Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

General accounting

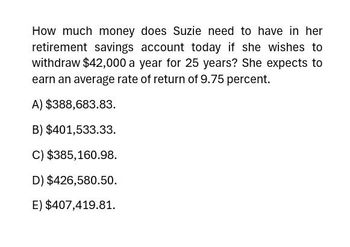

Transcribed Image Text:How much money does Suzie need to have in her

retirement savings account today if she wishes to

withdraw $42,000 a year for 25 years? She expects to

earn an average rate of return of 9.75 percent.

A) $388,683.83.

B) $401,533.33.

C) $385,160.98.

D) $426,580.50.

E) $407,419.81.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Refer to the present value table information on the previous page. What amount should Brett have in his bank account today, before withdrawal, if he needs 2,000 each year for 4 years, with the first withdrawal to be made today and each subsequent withdrawal at 1-year intervals? (Brett is to have exactly a zero balance in his bank account after the fourth withdrawal.) a. 2,000 + (2,000 0.926) + (2,000 0. 857) + (2,000 0.794) b. 2,0000.7354 c. (2,000 0.926) + (2,000 0.857) + (2,000 0.794) + (2,000 0.735) d. 2,0000.9264arrow_forward6. If you desire to have $80,000 for a down payment for a house in 7 years, what amount would you need to deposit each year for these 7 years? Assume that your money will earn 10 percent per year. 7. Kate deposits $9,900 each yearinto her retirement account. If these funds have an average earning of 11 percent over the 40 years until her retirement, what will be the value of her retirement account?arrow_forwardA man wants to set up a 529 college savings account for his granddaughter. How much would he need to deposit each year into the account in order to have $80,000 saved up for when she goes to college in 15 years, assuming the account earns a 8% annual return. Annual deposit:arrow_forward

- Arthur wishes to have 80,000 in her bank account. How much suould she deposit in a bank account that pays 8% compounded quarterly so that after 6 years and 5 months, she can have her desired money? Choices are: 31, 889.7541648, 110.24584 and 50,000arrow_forwardWhat payment every year should Carie deposit to her savings account in order to save $37,100 in 11.5 years if money can earn 3.19% compounded annually?arrow_forwardYour first child was just born and you want to set up an annuity due savings plan to finance her college education. Your financial institution pays 3.15% interest. If you deposit $1,000 today, and make additional $1,000 deposits every year for the next 17 years, how much will accumulate in the account in 18 years? O $23,733.86 O $25,485.19 O $24,611.49 O $24,481.48arrow_forward

- K. Tanja wants to establish an account that will supplement her retirement income beginning 30 years from now. Find the lump sum she must deposit today so that $400,000 will be available at time of retirement, if the interest rate is 10%, compounded quarterly. How much must Tanja invest? P= (Round to the nearest cent as needed.)arrow_forwardHolly Krech is planning for her retirement, so she is setting up a payout annuity with her bank. She wishes to receive a payout of $1,900 per month for twenty years. (a) How much money must she deposit if her money earns 7.8% interest compounded monthly? (Round your answer to the nearest cent.)___________ $ (b) Find the total amount that Holly will receive from her payout annuity. Thank you!arrow_forwardWithout using Excel and using the formula, Cheryl is setting up a payout annuity and wishes to receive $1200 per month for 20 years. A. How much does she have to deposit if her money earns 8% interest compounded monthly? B. Find the total amount Cheryl will receive from her payout annuity.arrow_forward

- How much do you need to save each year for 30 years in order to have $775,000, assuming you are investing the money in an account that earns 8%? How much of the $775,000 comes from contributions (your out of pocket costs)?arrow_forwardTo help with a down payment on a home, Elsa is going to invest. Assuming an interest rate of 1.73% compounded annually, how much would she have to invest to have $36,800 after 7 years? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas. $0 S oo E Darrow_forward4. A couple decides to invest some money in an account for use during retirement. Their goal is to have $100,000 in 40 years. The account pays 5.5% compounded monthly. A. How much do they need to invest to meet their goal? B. How much interest will they earn? C. What is the annual percentage yield? D. Prepare a table that shows the growth of the investment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning