Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Please give me answer accounting questions

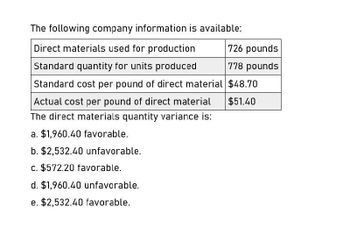

Transcribed Image Text:The following company information is available:

Direct materials used for production

Standard quantity for units produced

726 pounds

778 pounds

Standard cost per pound of direct material $48.70

Actual cost per pound of direct material

The direct materials quantity variance is:

a. $1,960.40 favorable.

b. $2,532.40 unfavorable.

c. $572.20 favorable.

d. $1,960.40 unfavorable.

e. $2,532.40 favorable.

$51.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- H.J. Heinz Company uses standards to control its materials costs. Assume that a batch of ketchup (7,650 pounds) has the following standards: The actual materials in a batch may vary from the standard due to tomato characteristics. Assume that the actual quantities of materials for batch 08-99 were as follows: a.Determine the standard unit materials cost per pound for a standard batch. b.Determine the direct materials quantity variance for batch 08-99.arrow_forwardThe standard costs and actual costs for direct materials for the manufacture of 2,780 actual units of product are as follows: Standard Costs Direct materials Direct materials 2,780 kilograms at $8.70 Actual Costs 2,900 kilograms at $8.05 The direct materials quantity variance is Oa. $835 unfavorable Ob. $1,044 unfavorable Oc. $1,044 favorable Od. $835 favorablearrow_forwardThe standard costs and actual costs for direct materials for the manufacture of 2,640 actual units of product are as follows: Standard Costs Direct materials Direct materials 2,640 kilograms at $8.90 Actual Costs 2,700 kilograms at $8.10 The direct materials quantity variance is Oa. $534 unfavorable Ob. $427 unfavorable Oc. $427 favorable Od. $534 favorable Previousarrow_forward

- The standard costs and actual costs for direct materials for the manufacture of 2,300 actual units of product are as follows: Standard Costs Direct materials Direct materials Actual Costs The direct materials price variance is Oa. $166 unfavorable Ob. $368 favorable Oc. $166 favorable Od. $368 unfavorable 1,040 kilograms at $8.51 2,300 kilograms at $8.35arrow_forwardThe standard costs and actual costs for direct materials for the manufacture of 2,800 actual units of product are as follows: Standard CostsDirect materials 1,040 kilograms at $8.51 Actual CostsDirect materials 2,800 kilograms at $8.05 The direct materials price variance is a. $478 favorable b. $478 unfavorable c. $1,288 favorable d. $1,288 unfavorablearrow_forwardSubject: acountingarrow_forward

- The standard costs and actual costs for direct materials for the manufacture of 2,200 actual units of product are as follows: Standard Costs Direct materials 1,040 kilograms @$8.57 Actual Costs Direct materials 2,200 kilograms @ $8.35 The direct materials price variance is Oa. $229 favorable Ob. $229 unfavorable Oc. $484 unfavorable Od. $484 favorablearrow_forwardCan you answer both of these questionsarrow_forwardProvide information and explanationarrow_forward

- The standard costs and actual costs for direct materials for the manufacture of 2,590 actual units of product are as follows: Standard CostsDirect materials 2,590 kilograms at $8.50 Actual CostsDirect materials 2,700 kilograms at $8.10 The direct materials quantity variance is a. $748 favorable b. $748 unfavorable c. $935 favorable d. $935 unfavorablearrow_forwardNeed answerarrow_forwardprovide correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub