Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

You have been tasked with recommending one of the mutually exclusive industrial sanitation

(c) Both systems (d) Neither system.

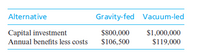

Transcribed Image Text:Alternative

Gravity-fed Vacuum-led

Capital investment

Annual benefits less costs

$800,000

$1,000,000

$106,500

$119,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Five mutually exclusive alternatives are being considered for providing a sewage-treatment facility. The annual equivalent costs and estimated benefits of the alternatives are as follows (shown): Which plan, if any, should be adopted if the Sewage Authority wishes to invest if, and only if, the B–C ratio is at least 1.0.?arrow_forwardTassie Ltd is considering replacing an old management system with a new one. Use the following information to determine the feasibility of this replacement plan and explain your decision in detail. Costs of new system: $80,000 Costs of old system: $95,000 Depreciations of new system: Prime cost to zero Depreciations of old system: $5,000 per year Life of old system: will be written off in 5 years if no replacement Life of new system: 5 years Salvage value of new system at the end of its life: $18,000 Salvage value of old system at the end of its life: $0 Market value of the old system now: $55,000 Total savings from the new system:…arrow_forwardA firm is considering three mutually exclusive alternatives as part of a production improvement program. The alternatives are as follows: A B C Installed cost $8,000 $12,000 $16,000 Uniform annual benefit 1,600 1,750 2,050 Useful life, in years 10 20 20 For each alternative, the salvage value at the end of useful life is zero. At the end of 10 years, Alt. A could be replaced by another A with identical cost and benefits. (a)Construct a choice table for interest rates from 0% to 100%. (b)The MARR is 12%. If the analysis period is 20 years, which alternative should be selected?arrow_forward

- In desalting groundwater that contains a significant amount of sulfates, the concentrate that is generated during the desalting process can sometimes be tough on equipment, so the equipment’s useful life is uncertain. For a treatment train that has an initial cost of $90,000 and an estimated operating cost (OC) between $15,000 and $20,000 per month, use a spreadsheet to determine how many months the equipment must last to recover the investment at i = 0.5% per month at each OC value? Assume the income from the sale of calcium sulfate is $22,000 per month. (Note: Solve using increments of $1000 OC per month.)arrow_forwardPeyton Manufacturing is trying to decide between two different conveyor belt systems. System A costs $260,000, has a four-year life, and requires $80,000 in pretax annual operating costs. System B costs $366,000, has a six-year life, and requires $74,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever system is chosen, it will not be replaced when it wears out. The tax rate is 25 percent and the discount rate is 9 percent. Calculate the NPV for both conveyor belt systems. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g.. 32.16.) System A System B Which conveyor belt system should the firm choose? O System A O System B 4arrow_forwarddetermine the most economic alternative using AW analysis at 12% per year. Give an explanation and draw the results.arrow_forward

- Rust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $276,000, has a four-year life, and requires $84,000 in pretax annual operating costs. System B costs $390,000, has a six-year life, and requires $78,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 24 percent and the discount rate is 8 percent. Calculate the EAC for both conveyor belt systems. Note: Your answers should be negative values and indicated by minus signs. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. System A System B Which conveyor belt system should the firm choose? System A System Barrow_forwardA site on a major river is being evaluated for a new lock and dam for navigation purposes. Two options are considered: (a) single 1200-foot lock or (b) single 1200-foot lock and a single 600-foot lock (two locks, side by side). Benefits and costs of the two options are indicated in the table. Interest rate to be used is 7%, and the planning period is 50 years. Initial cost Annual operating cost Annual benefit Single Lock ($ million) 60.0 1.0 12.0 Double Locks ($ million) 85.0 1.5 16.0 (a-5 pts) Show the cash flow table for both options. (You may show only for the first three years as the same numbers will repeat for the remaining planning period.) (b-10 pts) Solve by the present worth method. (c-10 pts) Solve by the annual cash flow method. (d-10 pts) Solve by the incremental benefit-cost ratio method. (e-5 pts) Check your solutions for (b), (c), and (d). Are they different? Explain.arrow_forwardYou are considering relocating your outdoor-equipment manufacturing plant and have narrowed your choices to four possible locations based on the availability of high quality labor, rail transportation, and an adequate distribution network. Based on the following costs and benefits associated with each location, use incremental analysis and IRR to choose the most cost-effective location assuming MARR = 15%. Initial cost (Year 0) Annual operations and maintenance costs (Years 1 thru 5) Annual gross benefits (Years 1 thru 5) Upload Choose a File Question 6 Portland, OR Bend, OR Boise, ID $700,000 $800,000 $600,000 500,000 800,000 Seattle, WA $1,000,000 1,000,000 400,000 1,100,000 You consider purchasing a new piece of equipment (7yr MACRS property) f 1,375,000 625,000 1,500,000 sod POLE 1-10 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education