Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Can you please check my work it keeps showing I'm mi

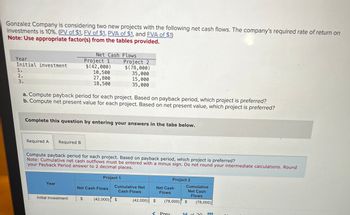

Transcribed Image Text:Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on

investments is 10%. (PV of $1, FV of $1, PVA of $1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided.

Net Cash Flows

Year

Project 1

Initial investment

$(42,000)

1.

10,500

27,800

18,500

2.

3.

Project 2

$(78,000)

35,000

15,000

35,000

a. Compute payback period for each project. Based on payback period, which project is preferred?

b. Compute net present value for each project. Based on net present value, which project is preferred?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute payback period for each project. Based on payback period, which project is preferred?

Note: Cumulative net cash outflows must be entered with a minus sign. Do not round your intermediate calculations. Round

your Payback Period answer to 2 decimal places.

Project 1

Project 2

Year

Net Cash Flows

Cumulative Net

Cash Flows

Net Cash

Flows

Cumulative

Net Cash

Flows

Initial investment

$

(42,000) $

(42,000) $

(78,000) $

(78,000)

<Prev

14

of 20

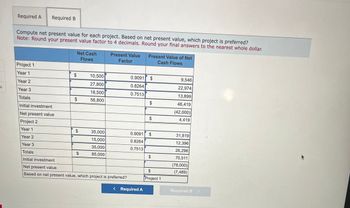

Transcribed Image Text:Required A

Required B

Compute net present value for each project. Based on net present value, which project is preferred?

Note: Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.

Net Cash

Flows

Present Value

Present Value of Net

Factor

Cash Flows

Project 1

Year 1

$

EA

Year 2

S

Year 3

Totals

Initial investment

Net present value

Project 2

Year 1

Year 2

Year 3

Totals

Initial investment

Net present value

10,500

0.9091

$

SA

27,800

0.8264

18,500

0.7513

$

56,800

EA

9,546

22,974

13,899

$

46,419

(42,000)

SA

$

4,419

$

SA

35,000

0.9091

$

31,819

15,000

0.8264

12,396

35,000

0.7513

26,296

$

85,000

$

70,511

(78,000)

$

(7,489)

Based on net present value, which project is preferred?

Project 1

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forwardFoster Manufacturing is analyzing a capital investment project that is forecast to produce the following cash flows and net income: The payback period of this project will be: a. 2.5 years. b. 2.6 years. c. 3.0 years. d. 3.3 years.arrow_forward

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardFoster Manufacturing is analyzing a capital investment project that is forecasted to produce the following cash flows and net income: After-Tax Cash Flows $(20,000) Net Income Year 1 6,000 2,000 6,000 8,000 2,000 3 2,000 8,000 2,000 Using the present value tables provided in Appendix A, the internal rate of return (rounded to the nearest whole percentage) is: а. 5%. b. 12%. C 14%. d. 40%.arrow_forwardConsider an investment project with the cash flows given in the table below. Compute the IRR for this investment. Is the project acceptable at MARR = 10%? The IRR for this project is %. (Round to one decimal place.) n 0 1 2 3 Cash Flow -$35,000 15,000 14,520 13,990arrow_forward

- Jiminez Company has two Investment opportunitles. Both Investments cost $5,700 and will provide the following net cash flows: Year Investment A Investment B $3,350 $3,350 3,350 4,420 3 3,350 2,350 4 3,350 1,140 What Is the total present value of Investment A's cash flows assuming an 9% minimum rate of return? (PV of $1 and PVA of $1) (Use approprlate factor(s) from the tables provlded. Do not round Intermedlate calculetions. Round your answer to the nearest doillar.) Multiple Choice $11,830. $5.153. $9.416. $3.350. Prey Nest > $51 AMarrow_forwardFollowing is information on two alternative investment projects being considered by Tiger Company. The company requires a 7% return from its investments (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Initial investment Net cash flows in: Year 1 Year 2 Year 3 Required A Required B Project X1 Year 11 Year 2 Year 3 a. Compute each project's net present value. b. Compute each project's profitability index. c. If the company can choose only one project, which should it choose on the basis of profitability index? Totals Initial investment Net present value Complete this question by entering your answers in the tabs below. Project X2 Year 1 Year 2 Year 3 Totais Initial investment S Project X1 $ (116,000) Compute each project's net present value. (Round your final answers to the nearest dollar) Net Cash Flows Present Value of Net Cash Flows S 43,000 53,500 78,500 Required C O 0 Present Value of 1 at 7% Project X2 $ (192,000) $ 87,000 77,000…arrow_forwardConsider the cash flows for the investment projects given in Table. Assume that the MARR = 10%. (a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected on the basis of the IRR criterion? (b) Assume that projects C and E are mutually exclusive. Using the IRR criterion, which Project would you select?. Net Cash Flow B D. E -4,850 2,100 2,100 2,500 4,250 3,200 2,850 800 300 4,250 4,250 2,850 2,900 1,050 500 -835 -835 -835 -835 1,500 3.250 1,600 1,200 2,100 2,100arrow_forward

- Molin Inc. is considering to a project that will have the following series of cash flow from assets (in $ million): Year Cash flow 0 -1,580.92 1 453 2 749 3 935 The required return for the project is 6%. Year Cash flow 0 -1,580.92 1 453 2 749 3 935 1. The required return for the project is 6%. 2. What is the project's profitability index? 3. What is the internal rate of return (IRR) for this project?arrow_forwardFollowing is information on two alternative investments being considered by Jolee Company. The company requires a 10% return from its investments. For each alternative project, compute the (a) net present value and (b) profitability index. (Round your answers in part b to two decimal places.) If the company can only select one project, which should it choose?arrow_forwardYou are given the following cash flows for a project. Assuming a cost of capital of 12.84 percent. determine the profitability index for this project. Year 0 1 2 3 4 5 O 14981 O 1.68/7 O1.7508 1.6245 1.5613 Cash Flow -$1,115.00 $554.00 $622.00 $648 00 $426.00 $216.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,