EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Need answer

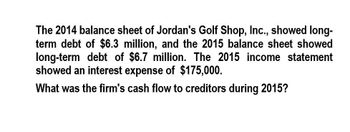

Transcribed Image Text:The 2014 balance sheet of Jordan's Golf Shop, Inc., showed long-

term debt of $6.3 million, and the 2015 balance sheet showed

long-term debt of $6.7 million. The 2015 income statement

showed an interest expense of $175,000.

What was the firm's cash flow to creditors during 2015?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accountingarrow_forwardHerbert Company reported the following information for 2013: Repaid long-term debt $75,000 Paid interest on note payable 1,570 Issued common stock 30,000 Paid dividends 18,000 Based on this information, what is the cash flow from financing activities?arrow_forwardNeed answer this questionarrow_forward

- Central Bank has the following information (in $million). 2017 ($ million) 2018 ($ million) Revenue 780 890 Net income 240 375 Assets 22,450 27,850 Equity 2,250 2,980 Which of the following statements about Central Bank is CORRECT? Select one: a. From 2017 to 2018, its Return on Equity decreased, Return on Assets decreased, and Leverage Multiplier increased. b. From 2017 to 2018, its Return on Equity increased, Return on Assets increased, and Leverage Multiplier decreased. c. From 2017 to 2018, its Return on Equity increased, Return on Assets increased, and Leverage Multiplier increased. d. From 2017 to 2018, its Return on Equity increased, Return on Assets decreased, and Leverage Multiplier increased.arrow_forwardCash flow identity. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,100 for 2017 and had an overall tax rate of 40% for 2017. Verify the cash flow identity: cash flow from assets = cash flow to creditors + cash flow to owners The cash flow from assets is $ 24,380. (Round to the nearest dollar.) The cash flow to creditors is $ 45000. (Round to the nearest dollar.) The cash flow to owners is $ (Round to the nearest dollar.)arrow_forwardBold Company’s 2016 income statement reported total credit revenue of $250,000. Bold’s accounts receivable balance on January 1, 2016 was $30,000, and its December 31, 2016 accounts receivable balance was $10,000. Bold’s accounts payable balance on January 1, 2016 was $25,000, and its December 31, 2016 accounts payable balance was $35,000. How much did Bold collect from customers during 2016?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning