EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

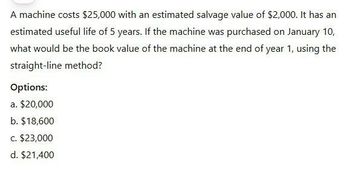

Transcribed Image Text:A machine costs $25,000 with an estimated salvage value of $2,000. It has an

estimated useful life of 5 years. If the machine was purchased on January 10,

what would be the book value of the machine at the end of year 1, using the

straight-line method?

Options:

a. $20,000

b. $18,600

c. $23,000

d. $21,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An asset cost $200,000. It has a salvage value of $40,000. It has a 10 year life. What would be its book value at the end of year one if it uses straight-line depreciation? Group of answer choices $144,000 $160,000 $40,000 $184,000arrow_forwardA certain machine costs 2.5M while its salvage value is 150,000 at the end of 8 years. Determine its book value at the end of 4 years using the Straight Line Method. a. 1,835,000 b. 1, 825,000 c. 1,325,000 d. 1,385,000arrow_forwardAn asset cost $200,000. It has a salvage value of $40,000. It has a 10 year life. What would accumulated depreciation be at the end of three years assuming straight line depreciation? Group of answer choices $60,000 $40,000 $48,000 $160,000arrow_forward

- What is the present worth equivalent of the machine considered to be the most preferred choice? (i=10%) show detailed solutionarrow_forwardA machine, purchased for$50,000, has a depreciable life of five years. It will havean expected salvage value of $4,500 at the end of the depreciable life. Find theyearly depreciation, Book value every year using the following methods: a. MATHESON EQUATION b. SINKING FUND METHOD ( i = 12%)arrow_forwardA certain power plant is considering two alternatives with regards to a hydraulic equipment which it needs. The following alternatives were considered. Equipment A Equipment B First Cost: P 120,000 P 136,000 Salvage Value: P 15,000 0 Life: 6 years 8 years Annual Maintenance: P 9,000 P 7,000 Compute the difference between the equivalent present worth of the two alternatives if interest rate is 7% compounded annually. Select one: a. P 26,410 b. P 30,108 c. P 28,312 d. P 24,895arrow_forward

- Reference: Case Study S Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below. Initial cost Benefits/year Machine X $120,000 $20,000 for the first 10 years and $9,000 for the next 10 years Life Salvage value $40,000 MARR 5.2. The NPW of machine X is A) $35,158 B) $48,192 C) $50,752 Machine Y $96,000 $12,000 per year for 20 years. 20 years 8% $20,000arrow_forwardThe cost of an equipment is P650,000 and the cost of installation is P45,000. If the salvage value is 12% of the cost of equipment at the end of 10 years, determine the book value at the end of the fourth year. a. Use straight-line method (SLM) b. Use sinking fund method (SFM) at 3.5% interest. Please answer completely will give rating surely Complete Answer neededarrow_forward21. A machine costs P60,000 and the salvage value is P10,000 after 10 years. Find the book value after 7 years by Straight Line Method. Answer with text and/or attachments:arrow_forward

- What is the present worth equivalent of the machine considered to be the least preferred choice? (i=10%) show detailed solutionarrow_forwardA company is considering two alternatives with regards to equipment which it needs. The alternatives are as follows: Alternative A: Purchase Cost of Equipment 703,668700,000 Salvage Value 100,454100,000 Daily operating cost 501500 Economic life, years 10 Alternative B: Rental at 1,5751,500 per day. At 18% interest, how many days per year must the equipment be in use if Alternative A is to be chosen.arrow_forwardChoose the bestarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT