CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

GENERAL ACCOUNT

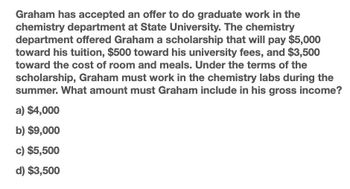

Transcribed Image Text:Graham has accepted an offer to do graduate work in the

chemistry department at State University. The chemistry

department offered Graham a scholarship that will pay $5,000

toward his tuition, $500 toward his university fees, and $3,500

toward the cost of room and meals. Under the terms of the

scholarship, Graham must work in the chemistry labs during the

summer. What amount must Graham include in his gross income?

a) $4,000

b) $9,000

c) $5,500

d) $3,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jarrod receives a scholarship of 18,500 from Riggers University to be used to pursue a bachelors degree. He spends 12,000 on tuition, 1,500 on books and supplies, 4,000 for room and board, and 1,000 for personal expenses. How much may Jarrod exclude from his gross income?arrow_forwardThis year (2023), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $79,700 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) Interest paid on accumulated student loans. Cost of purchasing a delivery uniform Contribution to State University deliveryman program $ 1,200 2,960 1,560 1,380 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. Evan's AGI Taxable incomearrow_forwardHilda received a research grant from the University of Timberland in amounts of $10,000 for her time and $3,000 for related supplies and expenses. She purchased a $28,000 Audi the day after depositing the school’s check. Hilda is a candidate for a PhD in philosophy and ethics. What is her gross income from the grant? Where did you locate your answer? If you located a case, Administrative Interpretation(s) or IRC section, is the authority still valid?arrow_forward

- Cathy Coed is a full-time senior student at Big Research University (BRU). Cathy is considered by most as a brilliant student and has been given a $35,000- per year scholarship. In the current year, Cathy Pays the following amounts to attend BRU: Tuition $26,000 Required lab fees $300 Required books and supplies $1,000 Room and board $7,500 What are the tax consequences (i.e., how much is income) of the $35,000 current’s year scholarship to Cathy? In answering this case, use an online tax service with only the internal revenue code database selected. State your key words and which online tax services you used to arrive at your answer.arrow_forwardThis year (2022), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $74,850 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) $ 1,200 Interest paid on accumulated student loans 2,970 Cost of purchasing a delivery uniform 1,570 Cash contribution to State University deliveryman program 1,385 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. What is Evan's AGI? What is Evan's Taxable Income?arrow_forwardAlpesharrow_forward

- Jesse is enrolled for one class at a local community college; tuition cost him $190. Jesse’s AGI is $20,000. Before considering a limitation due to tax liability, Jesse can take a lifetime learning credit of: a. $38 b. $0 c. $190 d. $100 e. $250arrow_forwardWally is employed as an executive with Pay More Incorporated. To entice Wally to work for Pay More, the corporation loaned him $25,000 at the beginning of the year at a simple interest rate of 1 percent. Wally would have paid interest of $3,000 this year if the interest rate on the loan had been set at the prevailing federal interest rate. Required: a. Wally used the funds as a down payment on a speedboat and repaid the $25,000 loan (including $250 of interest) at year-end. a-1. Does this loan result in any income to either party? a-2. Indicate the amount of income to either party that results from the loan. b. Assume instead that Pay More forgave the loan and interest on December 31. What amount of gross income does Wally recognize this year? Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B བིཀ Wally used the funds as a down payment on a speedboat and repaid the $25,000 loan (including $250 of interest) at year- end. Does this loan…arrow_forwardtes This year (2023), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $79,400 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) Interest paid on accumulated student loans Cost of purchasing a delivery uniform Contribution to State University deliveryman program $ 1,200 2,940 1,540 1,370 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. Evan's AGI Taxable incomearrow_forward

- Linda is an employee of JRH Corporation. Which of the following would be included in Lindas gross income? a. Premiums paid by JRH Corporation for a group term life insurance policy for 50,000 of coverage for Linda. b. 1,000 of tuition paid by JRH Corporation to State University for Lindas masters degree program. c. A 2,000 trip given to Linda by JRH Corporation for meeting sales goals. d. 1,200 paid by JRH Corporation for an annual parking pass for Linda.arrow_forwardKelly receives a $40,000 scholarship to Ivy University. She uses $30,000 on tuition and books, $5,000 for a used car, and $5,000 for rent while at school. Kelly will recognize _____ gross income. $0 $5,000 $10,000 $30,000 $40,000arrow_forwardMichiko and Saul are planning to attend the same university next year. The university estimates tuition, books, fees, and living costs to be 12,000 per year. Michikos father has agreed to give her the 12,000 she needs to attend the university. Saul has obtained a job at the university that will pay him 14,000 per year. After discussing their respective arrangements, Michiko figures that Saul will be better off than she will. What, if anything, is wrong with Michikos thinking?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT