FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

financial account

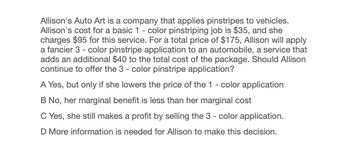

Transcribed Image Text:Allison's Auto Art is a company that applies pinstripes to vehicles.

Allison's cost for a basic 1 - color pinstriping job is $35, and she

charges $95 for this service. For a total price of $175, Allison will apply

a fancier 3 - color pinstripe application to an automobile, a service that

adds an additional $40 to the total cost of the package. Should Allison

continue to offer the 3 - color pinstripe application?

A Yes, but only if she lowers the price of the 1 - color application

B No, her marginal benefit is less than her marginal cost

C Yes, she still makes a profit by selling the 3 - color application.

D More information is needed for Allison to make this decision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Marquette has an opportunity to sell its product through an online retailer. To begin selling through this online platform, they are required to ship 2,000 units to the retailers’ order fulfillment warehouse. The other condition of this offer is that they pay a one-time vendor marketing fee of $5,000. To get the units to the fulfillment warehouse by the deadline Marquette will need to pay for expedited shipping at a cost of $10 per unit. What is the minimum price Marquette should charge the retailer for this initial order of 2,000 units? (Show all supporting calculations). (NOTE: ignore taxes or other costs not specifically mentioned in the questions.)arrow_forwardCool Boards manufactures snowboards. Its cost of making 1,800 bindings is as follows: (Click the icon to view the costs.) Suppose Lewis will sell bindings to Cool Boards for $16 each. Cool Boards would pay $3 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.70 per binding. Read the requirements. Requirement 1. Cool Boards' accountants predict that purchasing the bindings from Lewis will enable the company to avoid $1,800 of fixed overhead. Prepare an analysis to show whether Cool Boards should make or buy the bindings. (Only enter the net relevant costs. For the Difference column, use a minus sign or parentheses only when the cost of outsourcing exceeds the cost of making the bindings in-house.) Variable costs: Direct materials Direct labor Variable overhead Binding costs Fixed costs Purchase price from Lewis Transportation Logo Total differential cost of 1,800 bindings Should Cool Boards make or buy the bindings? Decision:…arrow_forwardMountain Fun manufactures snowboards. Its cost of making 2,100 bindings is as follows: (Click the icon to view the costs.) Suppose Hemingway will sell bindings to Mountain Fun for $14 each. Mountain Fun would pay $3 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.70 per binding. Read the requirements. Requirement 1. Mountain Fun's accountants predict that purchasing the bindings from Hemingway will enable the company to avoid $1,800 of fixed overhead. Prepare an analysis to show whether Mountain Fun should make or buy the bindings. (Only enter the net relevant costs. For the Difference column, use a minus sign or parentheses only when the cost of outsourcing exceeds the cost of making the bindings in-house.) Variable costs: Binding costs Direct materials Direct labor Variable overhead Fixed costs Purchase price from Hemingway Transportation Logo Total differential cost of 2,100 bindings Should Mountain Fun make or buy the…arrow_forward

- Bria Furniture sells bed frames and mattresses. One of its products is a premium therapeutic bed set produced by OmniSleep, which comes with a mattress and a bed frame. Bria offers a package consisting of the mattress, the frame, and on-site installation by its staff. All of these components can be sold separately, as often done by other vendors, so Bria concludes that these are separate performance obligations. Bria sells the OmniSleep package for $3,000. The mattress and the frame are sold separately for $2,000 and $900, respectively. Other vendors in the same area typically charge $200 for on-site installation. Bria does not sell on-site installation separately. On average, the prices charged by Bria are 10% higher than those of its competitors. Bria estimates that it incurs about $100 of compensation and other costs to provide the installation service. The profit margin over cost is estimated to be approximately 35%. Required: (a) Estimate the stand-alone selling price of the…arrow_forwardCool Boards manufactures snowboards. Its cost of making 2,100 bindings is as follows: (Click the icon to view the costs.) Suppose Hemingway will sell bindings to Cool Boards for $16 each. Cool Boards would pay $3 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.40 per binding. Requirements 1. Cool Boards' accountants predict that purchasing the bindings from Hemingway will enable the company to avoid $2,400 of fixed overhead. Prepare an analysis to show whether Cool Boards should make or buy the bindings. 2. The facilities freed by purchasing bindings from Hemingway can be used to manufacture another product that will contribute $3,500 to profit. Total fixed costs will be the same as if Cool Boards had produced the bindings. Show which alternative makes the best use of Cool Boards' facilities: (a) make bindings, (b) buy bindings and leave facilities idle, or (c) buy bindings and make another product. Print - X Done Data…arrow_forwardDiamond Boot Factory normally sells its specialty boots for $23 a pair. An offer to buy 105 boots for $16 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $8, and special stitching will add another $3 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization.$ Should Diamond Boot Factory accept or reject the special offer?arrow_forward

- Diamond Boot Factory normally sells its specialty boots for $35 a pair. An offer to buy 125 boots for $31 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organizatioarrow_forwardTupper Inc. and Victory Inc. are two small clothing companies that are considering leasing a dyeing machine together. The companies estimated that in order to meet production, Tupper needs the machine for 950 hours and Victory needs it for 700 hours. If each company rents the machine on its own, the fee will be $85 per hour of usage. If they rent the machine together, the fee will decrease to $80 per hour of usage. Read the requirements. Requirement 1. Calculate Tupper's and Victory's respective share of fees under the stand-alone cost-allocation method. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Stand-alone Tupper Victoryarrow_forwardAssume that Juicy reports the following costs to make 17.5 oz. bottles for its Juice Cocktails: (Click the icon to view the costs.) Another manufacturer offers to sell Juicy the bottles for $0.25. The capacity now used to make bottles will become idle if the company purchases the bottles. Further, one supervisor with a salary of $60,000, a fixed cost, would purchased. Requirement 1. Prepare a schedule that compares the costs to make and buy the 17.5 oz. bottles. Should Juicy make or buy the bottles? (Round the cost per bottle to three decimal places.) Direct materials Direct labor Variable factory overhead Avoidable annual fixed factory overhead Purchase cost Total relevant costs Make Total Per Bottle Total $ 104,500 $ 0.095 $ 45,100 $ 0.041 71,500 0.065 60,000 Buy Data table Per Bottle Juicy Company Cost of Making 17.5-Ounce Bottles 275,000 0.250 Total Cost for 1,100,000 Bottles Cost per Bottle $ 281,100 $ 275,000 $ 0.250 Direct materials 104,500 $ 0.095 Direct labor 45,100 0.041…arrow_forward

- Diamond Boot Factory normally sells its specialty boots for $24 a pair. An offer to buy 125 boots for $16 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $9, and special stitching will add another $3 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization.$fill in the blank 1 Income/Loss? Should Diamond Boot Factory accept or reject the special offer? Yes or Noarrow_forwardTupper Inc. and Victory Inc. are two small clothing companies that are considering leasing a dyeing machine together. The companies estimated that in order to meet production, Tupper needs the machine for 950 hours and Victory needs it for 700 hours. If each company rents the machine on its own, the fee will be $85 per hour of usage. If they rent the machine together, the fee will decrease to $80 per hour of usage. Read the requirements. Requirements 1. Calculate Tupper's and Victory's respective share of fees under the stand-alone cost-allocation method. 2. Calculate Tupper's and Victory's respective share of fees using the incremental cost-allocation method assuming (a) Tupper ranked as the primary party and (b) Victory ranked as the primary party. 3. Calculate Tupper's and Victory's respective share of fees using the Shapley value method. 4. Which method would you recommend Tupper and Victory use to share the fees? - Xarrow_forwardDiamond Boot Factory normally sells its specialty boots for $31 a pair. An offer to buy 100 boots for $25 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $11, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization. Income Should Diamond Boot Factory accept or reject the special offer? Accept the special offer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education