Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Account Problem

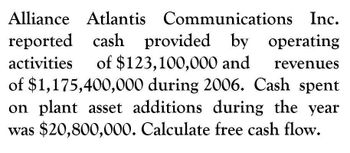

Transcribed Image Text:Alliance Atlantis

Communications Inc.

activities

reported cash provided by operating

of $123,100,000 and revenues

of $1,175,400,000 during 2006. Cash spent

on plant asset additions during the year

was $20,800,000. Calculate free cash flow.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Alliance Atlantis Communications Inc. reported cash provided by operating activities of $123,100,000 and revenues of $1,175,400,000 during 2006. Cash spent on plant asset additions during the year was $20,800,000. Calculate free cash flow = Warrow_forwardCalculate free cash flowarrow_forwardsolve this one pleasearrow_forward

- Kela corporation reports net income of 570,000 that includes depreciation expense of 77,000 also cash of 47,000 it was borrowed on a three year note payable based on the data total cash inflows operating activities arearrow_forwardKela Corporation reports net income of $570,000 that includes depreciation expense of $78,000. Also, cash of $59,000 was borrowed on a 4-year note payable. Based on this data, total cash inflows from operating activities are: Multiple Choice $629,000. $648,000. $492,000. $707,000.arrow_forwardI need help with thisarrow_forward

- An analysis of the general ledger accounts indicates that delivery equipment, which cost P80,000 and on which accumulated depreciationtotaled 36,000 on the date of sale, was sold for P37,200 during the year. Using this information, indicate the items to be reported on thestatement of cash flowsarrow_forward8. State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows:12. Sweeter Enterprises Inc. has cash flows from operating activities of $300,000. Cash flows used for investments in property, plant, and equipment totaled $63,000, of which 60% of this investment was used to replace existing capacity.arrow_forwardCash Flows from Operating Activities-Indirect Method The net income reported on the income statement for the current year was $294,100. Depreciation recorded on equipment and a building amounted to $87,900 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $75,580 $80,110 Accounts receivable (net) 95,840 98,860 Inventories 188,950 170,310 Prepaid expenses 10,510 11,300 Accounts payable (merchandise creditors) 84,420 89,400 Salaries payable 12,170 11,140 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Changes in current…arrow_forward

- Kraco Corporation reported net income of $450,000, including the effects of depreciation expense of $60,000, and amortization expense on a patent of $10,000. Also, cash of $50,000 was borrowed on a 5-year note payable. Based on this data, total cash inflow from operating activities using the indirect method was: O a. $520,000 O b. $470,000 OC. $440,000 O d. $570,000arrow_forwardRequirements Calculate the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, were $106,000 and $101,000, respectively. Depreciation for the period was $18,000, and purchases of new plant assets were $26,000. Plant assets were sold at a gain of $5,000. What were the cash proceeds of the sale? b. Beginning and ending Retained Earnings were $44,000 and $70,000, respectively. Net income for the period was $46,000, and stock dividends were $6,000. How much were the cash dividends? Requirement a. Beginning and ending Plant Assets, Net, were $106,000 and $101,000, respectively. Depreciation for the period was $18,000, and purchases of new plant assets were $26,000. Plant assets were sold at a gain of $5,000. What were the cash proceeds of the sale? Cash proceeds from the sale werearrow_forwardPls I need help with this 2 cashflow questions. Find attached Additional information:Equipment which had cost GH¢255, 000 and with a net book value of GH¢ 135,000 and was sold for GH¢96, 000 during the year.The cash proceeds of the sale of asset investments properties amounted to GH¢75,000.Dividends paid during the year amounted to GH¢240,000. Required:Prepare the company’s statement of cash flows for the year ended 31st December 2018, using the indirect method, adopting the format in IAS 7 Statement of cash flows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,