Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

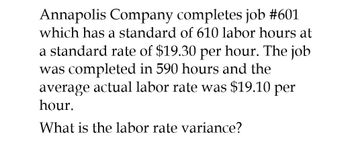

Transcribed Image Text:Annapolis Company completes job #601

which has a standard of 610 labor hours at

a standard rate of $19.30 per hour. The job

was completed in 590 hours and the

average actual labor rate was $19.10 per

hour.

What is the labor rate variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Coops Stoops estimated its annual overhead to be $85,000 and based its predetermined overhead rate on 24,286 direct labor hours. At the end of the year, actual overhead was $90,000 and the total direct labor hours were 24,100. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardBabu Company completes job #928 which has a standard of 610 labor hours at a standard rate of $19.30 per hour. The job was completed in 590 hours and the average actual labor rate was $19.10 per hour. What is the labor rate variance? Don't Use Aiarrow_forwardGeneral Accountingarrow_forward

- Cavy Company estimates that total factory overhead costs will be $1,011,028 for the year. Direct labor hours are estimated to be 100,700. a. Determine the predetermined factory overhead rate. Round your answer to the nearest cent.$fill in the blank 8b99eb02a009f9f_1 b. Determine the amount of factory overhead applied to Job 567 if the amount of direct labor hours is 1,200 and Job 999 if the amount of direct labor hours is 2,800. Job 567 $fill in the blank 8b99eb02a009f9f_2 Job 999 $fill in the blank 8b99eb02a009f9f_3 c. Prepare the journal entry to apply factory overhead for April according to the predetermined overhead rate. fill in the blank aa9138f9703b038_2 fill in the blank aa9138f9703b038_4arrow_forwardBreakaway Company's labor information for May is as follows: Actual direct labor hours worked Standard direct labor hours allowed Total payroll for direct labor Direct labor time variance $18,320 (unfavorable) A. What is the actual direct labor rate per hour? Round your answer to two decimal places. Actual direct labor rate $ per hour B. What is the standard direct labor rate per hour? Round your answer to two decimal places. Standard direct labor rate per hourarrow_forwardCavy Company estimates that total factory overhead costs will be $572,128 for the year. Direct labor hours are estimated to be 94,100. a. Determine the: 1. Predetermined factory overhead rate. Round your answer to the nearest cent.$fill in the blank acece905b02a058_1 per labor hour 2. Amount of factory overhead applied to Job 345 if the amount of direct labor hours is 1,200 and Job 777 if the amount of direct labor hours is 3,300. Job 345 $fill in the blank acece905b02a058_2 Job 777 $fill in the blank acece905b02a058_3 b. Journalize the entry to apply factory overhead for April, assuming Jobs 345 and 777 are the only jobs in production during the month. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - - Select - - Select -arrow_forward

- Coleridge Company estimates that its production workers will work 143,000 direct labor hours during the upcoming period and that overhead costs will amount to $1,287,000. Assume overhead to be allocated on the basis of direct labor hours. What predetermined overhead rate would be used to apply overhead to production during the period? Multiple Choice $9.00 per direct labor hour $0.97 per direct labor hour $0.97 per unit $9.00 per unitarrow_forwardCavy Company estimates that total factory overhead costs will be $1,053,206 for the year. Direct labor hours are estimated to be 107,800. a. Compute the predetermined factory overhead rate. Round your answer to the nearest cent. $4 per direct labor hour b. Determine the amount of factory overhead applied to Job 345 if the amount of direct labor hours is 1,200 and to Job 777 if the amount of direct labor hours is 3,300. Job 345 Job 777 $4 c. Journalize the entry to record the factory overhead applied if Jobs 345 and 777 are the only jobs for the period. If an amount box does not require an entry, leave it blank.arrow_forwardAmazing Corporation gathered the following information for Job #928: Standard Total Cost Actual Total Cost Direct labor: Standard: 900 hours at $6.50/hr. $5,850 Actual: 200 hours at $4.75/hr. $950 What is the direct labor efficiency variance?arrow_forward

- Cavy Company estimates that total factory overhead costs will be $1,039,500 for the year. Direct labor hours are estimated to be 110,000.arrow_forwardCavy Company estimates that total factory overhead costs will be $747,937 for the year. Direct labor hours are estimated to be 104,900. a. Determine the:1. Predetermined factory overhead rate. Round your answer to the nearest cent.2. Amount of factory overhead applied to Job 345 if the amount of direct labor hours is 1,000 and Job 777 if the amount of direct labor hours is 3,000. Job 345 Job 777 b. Journalize the entry to apply factory overhead for April, assuming Jobs 345 and 777 are the only jobs in production during the month. If an amount box does not require an entry, leave it blank.arrow_forwardThe details regarding Labour force engaged in a work scheduled to be completed in 30 hours are as follows:- The work is actually completed in 32 hours. Calculate Labour Variances. Show your working clearly.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College