Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

- What is the balance in the Cost of Goods Sold account after the adjustment?

2.Post the appropriate entries to Work in Process Inventory Control account & determine the account balance on January 31, the end of the month.

3.

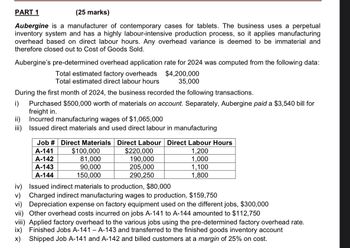

Transcribed Image Text:PART 1

(25 marks)

Aubergine is a manufacturer of contemporary cases for tablets. The business uses a perpetual

inventory system and has a highly labour-intensive production process, so it applies manufacturing

overhead based on direct labour hours. Any overhead variance is deemed to be immaterial and

therefore closed out to Cost of Goods Sold.

Aubergine's pre-determined overhead application rate for 2024 was computed from the following data:

Total estimated factory overheads

Total estimated direct labour hours

$4,200,000

35,000

During the first month of 2024, the business recorded the following transactions.

Purchased $500,000 worth of materials on account. Separately, Aubergine paid a $3,540 bill for

freight in.

ii) Incurred manufacturing wages of $1,065,000

iii) Issued direct materials and used direct labour in manufacturing

Job # Direct Materials Direct Labour Direct Labour Hours

A-141

A-142

A-143

A-144

$100,000

81,000

90,000

150,000

$220,000

190,000

205,000

290,250

1,200

1,000

1,100

1,800

iv) Issued indirect materials to production, $80,000

v) Charged indirect manufacturing wages to production, $159,750

vi) Depreciation expense on factory equipment used on the different jobs, $300,000

vii) Other overhead costs incurred on jobs A-141 to A-144 amounted to $112,750

viii) Applied factory overhead to the various jobs using the pre-determined factory overhead rate.

ix) Finished Jobs A-141 - A-143 and transferred to the finished goods inventory account

✗) Shipped Job A-141 and A-142 and billed customers at a margin of 25% on cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bumblebee Mobiles manufactures a line of cell phones. The management has identified the following overhead costs and related cost drivers for the coming year. The following were incurred in manufacturing two of their cell phones, Bubble and Burst, during the first quarter. REQUIREMENT Review the worksheet called ABC that follows these requirements. You have been asked to determine the cost of each product using an activity-based cost system. Note that the problem information is already entered into the Data Section of the ABC worksheet.arrow_forwardPART 1 (25 marks) Aubergine is a manufacturer of contemporary cases for tablets. The business uses a perpetual inventory system and has a highly labour-intensive production process, so it applies manufacturing overhead based on direct labour hours. Any overhead variance is deemed to be immaterial and therefore closed out to Cost of Goods Sold. Aubergine's pre-determined overhead application rate for 2024 was computed from the following data: Total estimated factory overheads Total estimated direct labour hours $4,200,000 35,000 During the first month of 2024, the business recorded the following transactions. Purchased $500,000 worth of materials on account. Separately, Aubergine paid a $3,540 bill for freight in. ii) Incurred manufacturing wages of $1,065,000 iii) Issued direct materials and used direct labour in manufacturing Job # Direct Materials Direct Labour Direct Labour Hours A-141 A-142 A-143 A-144 $100,000 81,000 90,000 150,000 $220,000 190,000 205,000 290,250 1,200 1,000…arrow_forwardK Dakota Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Dakota allocates manufacturing overhead costs using direct manufacturing labor costs. Dakota provides the following information (Click the icon to view the information.) Read the requirements Requirement 1. Compute the actual and budgeted manufacturing overhead rates for 2020 (Enter your answer as a number [not as a percentage] rounded to two decimal places, XXX) Actual manufacturing overhead rate = 1.95 Budgeted manufacturing overhead rate 1.7 = Requirements BES 4 1. Compute the actual and budgeted manufacturing overhead rates for 2020 2. During March, the job-cost record for Job 626 contained the following information Direct materials used $55,000 Direct manufacturing labor costs $45,000 Compute the cost of Job 626 using (a) actual costing and (b) normal costing 3. At the end of 2020, compute the under- or…arrow_forward

- The management of Winterroth Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The Corporation's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours. Estimated at the Beginning of the Year Сapacity Actual Machine-hours 53,000 63,000 49,000 Manufacturing overhead $1,803,060 $1,803,060 $1,803,060 If the Corporation bases its predetermined overhead rate on capacity, then as shown on the income statement prepared for internal management purposes, the cost of unused capacity would be closest to: Multiple Choice $286,200 $400,680 $264,600 $136,080arrow_forwardPLANTWIDE, DEPARTMENT, AND ABC INDIRECT COST RATES. Roadster Company (RC) designs and produces automotive parts. In 2020, the actual variable manufacturing overhead is $280,000. RC's simple costing system allocates variable manufacturing overhead to its three customers based on machine hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so RC's controller Matthew Draper realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: 1 Home A Insert Page Layout Formulas B 2 Department 3 Design 4 Production 5 Engineering 6 Total Cost Driver CAD-design-hours Engineering-hours Machine-hours Data с Review Manufacturing Overhead in 2020 $ 35,000 25,000…arrow_forwardplease help me solve the requirementsarrow_forward

- need correct and complete answer for all requirements with working answer should be well explainedarrow_forwardPlease complete all for requirementsarrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 56.000 machine-hours would be required for the period's estimated level of production. It also estimated $1,060,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following Information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or…arrow_forward

- Required information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 53,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,080,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or…arrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 56,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Molding 21,000 $780,000 $ 4.00 Fabrication 35,000 $ 260,000 $ 1.00 Total 56,000 $ 1,040,000 During the year, the…arrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $980,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Molding $ 370,000 $ 200,000 15,000 Job C-200 Direct…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning