FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help with this accounting question do fast

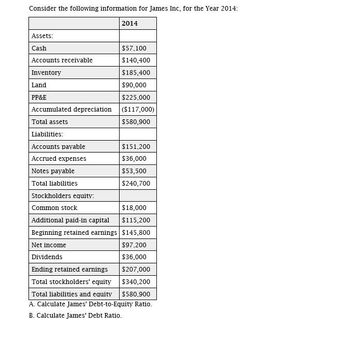

Transcribed Image Text:Consider the following information for James Inc, for the Year 2014:

Assets:

2014

Cash

$57.100

Accounts receivable

$140,400

Inventory

$185,400

Land

$90,000

PP&E

$225,000

Accumulated depreciation

($117,000)

Total assets

$580,900

Liabilities:

Accounts payable

$151,200

Accrued expenses

$36,000

Notes payable

$53,500

Total liabilities

$240,700

Stockholders equity:

Common stock

$18,000

Additional paid-in capital

$115,200

Beginning retained earnings $145,800

Net income

$97.200

Dividends

$36,000

Ending retained earnings

$207,000

Total stockholders' equity

$340,200

Total liabilities and equity

$580,900

A. Calculate James' Debt-to-Equity Ratio.

B. Calculate James' Debt Ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Best Buy Co., Inc.Balance SheetAt January 30, 2016($ in millions)AssetsCurrent assets:Cash and cash equivalents $ 1,976Short-term investments 1,305Accounts receivable, net 1,162Merchandise inventories 5,051Other current assets 392Total current assets 9,886Long-term assets 3,633Total assets $13,519Liabilities and Shareholders’ EquityCurrent liabilities:Accounts payable $ 4,450Other current liabilities 2,475Total current liabilities 6,925Long-term liabilities 2,216Shareholders’ equity 4,378Total liabilities and shareholders’ equity $13,519Best Buy Co., Inc.Income StatementFor the Year Ended January 30, 2016($ in millions)Revenues $ 39,528 Costs and expenses 38,153Operating income 1,375 Other income (expense)* (65)Income before income taxes 1,310 Income tax expense 503Net income $ 807*Includes $80 of interest expense.Liquidity and solvency ratios for the industry are as follows:Industry AverageCurrent ratio 1.23Acid-test ratio 0.60Debt to equity 0.70Times interest earned 5.66…arrow_forwardHow to calculate Net Operating Asset from this balance sheet for fiscal year-end 2015 .arrow_forwardLOWE'S Balance Sheets (in millions) Fiscal 2013 Fiscal 2012 Amount Percent Amount Percent Assets Current Assets Cash S 391 1.2% $ 541 1.7% Short-term Investments 185 0.6 125 0.4 Inventory 9.127 27.9 8,600 26.3 Other Current Assets 593 1.8 S18 1.6 Property and Equipment, Net Other Assets 20.834 63.6 21.477 65.7 1.602 $32.732 1405 S32.666 100,0% 4.9 4.3 Total Assets 100.0% Liabilities and Stockholders' Equity Current Liabilities S 8.876 27.1% $ 7,708 23.6% Long-term Liabilities 12003 36.7 11.101 34.0 Total Liabilities 20.879 63.8 18.809 57.6 11.853 $32732 36.2 Stockholders' Equity Total Liabilities and Stockholders' Equity 13,857 42.4 J00.0% $32,666 100.0% LOWE'S Income Statements (in millions) Fiscal 2013 Fiscal 2012 Amount Percent Amount Percent Net Sales Revenue $53,417 100.0% $50,521 100.0% Cost of Sales 34,941 65.4 33,194 17,327 65.7 Gross Profit 18,476 34.6 34.3 14,327 26.8 27.3 Operating and Other Expenses Interest Expense Income Tax Expense 13,767 476 0.9 423 0.8 1.387 2.6 1,178…arrow_forward

- mework i 0 ences Mc Graw Hill INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow million million million $ 27,571 17,573 1,406 $ 8,592 521 2022 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 121 620 $ 4,420 Saved $ 22,839 2,657 3,103 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity $ 33,019 Total liabilities and…arrow_forwardNeed helparrow_forwardSagararrow_forward

- General Accountingarrow_forwardWiemers Corporation’s comparative balance sheets are presented below. WIEMERS CORPORATIONBalance SheetsDecember 31 2017 2016 Cash $ 3,400 $ 4,000 Accounts receivable (net) 21,700 23,400 Inventory 10,200 7,500 Land 20,100 25,600 Buildings 69,700 69,700 Accumulated depreciation—buildings (15,500 ) (10,700 ) Total $109,600 $119,500 Accounts payable $ 12,000 $ 31,400 Common stock 75,600 69,200 Retained earnings 22,000 18,900 Total $109,600 $119,500 Wiemers’s 2017 income statement included net sales of $107,000, cost of goods sold of $59,700, and net income of $15,100.Compute the following ratios for 2017. (Round Debt to assets ratio to 1 decimal place, e.g. 1.6, or 1.6% and all other answers to 2 decimal places, e.g. 1.64, or 1.64% .) (a) Current ratio enter your answer rounded to 2 decimal places :1 (b) Acid-test ratio…arrow_forwardCalculate the following for Co. XYZ: c. Average collection period (365 days) d. Times interest earned Assets: Cash and marketable securities $400,000Accounts receivable 1,415,000Inventories 1,847,500Prepaid expenses 24,000Total current assets $3,686,500Fixed assets 2,800,000Less: accumulated depreciation 1,087,500Net fixed assets $1,712,500Total assets $5,399,000Liabilities: Accounts payable $600,000Notes payable 875,000Accrued taxes Total current liabilities $1,567,000Long-term debt 900,000Owner's equity Total liabilities and owner's equity Co. XYZ Income Statement: Net sales (all credit) $6,375,000Less: Cost of goods sold 4,375,000Selling and administrative expense 1,000,500Depreciation expense 135,000Interest expense Earnings before taxes $765,000Income taxes Net income Common stock dividends $230,000Change in retained earningsarrow_forward

- Current Attempt in Progress Presented below are a number of balance sheet items for Culver, Inc. for the current year, 2017. Goodwill $ 211,800 Accumulated depreciation-equipment $ 467,100 Payroll taxes payable 67,100 Inventory 400,400 Bonds payable 501,800 Rent payable (short-term) 41,800 Discount on bonds payable 35,100 Income tax payable 112,600 Cash 62,800 Rent payable (long-term) 81,800 Land 352,800 Common stock, $1 par value 251,800 Notes receivable 162,300 Preferred stock, $25 par value 1,251,800 Notes payable (to banks) 266,700 Prepaid expenses 70,560 Accounts payable 348,800 Equipment 1,387,800 Retained earnings ? Equity investments (trading) 376,800 Income taxes receivable 47,400 Accumulated depreciation-buildings 361,300 Unsecured notes payable (long-term) 1,301,800 Buildings 2,801,800 Prepare a classified…arrow_forwardWhat is the current ratio of Nezuko Inc.?arrow_forwardUsing the information below calculate the ROC of the company Years Revenue ($M) Net Income ($M) 2012 221.8 2.9 2013 473.8 20.2 2014 627.7 36.4 2015 947.8 45.0 2016 1,015.5 50.3 2017 1,046.2 64.9 2018 1,293.2 90.4 Years Total Assets ($M) Fixed Assets ($M) Current Assets ($M) Total Equity ($M) Retained Earnings ($M) 2012 430 286 144 293 12.8 2013 956 501 455 558 33.0 2014 922 668 324 620 69.4 2015 1103 796 307 665 114.4 2016 1120 835 285 729 164.7 2017 1294 738 556 805 229.6 2018 2053 703 1350 934 320arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education