Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

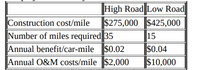

Two different routes are being considered for a mountain highway. The high road would require building several bridges and would navigate around the highest mountain points, thus requiring more roadway. The low road would construct several tunnels for a more direct route through the mountains. Projected travel volume for this new section of road is 3500 cars per day. Use the modified B/C ratio to determine which alternative should be recommended. Assume that project life is 45 years and i = 5%

Transcribed Image Text:High Road Low Road

$275,000 $425,000

Construction cost/mile

Number of miles required 35

Annual benefit/car-mile $0.02

Annual O&M costs/mile $2,000

15

$0.04

$10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flowarrow_forwardA site on a major river is being evaluated for a new lock and dam for navigation purposes. Two options are considered: (a) single 1200-foot lock or (b) single 1200-foot lock and a single 600-foot lock (two locks, side by side). Benefits and costs of the two options are indicated in the table. Interest rate to be used is 7%, and the planning period is 50 years. Initial cost Annual operating cost Annual benefit Single Lock ($ million) 60.0 1.0 12.0 Double Locks ($ million) 85.0 1.5 16.0 (a-5 pts) Show the cash flow table for both options. (You may show only for the first three years as the same numbers will repeat for the remaining planning period.) (b-10 pts) Solve by the present worth method. (c-10 pts) Solve by the annual cash flow method. (d-10 pts) Solve by the incremental benefit-cost ratio method. (e-5 pts) Check your solutions for (b), (c), and (d). Are they different? Explain.arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $400 per unit and sales volume to be 1,000 units in year 1; 1,500 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What change in NWC occurs at the end of year 1?arrow_forward

- A video rental store will cost $650,000 to open. Assuming annual sales of $1 million, variable costs of 35 percent, fixed costs of $300,000, depreciation of $100,000, and a tax rate of 35 percent, calculate the NPV of the project over a 10-year horizon (no inflation or salvage value assumed) with a 12 percent cost of capital. Conduct a sensitivity analysis by allowing investment, sales, variable costs, and fixed costs to vary by plus/minus 10 percent from their original estimates. Which variable appears to affect profitability the most? What does the sensitivity analysis suggest the investor do?arrow_forwardA proposed bridge on the interstate highway is being considered at the cost of 4 million dollars. It is expected that the bridge will have a life of 30 years. Construction costs will be paid by government agencies. Operation and maintenance costs are estimated to be $250,000 per year. Benefits to the public are estimated to be $900,000 per year. The building of the bridge will result in an estimated cost of $250,000 per year to the general public. The project requires a return of 5%. Determine the benefit/cost (B/C) ratio.arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $450 per unit and sales volume to be 1,200 units in year 1; 1,325 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $250 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $150,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $30,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flowarrow_forward

- You are evaluating two projects. You may accept only one of them. Project one will cost $379,000 initially and will pay $134,000 each year for the next 5 years. Project two will cost $454,000 initially, but will pay $101,000 for the next 10 years. The firm's cost of capital is 15%. Use the replacement chain approach to compute the NPV of each project. Which project has the highest NPV and by how much? Round your answers to the nearest dollar.arrow_forwardA proposal is being considered to improve an existing road connecting two medium size cities in West Africa to reduce transportation costs. The cost of the project is $1,000,000. Present annual transportation cost for all traffic amounts to $1,270,000 per year and would continue if no improvement is made. After the improvement, annual transportation costs are estimated to be $1,166,000. Assume the life of the project 20 years, and MARR is 12%. Should the project be undertaken? Evaluate this proposal by using the net present value method, benefit/cost method, and internal rate of return method. Assume costs appear at the beginning of each year while benefits at the end of a year.arrow_forwardSelect all that are true with respect to historical data on risk and return in the U.S. financial markets since about 1926, Group of answer choices A portfolio of small stocks has earned higher returns than large stocks, with less risk A portfolio of small stocks has earned higher returns that large stocks, with higher risk Stocks have outperformed government bonds, albeit with higher risk With respect to a diversified stock portfolio, the longer the holding period, the higher the risk. With respect to a diversified stock portfolio, the longer the holding period, the lower the risk.arrow_forward

- The Logan Well Services Group is considering two sites for storage and recovery of reclaimed water. The mountain site (MS) will use injection wells that cost $4.2 million to develop and $280,000 per year for M&O. This site will be able to accommodate 150 million gallons per year. The valley site (VS) will involve recharge basins that cost $11 million to construct and $400,000 per year to operate and maintain. At this site, 720 million gallons can be injected each year. If the value of the injected water is $3.00 per thousand gallons, which alternative, if either, should be selected according to the B/C ratio method? Use an interest rate of 8% per year and a 20-year study period. The B/C ratio is . Select alternative (Click to select) neither of the alternatives mountain site valley site .arrow_forwardA highway is to be built connecting Maud and Bowlegs. Route A follows the old road and costs $4 million initially and $210,000/year thereafter. A new route, B, will cost $6 million initially and $180,000/year thereafter. Route C is an enhanced version of Route B with wider lanes, shoulders, and so on. Route C will cost $9 million at first, plus $260,000 per year to maintain. Benefits to the users, considering time, operation, and safety, are $500,000 per year for A, $850,000 per year for B, and $1,000,000 per year for C. Using a 7% interest rate, a 15-year study period, and a salvage value of 50% of first cost, determine which road should be constructed.arrow_forwardYou are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $450 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $250 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $180,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $40,000. NWC requirements at the beginning of each year will be approximately 25 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 12 percent. (Use SL depreciation table) What will the cash flows for this project be? Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places. Year Total cash flow 0 1 2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education