FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

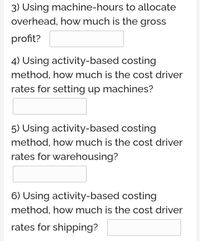

Transcribed Image Text:3) Using machine-hours to allocate

overhead, how much is the gross

profit?

4) Using activity-based costing

method, how much is the cost driver

rates for setting up machines?

5) Using activity-based costing

method, how much is the cost driver

rates for warehousing?

6) Using activity-based costing

method, how much is the cost driver

rates for shipping?

Transcribed Image Text:MTI makes three types of lawn tractors: M3100, M4100, and M6100. In the past, it allocated

overhead to products using machine-hours. Last year, the company produced 10,000 units of

M3100, 17,500 units of M4100, and 10,000 units of M6100 and had the following revenues

and costs:

MTI

Income Statement

M3100

M4 100

M6100

Total

Sales revenue.

Direct costs

Direct materials ..

Direct labor

$9,000,000 $15,000,000 $13,500,000 $37,500,000

3,000,000

600,000

4,500,000

900,000

3,300,000 10,800,000

1,800,000 3,300,000

Variable overhead

Setting up machines.

Processing sales orders...

Warehousing .....

Operating machines

Shipping ..

Contribution margin.

Plant administration

2,400,000

1,800,000

2,400,000

1,200,000

900,000

$14,700,000

Gross profit.....

6,000,000

$ 8,700,000

MTI's controller has heard about activity-based costing and puts together an employee team

to recommend cost allocation bases. The employee team recommends the following:

Activity

Cost Driver

M3100 M4100 M6100

Setting up machines.... Production runs

Processing sales orders

Warehousing...

Operating machines

Shipping..

10

20

20

Sales orders received

Units held in inventory

Machine-hours

180

400

220

100

200

100

6,000

10,000 17,500 10,000

9,000 10,000

Units shipped

The employee team recommends that plant administration costs not be allocated to products.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Golfers, Inc. (Gl) manufactures golf-related equipment including golf balls. This year's expected production of golf balls is 80,000 packs (each consisting of four golf balls). Cost data are as follows: Product costs directly traceable to balls! Direct materials. Direct labour Variable manufacturing overhead Fixed manufacturing overhead General allocated overhead Pack $2.30 1.20 0.25 Packs $184,000 96,000 20,000 40,800 21,600 $362,400 The full cost of one pack of golf balls is $4.53. Gl has received an offer from an outside supplier to supply any desired quantity of balls at a price of $5.45 per pack of four golf balls. The cost accounting department has provided the following information: a. The direct fixed manufacturing overhead is the cost of leasing the machine that stamps out the balls. The machine can produce a maximum of 500,000 balls per year. If the balls are bought, the machine will no longer be needed. b. No other costs will be affected. Per Unit Required: 1. Prepare an…arrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($378,000 ÷ 900,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Direct Labor Rate Variance Direct Labor Efficiency Variance IF TI 1,000,000 11,800,000 $ 8,260,000 $ Required: Calculate Parker Plastic's direct labor rate and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). F 245,000 2,891,000 $ 318,500 $ 355,000 Standard Quantity 12 square…arrow_forwardSummer Enterprises produces "Breeze" and "Storm" cooling fans. Selected data related to each product is as follows: Breeze Storm Sales price per unit $200 $300 Direct materials per unit $60 $70 Direct labour per unit $30 $35 Variable overhead per unit $10 $15 Direct labour hours per unit 2 There is a maximum of 24,000 direct labour hours available each year.arrow_forward

- Consider zagol manufacturing which is engaged in the manufacturing of product ABC. To produce one unit of the product the company incurs the following costs: Direct material ______$5/kg Direct labor_________$10/hour Total Manufacturing overhead __________________$30000 The company produces a total of 10000 units per month. And the actual price the product is sold is around $24. Company XYZ offers to buy a total of 5000 units this month at the price of $ 17/unit. Would you accept the order if you are the manager? (assume 20% of the manufacturing overhead is variable costarrow_forwardRequired information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,600 units, and monthly production costs for the production of 1,300 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($270 fixed) Depreciation Total Cost $ 2,500 8,100 650 3,000 510 750 Suppose it sells each birdbath for $24. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,500 units.arrow_forwardMunoz Sporting Equipment manufactures baseball bats and tennis rackets. Department B produces the baseball bats, and Department T produces the tennis rackets. Munoz currently uses plantwide allocation to allocate its overhead to all products. Direct labor cost is the allocation base. The rate used is 200 percent of direct labor cost. Last year, revenue, materials, and direct labor were as follows. Sales revenue Direct labor Direct materials Baseball Bats $1,540,000 260,000 556,000 Tennis Rackets a. Using plantwide allocation b. Using department's allocation rate $1,025,000 130,000 289,000 Required: a. Compute the profit for each product using plantwide allocation. b. Maria, the manager of Department T, was convinced that tennis rackets were really more profitable than baseball bats. She asked her colleague in accounting to break down the overhead costs for the two departments. She discovered that had department rates been used, Department B would have had a rate of 150 percent of…arrow_forward

- Munoz Sporting Equipment manufactures baseball bats and tennis rackets. Department B produces the baseball bats, and Department Y produces the tennis rackets. Munoz currently uses plantwide allocation to allocate its overhead to all products. Direct labor cost is the allocation base. The rate used is 100 percent of direct labor cost. Last year, revenue, materials, and direct labor were as follows. Baseball Bats Tennis Rackets Sales revenue $1,550,000 $1,000,000 Direct labor 360,000 100,000 Direct materials 558,000 290,000 Required: Compute the profit for each product using plantwide allocation. Maria, the manager of Department T, was convinced that…arrow_forwardVisnoarrow_forwardVikram bhaiarrow_forward

- Please help me with this questionarrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($639,200 + 940,000 units) Parker Plastic had the following actual results for the past year. Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 1,020,000 12,900,000 $ Direct Labor Rate Variance Direct Labor Efficiency Variance 16,770,000 338,000 $ 4,258,800 $ 1,760,000 $ 395,000 Required: Calculate Parker Plastic's direct labor rate and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Answer is complete but not…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education