SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please solve the issue

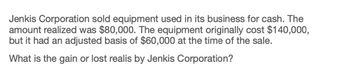

Transcribed Image Text:Jenkis Corporation sold equipment used in its business for cash. The

amount realized was $80,000. The equipment originally cost $140,000,

but it had an adjusted basis of $60,000 at the time of the sale.

What is the gain or lost realis by Jenkis Corporation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the answer?arrow_forwardI need help to get answerarrow_forwardCCC Manufacturing Inc. sold equipment that it uses in its business for $110,000. CCC bought the equipment two years ago for $95,000 and has claimed $10,000 of depreciation expense. What is the amount and character of CCC's gain or loss? $25,000 ordinary gain. $25,000 capital gain. $10,000 ordinary gain and $15,000 §1231 gain. $15,000 ordinary gain and $10,000 §1231 gain.arrow_forward

- Zenith Corporation sells some of its used store fixtures. The acquisition cost of the fixtures is $13,732, and the accumulated depreciation on these fixtures is $8,504 at the time of sale. The fixtures are sold for $4,206. The value of this transaction in the investing section of the statement of cash flows isarrow_forwardWhat was the gain or loss on the sale of the equipment on this general accounting question?arrow_forwardThe Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally purchased for $40,000, and depreciation through the date of sale totaled $25,000. 1. What was the gain or loss on the sale of the equipment? on salearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you