FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

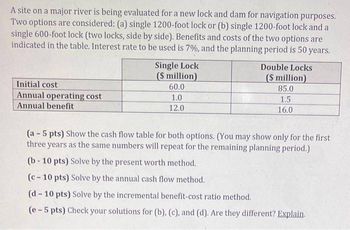

Transcribed Image Text:A site on a major river is being evaluated for a new lock and dam for navigation purposes.

Two options are considered: (a) single 1200-foot lock or (b) single 1200-foot lock and a

single 600-foot lock (two locks, side by side). Benefits and costs of the two options are

indicated in the table. Interest rate to be used is 7%, and the planning period is 50 years.

Initial cost

Annual operating cost

Annual benefit

Single Lock

($ million)

60.0

1.0

12.0

Double Locks

($ million)

85.0

1.5

16.0

(a-5 pts) Show the cash flow table for both options. (You may show only for the first

three years as the same numbers will repeat for the remaining planning period.)

(b-10 pts) Solve by the present worth method.

(c-10 pts) Solve by the annual cash flow method.

(d-10 pts) Solve by the incremental benefit-cost ratio method.

(e-5 pts) Check your solutions for (b), (c), and (d). Are they different? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- A small section of a highway can be dealt with in three different ways: (1) it can be left as it is (do nothing), (2) an embankment/bridge combination can be used; or (3) a cutting tunnel combination can be provided. Using whatever method is suitable, determine the alternative that has the best financial advantage. The interest rate for the investment is 5% per year. Alternative Life Initial cost Maintenance As is (do-nothing) Perpetual $35,000/yr Embankment/bridge Case (a) perpetual $170,000 $1,000/yr Case (b) 50 years $200,000 $2,000/yr Cutting tunnel Case (a) perpetual $75,000 $700/yr Case (b) 50 years $300,000 $2,000/yrarrow_forwardTwo renewable energy alternatives are available for providing energy at a remote federal research facility. The cash flow estimates associated with each alternative are given below. Use the conventional benefit-cost ratio method, with AW as the equivalent-worth measure, to determine which alternative should be selected at an interest rate of 14% per year over a 25- year study period. One alternative must be selected. Alternative I Alternative II Initial cost, $ $1,000,000 $990,000 Annual maintenance, $/year $380,000 $359,500 Annual benefits, $/year $500,000 $459,500 Salvage value, $ $17,000 $15,800 (a) Benefit-cost ratio of incremental cash flow = (b) Choose Alternativearrow_forwardA county in Tennessee is considering the following public interest project. Initial Cost $22.5M Annual Maintenance Cost $525K EUAB $3.3M Given a useful life of 12 years and an interest rate of 4%, the benefit /cost ratio is........... A. 1.01 B. 1.67 C. 1.48 D. 1.51.arrow_forward

- A proposed bridge on the interstate highway is being considered at the cost of 4 million dollars. It is expected that the bridge will have a life of 30 years. Construction costs will be paid by government agencies. Operation and maintenance costs are estimated to be $250,000 per year. Benefits to the public are estimated to be $900,000 per year. The building of the bridge will result in an estimated cost of $250,000 per year to the general public. The project requires a return of 5%. Determine the benefit/cost (B/C) ratio.arrow_forward4.) Two mutually exclusive alternative public works projects are under consideration. Their respective costs and benefits are included in the table below. Project A has an anticipated life of 35 years, and the useful life of Project B has been estimated to be 25 years. If the interest rate is 9%, which, if either, of these projects should be selected? Capital investment Annual oper. & maint. costs Annual benefit Useful life of project (years) PROJECT A 375,000 60,000 122,500 35 PROJECT B 312,500 55,000 115,000 25arrow_forwardThe following data pertain to an investment proposal (Ignore income taxes.): Cost of the investment $ 36,000 Annual cost savings $ 11,000 Estimated salvage value $ 4,000 Life of the project 5 years Discount rate 13% Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the proposed investment is closest to: (Round your intermediate calculations and final answer to the nearest whole dollar amount.)arrow_forward

- Bramblett Recording Studio is considering two investment proposals (1 and 2). Data for the two proposals are presented below: Proposal 1 Proposal 2 Cost of investment $75,000 $100,000 Estimated salvage value 15,000 20,000 Average estimated net income 18,000 13,200 Calculate the return on average investment for both proposals.arrow_forwardThe conventional B/C ratio for a flood control project along the Mississippi River was calculated to be 1.3. The benefits were $500,000 per year and the maintenance costs were $200,000 per year. What was the initial cost of the project if a discount rate of 7% per year was used and the project was assumed to have a 50-year life?arrow_forwardThe Dry Dock is considering a project with an initial cost of $107,770 and cash inflows for years 1 to 3 of $37,200 $54,600 and $46,900 respectively. What is the IRR?arrow_forward

- A project to control flooding from rare, but sometimes heavy, rainfalls in the arid southwest will have the following cash flow estimates. Determine which project should be selected on the basis of a B/C analysis using an interest rate of 8% per year and a 20-year study period.arrow_forwardYou are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forwardCost estimates for a porposed public facility are being evaluated. Initial construction cost is anticipated to be $120,000 and annual maintenance expenses are expected to be $6500 for the first 20 years and $2000 for every year thereafter. The facility is to be used and maintained for an indefinite period of time. Using an interest rate of 10% per year, the capitalized cost of this facility is most nearly? a. $180,000 b. $190,000 c. $200,000 d. $270,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education