Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

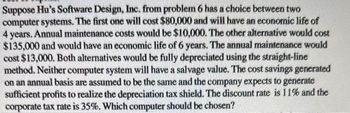

Transcribed Image Text:Suppose Hu's Software Design, Inc. from problem 6 has a choice between two

computer systems. The first one will cost $80,000 and will have an economic life of

4 years. Annual maintenance costs would be $10,000. The other alternative would cost

$135,000 and would have an economic life of 6 years. The annual maintenance would

cost $13,000. Both alternatives would be fully depreciated using the straight-line

method. Neither computer system will have a salvage value. The cost savings generated

on an annual basis are assumed to be the same and the company expects to generate

sufficient profits to realize the depreciation tax shield. The discount rate is 11% and the

corporate tax rate is 35%. Which computer should be chosen?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Rust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $276,000, has a four-year life, and requires $84,000 in pretax annual operating costs. System B costs $390,000, has a six-year life, and requires $78,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 24 percent and the discount rate is 8 percent. Calculate the EAC for both conveyor belt systems. Note: Your answers should be negative values and indicated by minus signs. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. System A System B Which conveyor belt system should the firm choose? System A System Barrow_forwardVijayarrow_forwardA utility company is considering adding a second feedwater heater to its existing system unit to increase the efficiency of the system and thereby reduce fuel costs. The 150-MW unit will cost $1,650,000 and has a service life of 25 years. The expected salvage value of the unit is considered negligible. With the second unit installed, the efficiency of the system will improve from 55% to 56%. The fuel cost to run the feedwater is estimated at $0.05 kWh. The system unit will have a load factor of 85%, meaning that the system will run 85% of the year. Determine the equivalent annual worth of adding the second unit with an interest rate of 12%. Oa) $1,603,098 b) $12,573,321 Oc) $1,813,473 d) None of thesearrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $267,000, has a three-year life, and has pretax operating costs of $72,000 per year. The Techron II costs $465,000, has a five-year life, and has pretax operating costs of $45,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $49,000. If your tax rate is 23 percent and your discount rate is 13 percent, compute the EAC for both machinesarrow_forwardVijayarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $270,000, has a three - year life, and has pretax operating costs of $73, 000 per year. The Techron II costs $470,000, has a five-year life, and has pretax operating costs of $46, 000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $50,000. If your tax rate is 25 percent and your discount rate is 9 percent, compute the EAC for both machines.arrow_forward

- Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,620,000; the new one will cost, $1,949,000. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $405,000 after five years. The old computer is being depreciated at a rate of $336,000 per year. It will be completely written off in three years. If we don't replace it now, we will have to replace it in two years. We can sell it now for $531,000; in two years, it will probably be worth $153,000. The new machine will save us $363,000 per year in operating costs. The tax rate is 23 percent, and the discount rate is 10 percent. a-1. Calculate the EAC for the the old computer and the new computer. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. What is the NPV of the decision to replace the computer now? (A negative answer should…arrow_forwardplease asnwer correctly: Your company has been approached to bid on a contract to sell 5,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.4 million and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $395,000 to be returned at the end of the project, and the equipment can be sold for $325,000 at the end of production. Fixed costs are $595,000 per year, and variable costs are $85 per unit. In addition to the contract, you feel your company can sell 12,300, 14,600, 19,200, and 11,600 additional units to companies in other countries over the next four years, respectively, at a price of $180. This price is fixed. The tax rate is 23 percent, and the required return is 10 percent. Additionally, the president of the company…arrow_forwardThe CFO of The Fun Factory is investigating the possibility of investing in a three-dimensional printer that would cost $16,500. The printer would eliminate the need to have prototypes of new toys be produced by a third party. The cost of having the prototypes manufactured by the third party is about $7,161 per year. The printer would have a useful life of five years with no salvage value with expected annual operating costs of $3,300 per year. Required: Compute the simple rate of return on the printer. (Round your answer to 1 decimal place.) Simple rate of return %arrow_forward

- You are evaluating two different silicon wafer milling machines. The Techron I costs $252,000, has a three-year life, and has pretax operating costs of $67,000 per year. The Techron Il costs $440,000, has a five-year life, and has pretax operating costs of $40,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $44,000. If your tax rate is 24 percent and your discount rate is 9 percent, compute the EAC for both machines. Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Techron I Techron II $ -304,725.75 Which machine should you choose? O Techron I O Techron IIarrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $216,000, has a three - year life, and has pretax operating costs of $55, 000 per year. The Techron II costs $380,000, has a five-year life, and has pretax operating costs of $28, 000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $32, 000. If your tax rate is 23 percent and your discount rate is 10 percent, compute the EAC for both machines. Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardA small company that manufactures vibration isolation platforms is trying to decide whether it should immediately upgrade the current assemblysystem D, which is rather labor-intensive, with the more highly automated system C one year from now. Some components of the current system canbe sold now for $9000, but they will be worthless hereafter. The operating cost of the existing system is $192,000 per year. System C will cost $320,000 with a $50,000 salvage value after four years. Its operating cost will be $68,000 per year. If you are told to do a replacement analysis using an interest rate of 10% per year, which system do you recommend?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education