Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

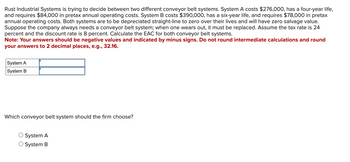

Transcribed Image Text:Rust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $276,000, has a four-year life,

and requires $84,000 in pretax annual operating costs. System B costs $390,000, has a six-year life, and requires $78,000 in pretax

annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value.

Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 24

percent and the discount rate is 8 percent. Calculate the EAC for both conveyor belt systems.

Note: Your answers should be negative values and indicated by minus signs. Do not round intermediate calculations and round

your answers to 2 decimal places, e.g., 32.16.

System A

System B

Which conveyor belt system should the firm choose?

System A

System B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Lang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System A costs $268,000, has a four-year life, and requires $82,000 in pretax annual operating costs. System B costs $378,000, has a six-year life, and requires $76,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever project is chosen, it will not be replaced when it wears out. The tax rate is 35 percent and the discount rate is 10 percent. Calculate the NPV for both conveyor belt systems. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardNonearrow_forwardF2arrow_forward

- Rust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $260,000, has a four-year life, and requires $80,000 in pretax annual operating costs. System B costs $366,000, has a six-year life, and requires $74,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 25 percent and the discount rate is 9 percent. Calculate the EAC for both conveyor belt systems. Note: Your answers should be negative values and indicated by minus signs. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. System A $ 38,562.29 X System B $ 25,802.08 x Which conveyor belt system should the firm choose? System A System Barrow_forwardBhaarrow_forwardTassie Ltd is considering replacing an old management system with a new one. Use the following information to determine the feasibility of this replacement plan and explain your decision in detail. Costs of new system: $80,000 Costs of old system: $95,000 Depreciations of new system: Prime cost to zero Depreciations of old system: $5,000 per year Life of old system: will be written off in 5 years if no replacement Life of new system: 5 years Salvage value of new system at the end of its life: $18,000 Salvage value of old system at the end of its life: $0 Market value of the old system now: $55,000 Total savings from the new system:…arrow_forward

- Delaney Company is considering replacing equipment that originally cost $532,000 and has accumulated depreciation of $372,400 to date. A new machine will cost $891,000. what is the the sunk cost in this situation?arrow_forwardplease answer both questions fully.arrow_forwardPeyton Manufacturing is trying to decide between two different conveyor belt systems. System A costs $260,000, has a four-year life, and requires $80,000 in pretax annual operating costs. System B costs $366,000, has a six-year life, and requires $74,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever system is chosen, it will not be replaced when it wears out. The tax rate is 25 percent and the discount rate is 9 percent. Calculate the NPV for both conveyor belt systems. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g.. 32.16.) System A System B Which conveyor belt system should the firm choose? O System A O System B 4arrow_forward

- The ABC Ltd is analysing the costs and benefits of setting up an extra fast-food outlet in Adelaide. The predicted costs and income flows are provided below: $2 million site acquisition and development costs. The capital depreciation expense is $50,000 per year. Investment in plant and equipment of $600,000. The plant and equipment have an estimated useful life of 5 years and the residual value would be zero. The plant and equipment will be depreciated on a straight-line basis for tax purposes. The forecasted sales in year 1 is $600,000 and $800,000 per year thereafter. Labour and material costs are equivalent to 50 per cent of incremental sales. The policy (objective) is to sell the outlet at the end of year 3. The estimated selling price is $3.5 million. Sales in a similar outlet of ABC Ltd will decline by $80,000 per year due to loss of customers and experienced staff to the new venture. Other operating costs are about $150,000 per year (fixed) The net working capital requirement at…arrow_forward4. What is correct answer?arrow_forwardPlease Do not Give imag formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education