signed an agreement to outsource its room-cleaning functions to Romano. The contract specifies the service fee to be $15,000 per month, and all payments are to be made shortly after the end of each quarter. It also specifies that Romano will receive an additional quarterly bonus of $3,000 if, during that quarter, Silvia receives no more than five complaints from customers about room cleanliness. On April 1, based on historical experience, Romano estimated that there is a 75% chance that it will receive the quarterly bonus. On May 5, Romano learned that, during March, there were two complaints from customers related to room cleanliness. Based on this new information, Romano revised its estimate downward to 40% that it would be entitled to receive the quarterly bonus. On June 30, Silvia notified Romano that, for the quarter ended, there were four complaints associated with…arrow_forwardRakesharrow_forward

- On July 1, Wiggins Associates enters into a contract to provide consulting services to Pennsylvania University (PU). The contract is anticipated to last four months and is intended to achieve significant cost savings at the university. The contract stipulates that PU will pay Wiggins $25,000 at the end of each month, and, if total cost savings reach a specific target, PU will pay an additional $20,000 to Wiggins at the end of the contract. Wiggins estimates a 75% chance that cost savings will reach the target.Assume that Wiggins estimates uncertain consideration as the most likely amount. Required:Do the following for Wiggins:a. Prepare the journal entry on July 31 to record the first month of revenue under the contract.b. Assuming total cost savings exceed the target, prepare the journal entry, if any, on October 31 to record receipt of the $20,000 bonus (ignore the normal October payment of $25,000).c. Assuming total cost savings do not reach the target, prepare the journal entry, if…arrow_forwardThe following situations are independent: 1. Mark Installation completes a $4,000 contract, starting work on June 16, and completing the work on July 15. The home builder pays them $1,000 in advance on June 15, $2,600 on July 15, and the balance ($400) when the home is sold in September. 2. An interior designer signs a contract in December 2020 to provide design services to a home builder, related to decorating a new show home. The contract is valued at $25,000 and the designer receives a 10% down payment upon signing the contract. All design work is done during January 2021. On February 1, 2021, the show home opens to the public and the home builder pays the 90% balance remaining on the contract. 3. A lawyer has a meeting with a new client on April 15 and agrees to represent her in a legal case. The fee negotiated is to be based on the number of hours the lawyer spends on the case. At the end of the meeting, the client pays the lawyer $500 as a "retainer." The case involves research…arrow_forwardInfotech Bhd enters a contract on 1 January 2019 to produce software for a customer for RM7,000,000. Infotech Bhd receives RM2,000,000 from the customer upon contract signing and the balance at the completion of the contract. According to the contract, the customer controls the system during the creation of the program. Infotech Bhd estimates that it will take two years to complete the project and uses the number of labor hours to estimate the rate of completion. Infotech spends 40,000 hours in the first year of the contract and another 10,000 hours the second year Prepare the entries recorded by Infotech over the life of this contract. Assume that all payments are complete by the end of 2020arrow_forward

- Lister Company currently gives its employees their pay at the end of each week. Lister’s weekly payroll totals $500,000. If Lister extends the pay period so as to pay its employees one week later throughout an entire year, the employees would in effect be "lending" the firm how much for the year?arrow_forwardVelocity, a publicly traded corporation with a calendar fiscal year, entered into an agreement with Wedding Planners, Inc. a wedding event planning company on February 14, 2022. The contract specifies that the services will begin on March 1, 2022. Velocity will design a marketing strategy to increase “hits” on Wedding Planners website by 40%. The contract will last for 3 months (though May 31, 2022). Wedding Planners promises to pay $25,000 at the beginning of each month for Velocity’s services with the first payment on March 1, 2022. At the end of the contract, Velocity will be entitled to an additional $15,000 bonus, depending on whether traffic on Wedding Planners’ website has increased by the desired 40%. At the inception of the contract, Velocity estimated there is an 85% chance that they will earn the $15,000 bonus and 15% likelihood they will not. These probabilities are based on past experience with similar projects and the company has significant experience in these…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education