SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

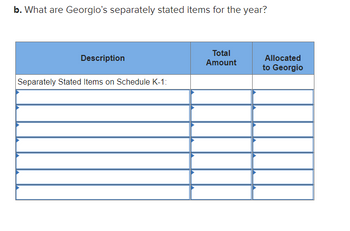

Transcribed Image Text:b. What are Georgio's separately stated items for the year?

Description

Separately Stated Items on Schedule K-1:

Total

Amount

Allocated

to Georgio

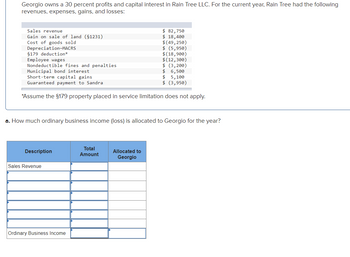

Transcribed Image Text:Georgio owns a 30 percent profits and capital interest in Rain Tree LLC. For the current year, Rain Tree had the following

revenues, expenses, gains, and losses:

Sales revenue

Gain on sale of land (§1231)

Cost of goods sold

Depreciation-MACRS

§179 deduction*

Employee wages

Nondeductible fines and penalties

Municipal bond interest

Short-term capital gains

Guaranteed payment to Sandra

$ 82,750

$ 18,400

$(49,250)

$ (5,950)

$(18,900)

$(12,300)

$ (3,200)

$ 6,500

$ 5,100

$ (3,950)

*Assume the $179 property placed in service limitation does not apply.

a. How much ordinary business income (loss) is allocated to Georgio for the year?

Description

Total

Amount

Allocated to

Georgio

Sales Revenue

Ordinary Business Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dengararrow_forwardRequired Information [The following information applies to the questions displayed below.] Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $12,000 from Falcons Corporation. Sales revenue Cost of goods sold Falcons Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Salary to owners Julio and Milania Employee wages Depreciation expense Section 179 expense Interest income (related to business income) Municipal bond income Government fines Overall net income Distributions Ordinary Income Amount Year 1 $ 335,000 (42,000) (40,000) (30,000) (20,000) (30,000) 12,000 1,808 Allocated to Julio 0 $ 186,800 $ 24,000 a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $240,000 of qualified property (unadjusted basis). Year 2 $ 465,000…arrow_forward11.arrow_forward

- Required Information Problem 09-59 (LO 09-4) (Algo) [The following information applies to the questions displayed below.] Georgio owns a 10 percent profits and capital interest in Rain Tree LLC. For the current year, Rain Tree had the following revenues, expenses, gains, and losses: Sales revenue Gain on sale of land ($1231) Cost of goods sold Depreciation-MACRS §179 deduction* Employee wages Nondeductible fines and penalties Municipal bond interest Short-term capital gains. Guaranteed payment to Sandra *Assume the §179 property placed in service limitation does not apply. Description Problem 09-59 Part a (Algo) a. How much ordinary business income (loss) is allocated to Georgio for the year? Sales revenue Ordinary Business Income $ 85,000 13,600 (46,750) (4,250) (14,500) Total Amount Allocated to Georgio (20,000) (3,800) 7,300 6,150 (3,700)arrow_forwardRequired Information Problem 09-59 (LO 09-4) (Algo) [The following information applies to the questions displayed below.] Georgio owns a 10 percent profits and capital interest in Rain Tree LLC. For the current year, Rain Tree had the following revenues, expenses, gains, and losses: Sales revenue Gain on sale of land (51231) Cost of goods sold Depreciation-MACRS §179 deduction* Employee wages Nondeductible fines and penalties Municipal bond interest Short-term capital gains Guaranteed payment to Sandra $ 85,000 13,600 (46,750) (4,250) (14,500) (20,000) (3,800) 7,300 6,150 (3,700) *Assume the $179 property placed in service limitation does not apply. Problem 09-59 Part b (Algo) b. What are Georgio's separately stated items for the year? Description Separately Stated Items on Schedule K-1: Total Amount Allocated to Georgioarrow_forwardkak.2arrow_forward

- On January 1, 2022, Sam and Sara formed a new business entity called Nice Brother Co. Sam contributes $250,000 cash and Sara contributes land with an adjusted basis of $300,000 and fair market value of $492,000 with a mortgage of $258,000 that is assumed by Nice Brother Co. Assume the following operating results for 2022: Sales $ 1,500,000 Interest income – from a bank $ 3,200 Royalties $ 60,000 Loss from sale of investment $ (7,000) Cost of goods sold $ 622,000 Salaries $ 450,000 Rent $ 144,000 Maintenance $ 24,000 Utilities $ 58,000 EPA penalty $ 1,000 Depreciation ? Charitable contribution $ 30,000 Payment to Sam for retirement* $ 15,000 *payment considered a guaranteed payment if the entity is a partnership The company’s only depreciable asset is equipment (useful life of 5 years) which will be purchased in 2022 for $100,000. The only asset sold was an investment purchased on 2/2/22 for $28,000 and sold on 11/4/22 for $21,000 What are the separately stated items allocated…arrow_forwardsanjuarrow_forwardD1. Accountarrow_forward

- George operates a business that generated revenues of $57 million and allocable taxable income of $1.32 million. Included in the computation of allocable taxable income were deductible expenses of $243,500 of business interest and $253,500 of depreciation. What is the business interest limitation that George will be subject to this year if the business does not qualify under the gross income test? Multiple Choice $396,000 $231,500 $319,950 $497,000 O $469,050arrow_forward1. George operates a business that generated revenues of $50 million and allocable taxable income of $560,000. Included in the computation of allocable taxable income were $900,000 of business interest expense, $20,000 of business interest income, and $180,000 of depreciation. What is the maximum business interest deduction that George will be eligible to claim this year if the business does not qualify under the gross income test? a) $168,000 b) $560,000 c) $612,000 d) $452,000 2. Mike started a calendar-year business on September 1stSeptember 1st of this year by paying 12 months of rent on his shop at $550 per month. What is the maximum amount of rent that Mike can deduct this year under each type of accounting method? a) $6,600 under the cash method and $6,600 under the accrual method b) $6,600 under the cash method and $2,200 under the accrual method c) $2,200 under the cash method and $2,200 under the accrual method d) $2,200 under the cash method and zero under the…arrow_forwardam. 112.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you