FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

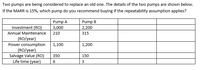

Transcribed Image Text:Two pumps are being considered to replace an old one. The details of the two pumps are shown below.

If the MARR is 15%, which pump do you recommend buying if the repeatability assumption applies?

Pump A

Investment (RO)

Pump B

2,200

3,000

Annual Maintenance

210

315

(RO/year)

Power consumption

(RO/year)

Salvage Value (RO)

Life time (year)

1,100

1,200

350

150

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The management of Kunkel Company is considering the purchase of a $21,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 12%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?arrow_forwardMemanarrow_forwardYou are the design consultant comparing two pump options. The first option has an installation cost of $34,000 and lasts 40 yearswith $1,000 maintenance every 10 years. The second option has an installation cost of $30,000 and lasts 40 years if a largerefurbishment of $15,000 is conducted after 20 years. Assuming a 4% MARR, Pv option 1 pv option 2 which option is the bestarrow_forward

- A "standard" model of a dozer costs $20,000 and has an annual operating expense of $450. The dozer will be replaced in 6 years when the salvage value is expected to be $2,000. A "super" model can be purchased for $25,000, but will have a salvage value of $7,000 when retired in 6 years. Its operating expenses are also $450 a year. The purchaser's other investment opportunities are 5%. Compare these alternatives by using the annual equivalent method.arrow_forwardThe following two alternatives are given. Data A B. First Cost $8,200 $5,600 Annual Cost $1,000 $800 Annual Benefit $2,700 $2,100 Life, Years 7. Salvage Value $2,800 $1,000 Assume that MARR is 15%. Use the incremental rate of return analysis to determine which alternative (A or B) one should choose. Find the AIRR, or a range of AIRR. O 10% O 10-12% O 12-15% O > 15%arrow_forwardPenny and Daughter’s construction business is considering purchasing a new Bobcat. The equipment will cost $230,000 and is expected to last 14 years. The Bobcat has a salvage vale of $16,000. Calculate the depreciation AND book value for each year. You can create one table for a-d or you can create different tables for each. This problem will need to be done in excel. (30 points)a. Use straight-line depreciation. (5 points)b. Use declining-balance depreciation with a depreciation rate that ensures the book value equals the salvage vale in the last year of the life of the equipment. c. Use double declining balance depreciation. d. Use MACRS depreciation where the Bobcat is considered a 10 year property. e. Graph the Book values of each methods on a single graph. The graph should have points at each year for each BV and a line of each method. You will have 4 lines on your graph. You should include year 0 on your graph so that all four lines start at the same point. Each method should be…arrow_forward

- Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $495,000 cost with an expected four-year life and a $10,000 salvage value. Additional annual information for this new product line follows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. $ 1,960,000 1,502,000 121,250 167,000 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 8%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine income and net cash flow for each year of this machine's…arrow_forwardCentral Mass Ambulance Service can purchase a new ambulance for $200,000 that will provide an annual net cash flow of $50,000 per year for five years. The salvage value of the ambulance will be $25,000. Assume the ambulance is sold at the end of year 5. Calculate the NPV of the ambulance if the required rate of return is 9%. (Round your answer to the nearest $1.) A) $(10,731) B) $10,731 C) $(5,517) D) $5,517arrow_forwardCompare the Annual Worth of the two systems and identify the better option at MARR = 10% per year: Solar: First cost $1,500,000; AOC $-700,000; Salvage value $100,000; Life of 8 years Geothermal: First cost $2,250,000; AOC $-600,000; Salvage value $50,000; Life of 8 years Select the Geothermal System with a calculated AW of $-1,017,368 Select the Geothermal System with a calculated AW of $-727,591 Select the Solar System with a calculated AW of $-1,238, Select the Solar System with a calculated AW of $-972,416arrow_forward

- Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $491,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new product line follows. (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 7%. $ 1,990,000 1,509,000 117,750 162,000 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute net present value…arrow_forward1. Determine the NPV of the new computer system (use 3 decimal places for the PV factor)arrow_forwardTwo techniques can be used to produce expansion anchors. Technique A costs $90,000 initially and will have a $12,000 salvage value after 3 years. The operating cost with this method will be $33,000 in year 1, increasing by $2600 each year. Technique B will have a first cost of $113,000, an operating cost of $7000 in year 1, increasing by $7000 each year,and a $43,000 salvage value after its 3-year life. At an interest rate of 13% per year, which technique should be used on the basis of a present worth analysis? Notice that there are no revenues. Please work out and do not use excel, however if you use excel please show how to input everything needed down to the formula, thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education