FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

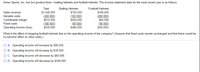

Transcribed Image Text:Armor Sports, Inc. has two product lines-batting helmets and football helmets. The income statement data for the most recent year is as follows:

Batting Helmets

$700,000

(150,000)

Total

Football Helmets

Sales revenue

$1,040,000

(430,000)

$610,000

(180,000)

$430.000

$340,000

(280.000)

$60.000

Variable costs

Contribution margin

Fixed costs

$550,000

(90,000)

(90 000)

($30,000)

Operating income (loss)

$460,000

What is the effect of dropping football helmets line on the operating income of the company? (Assume that fixed costs remain unchanged and that there would be

no adverse effect on other sales.)

O A. Operating income will increase by $90,000.

O B. Operating income will increase by $30,000.

O C. Operating income will decrease by $60,000.

O D. Operating income will decrease by $340,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Hammer Division of Excel Company produces hardened sledge hammers. One-third of Hammer's output is sold to the Government Products Division of Excel; the remainder is sold to outside customers. Hammer's estimated operating profit for the year is: Government Products Division Outside Customers Sales $ 15,000 $ 40,000 Variable costs (10,000 ) (20,000 ) Fixed costs (3,000 ) (6,000 ) Operating profits $ 2,000 $ 14,000 Unit sales 10,000 20,000 The Government Products Division has an opportunity to purchase 10,000 hammers of the same quality from an outside supplier on a continuing basis. The Hammer Division cannot sell any additional products to outside customers. Should the Excel Company allow its Government Products Division to purchase the hammers from the outside supplier at $1.25 per unit? Multiple Choice Yes; buying the hammers will save Excel $2,500. No; making the…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 928,000 472,000 456,000 69,400 44,500 116, 100 185,600 415,600 $ 40,400 Required 1 Complete this question by entering your answers in the tabs below. Required 2 Dirt Bikes $ 268,000 116,000 152,000 Mountain Bikes $ 403,000 200,000 203,000 Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production…arrow_forwardSheridan Company has two divisions; Sporting Goods and Sports Gear. The sales mix is 55% for Sporting Goods and 45% for Sports Gear, as determined by total sales dollars. Sheridan incurs $6690000 in fixed costs. The contribution margin ratio for Sporting Goods is 20%, while for Sports Gear it is 60%. The weighted-average contribution margin ratio isarrow_forward

- Blossom Repairs has 200 auto-maintenance service outlets nationwide. It performs primarily two lines of service: oil changes and brake repair. Oil change-related services represent 70% of its sales and provide a contribution margin ratio of 20% Brake repair represents 30% of its sales and provides a 40% contribution margin ratio. The company's fixed costs are $12,480,000 (that is $62,400 per service outlet). Sales mix is determined based upon total sales dollars. (a) Calculate the dollar amount of each type of service that the company must provide in order to break even. (Use Weighted Average Contribution Margin Ratio rounded to 2 decimal places ag 0.25 and round final answers to O decimal places, eg 2.510) Sales Dollars Needed Per Product Oil changes Brake repairarrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Weedban $ 12,00 $ 2.80 $ 129,000 Product Sales Variable expenses Contribution margin Traceable fixed expenses Product line segment margin Common fixed expenses not traceable to products Net operating income Greengrow $.33.00 $12.00 $ 41,000 Last year the company produced and sold 41,000 units of Weedban and 22.500 units of Greengrow. Its annual common fixed expenses are $100,000. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Weedban Greengrow Company $ 5,289,500 $4,502,000 $ 607,500 3,270,000 143,500 270,000 2,019,500 4,448,500 427,500 2,019,500 $4,448,500 $ 427,500 $ 2,019,500arrow_forwardShamrock Co. manufactures three types of computer desks. The income statement for the three products and the whole company is shown below: Sales Variable costs Fixed costs Total costs Operating income (loss) Product A Product B Product C $110,000 $135,000 75,000 125,000 $88,000 46,000 25,200 71,200 $16,800 18,000 93,000 $17,000 18,000 143,000 $(8,000) Total $333,000 246,000 61,200 307.200 $25,800 The company produces 1.000 units of each product. The company's capacity is 17,000 machine hours. The machine hours for each product are 7 hours for Product A, 5 hours for Product B, and 5 hours for Product C. Fixed costs are allocated based on machine hours.arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Total $ 917,000 460,000 457,000 Dirt Bikes $ 264,000 111,000 153,000 Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. 70,000 44,400 115,700 183,400 413,500 $ 43,500 Required 1 38,700 80,400 167,800 $ 43,200 Racing Bikes $ 251,000 158,000 93,000 20,600 15,600 36,400 50, 200 122,800 $ (29,800)arrow_forwardOriole Industries production division reported a net operating loss of $516000 in 2021. Included in that amount were common fixed corporate expenses of $734000 that were allocated to divisions based on segment gross profit. The division's segment margin was O $218000. O ($218000). O $516000. O ($516000).arrow_forwardThe Regal Cycle Company manufactures three types of bicycles—a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Total DirtBikes Mountain Bikes RacingBikes Sales $ 928,000 $ 261,000 $ 408,000 $ 259,000 Variable manufacturing and selling expenses 457,000 115,000 191,000 151,000 Contribution margin 471,000 146,000 217,000 108,000 Fixed expenses: Advertising, traceable 70,400 8,600 40,800 21,000 Depreciation of special equipment 42,700 20,100 7,200 15,400 Salaries of product-line managers 115,800 40,100 38,800 36,900 Allocated common fixed expenses* 185,600 52,200 81,600 51,800 Total fixed expenses 414,500 121,000 168,400 125,100 Net operating income (loss) $ 56,500 $ 25,000 $ 48,600 $ (17,100) *Allocated on the basis of sales dollars. Management is…arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total Dirt Bikes $ 920,000 469,000 451,000 $ 266,000 111,000 155,000 Mountain Bikes $ 402,000 200,000 Racing Bikes $ 252,000 158,000 202,000 94,000 69,200 8,400 40,400 20,400 44,000 21,000 7,700 15,300 114,700 40,300 38,600 35,800 184,000 53,200 80,400 50,400 411,900 122,900 167,100 121,900 $ 39,100 $ 32,100 $ 34,900 $ (27,900) Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage…arrow_forwardSmoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Xtreme Pathfinder Selling price per unit Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production and sales $ 116.00 $ 64.00 $ 12.00 $ 80.00 $ 52.00 $ 8.00 1.5 DLHS 1.0 DLHS 29,000 units 76,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: $ 1,912,000 119,500 DLHS Estimated total manufacturing overhead Estimated total direct labor-hours Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead…arrow_forwardThe following operating information reports the results of Ayayai Company’s production and sale of 12,500 air-conditioned motorcycle helmets last year. Based on early market forecasts, Ayayai expects the same results this year. Sales $2,026,000 Variable manufacturing expenses 862,000 Fixed manufacturing expenses 279,000 Variable selling and administrative expenses 112,000 Fixed selling and administrative expenses 229,000 The American Motorcycle Club has offered to purchase 1,600 helmets at a price of $100 each. Ayayai has sufficient idle capacity to fill the order, which would not affect the company’s cost structure or regular sales.If Ayayai accepts this order, by how much will its income increase or decrease? Operating income will select an option decreaseincrease by $enter a dollar amount .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education