FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

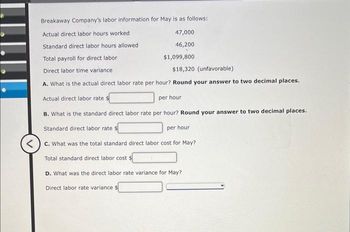

Transcribed Image Text:Breakaway Company's labor information for May is as follows:

Actual direct labor hours worked

Standard direct labor hours allowed

Total payroll for direct labor

Direct labor time variance

$18,320 (unfavorable)

A. What is the actual direct labor rate per hour? Round your answer to two decimal places.

Actual direct labor rate $

per hour

B. What is the standard direct labor rate per hour? Round your answer to two decimal places.

Standard direct labor rate

per hour

<c. What was the total standard direct labor cost for May?

Total standard direct labor cost $

D. What was the direct labor rate variance for May?

Direct labor rate variance $

47,000

46,200

$1,099,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Total Cost FormulaDavis Company has analyzed its overhead costs and derived a general formula for their behavior: $55,000 + $14 per direct labor hour employed. The company expects to use 50,000 direct labor hours during the next accounting period. What overhead rate per direct labor hour should be applied to jobs worked during the period? Round answer to two decimal places. Overhead rate per direct labor hour $_________arrow_forwardThe controller of Sunland Industries has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs. Month TotalMaintenance Costs TotalMachine Hours January $2,590 330 February 2,890 380 March 3,490 530 April 4,390 660 May 3,090 530 June 5,470 730 Determine the variable cost components using the high-low method. (Round answer to 2 decimal places e.g. 2.25.) Variable cost per machine hour $enter the variable cost per machine hour in dollars rounded to 2 decimal places Determine the fixed cost components using the high-low method. Total fixed costs $enter the total fixed costs in dollarsarrow_forwardKyle Forman worked 47 hours during the week for Erickson Company at two different jobs. His pay rate was $14.00for the first 40 hours, and his pay rate was $11.80 for the other 7 hours. Determine his gross pay for that week if thecompany uses the one-half average rate method.a. Gross pay ........................................................................................................................ $b. If prior agreement existed that overtime would be paid at the rate for the jobperformed after the 40th hour, the gross pay would be ................................................... $arrow_forward

- Given the following cost and activity observations for Bounty Company's utilities, use the high-low method to determine Bounty's variable utilities cost per machine hour. Round your answer to the nearest cent. Cost Machine Hours March $3,142 15,489 April 2,691 10,041 May 2,810 11,509 4 June 3,881 18,009 a. $0.15 b. $1.05 O c. $1.64 Od. $1.01 10:21 PM 670002 K 63°Farrow_forwardSteeler Towel Company estimates its overhead to be $483,000. It expects to have 138,000 direct labor hours costing $4,830,000 in labor and utilizing 11,500 machine hours. Calculate the predetermined overhead rate using: Round your answers to two decimal places. A. Direct labor hours $fill in the blank 1 per direct labor hour B. Direct labor dollars $fill in the blank 2 per direct labor dollar C. Machine hours $fill in the blank 3 per machine hourarrow_forwardMcBride and Associates employs two professional appraisers, each having a different specialty. Debbie specializes in commercial appraisals and Tara specializes in residential appraisals. The company expects to incur total overhead costs of $299,610 during the year and applies overhead based on annual salary costs. The salaries and billable hours of the two appraisers are estimated to be as follows: Annual Salary Billable Hours Debbie $ 126,480 1,700 Tara $ 73,260 1,650 The accountant for McBride and Associates is computing the hourly rate that should be used to charge clients for Debbie's and Tara's services. The hourly billing rate should be set to cover the total cost of services (salary plus overhead) plus a 25 percent markup. Required: 1. Compute the predetermined overhead rate.. 2. Compute the hourly billing rates for Debbie and Tara.arrow_forward

- Domesticarrow_forwardThe following annual amounts pertain to the Wolf Company: Estimated Overhead Costs Estimated Direct Labor hours $ 191,079 73,492 If actual overhead costs for the year amounted to $198,400 and actual direct labor worked amounted to 75.500 hours, then overhead would be Multiple Choice overapplied by $2112 underapplied by $2,112 underapplied by $2,100.arrow_forwardApplying Factory Overhead Jernigan Company estimates that total factory overhead costs will be $378,000 for the year. Direct labor hours are estimated to be 27,000. a. For Jernigan Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places.$fill in the blank fb95c2fa601df9b_1 per direct labor hour b. During August, Jernigan Company accumulated 550 hours of direct labor costs on Job 40 and 520 hours on Job 42. Determine the amount of factory overhead applied to Jobs 40 and 42 in August.$fill in the blank fb95c2fa601df9b_2 c. Prepare the journal entry to apply factory overhead to both jobs in August according to the predetermined overhead rate.arrow_forward

- 2 ts eBook Mc Graw Hill The following information is for Punta Company for July: a. Factory overhead costs were applied to jobs at the predetermined rate of $50.00 per labor hour. Job Sincurred 6,250 labor hours; Job T used 4,350 labor hours. b. Job S was shipped to customers during July. c. Job T was still in process at the end of July. d. The overapplied or underapplied overhead to the Cost of Goods Sold account was closed at the end of July. e. Factory utilities, factory depreciation, and factory insurance incurred are summarized as follows: " Utilities Depreciation Insurance Total f. Direct materials and indirect materials used are as follows: $ 16,500 48,750 Job Job T Indirect labor Total $ 19,500 84,750 Job S $ 32,250 Job T $75,000 37,250 14,250 $46,500 $ 112,250 Total 107,250 $ 51,500 158,750 214,750 $373,500 Material A Material B Subtotal Indirect materials Total g. Direct labor incurred for the two jobs and indirect labor are as follows: $ 63,000 52,500 148,000 $263,500…arrow_forwardU the common shares is $165 each and market price of the preferred is $230 each. (Round to nearest dollar.) b. Prepare the journal entry for the issuance when only the market price of the common stock is known and it is $170 per share. E14.6 (LO 1, 2) (Stock Issuances and Repurchase) Lindsey Hunter Corporation is authorized to issue 50,000 shares of $5 par value common stock. During 2025, Lindsey Hunter took part in the following selected transactions. a. Issued 5,000 shares of stock at $45 per share, less costs related to the issuance of the stock totaling $7,000. b. Issued 1,000 shares of stock for land appraised at $50,000. The stock was actively traded on a national stock exchange at approximately $46 per share on the date of issuance. c. Purchased 500 shares of treasury stock at $43 per share. The treasury shares purchased were issued in 2021 at $40 per share. d. Retired the treasury shares purchased in part (c). Instructions Prepare the journal entries to record these…arrow_forwardApplying factory overhead Instructions Chart of Accounts Factory Overhead Journal Instructions Bergan Company estimates that total factory overhead costs will be $620,000 for the year. Direct labor hours are estimated to be 80,0000. Required: a. For Bergan Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places. b. During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. Determine the amount of factory overhead applied to Jobs 200 and 305 in May. c. Prepare the journal entry on May 31 to apply factory overhead to both jobs in May according to the predetermined overhead rate, Refer to the chart accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education