Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

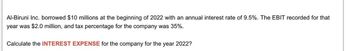

Transcribed Image Text:Al-Biruni Inc. borrowed $10 millions at the beginning of 2022 with an annual interest rate of 9.5%. The EBIT recorded for that

year was $2.0 million, and tax percentage for the company was 35%.

Calculate the INTEREST EXPENSE for the company for the year 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On December 1, 2022, Barnes Inc. borrow $100,000 to purchase a new building. The interest rate on the loan is 9% per year and the required payments are $800 per month. What is the carrying value of the company's loan (Note Payable account only, NOT the related Interest Payable) reported on the 2022 balance sheet? 99,400arrow_forwardOn December 1, 2021, your company borrowed $48,000, a portion of which is to be repaid each year on November 30. Specifically, your company will make the following principal payments: 2022, $6,400; 2023, $9,600; 2024, $12,800; and 2025, $19,200. Show how this loan will be reported in the December 31, 2022 and 2021 balance sheets, assuming principal payments will be made when required. Balance Sheet (Partial) As of December 31 2022 2021 Total Liabilitiesarrow_forwardThe McAllister Company borrowed $40,000 from a bank on January 1, 2021 at an interest rate of 4 percent; the loan will be repaid in full at the end of the two-year term. What amount of interest expense will the company record in its financial statements for the year 2022? As needed, round your final answer (but not intermediate steps) to the nearest whole dollar and enter as a positive number.arrow_forward

- Sally Corp. borrowed $360,000 from County Bank on January 1, 2020 signing a 15 year note payable. The loan has an interest rate of 4% and a fixed annual payment of $32,379. Annual payments begin January 1, 2021. What amount of the payment made on January 1, 2022 will be interest expense?arrow_forwardOn January 1, 2013, your brother's business obtained a 30-year amortized mortgage loan for $350,000 at a nominal annual rate of 7.35%, with 360 end-of-month payments. The firm can deduct the interest paid for tax purposes. What will the interest tax deduction be for 2017?Calculate using at least 4 decimal points and round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72 in the answer box provided. $22,769.25 $26,686.54 $24,483.06 $20,076.11 $19,096.79arrow_forwardExpress Jet borrows $100 million on October 1, 2021, for one year at 6% interest. For what amount does Express Jet report interest expense for the year ended December 31, 2022?a. $0. b. $4.5 million. c. $1.5 million. d. $6 million.arrow_forward

- On December 1, 2021, your company borrowed $15,000, a portion of which is to be repaid each year on November 30. Specifically, your company will make the following principal payments: 2022, $2,000; 2023, $3,000; 2024, $4,000; and 2025, $6,000. Show how this loan will be reported in the December 31, 2022 and 2021, balance sheets, assuming principal payments will be made when required. Total Liabilities Balance Sheet (Partial) $ As of December 31 2022 2021 0 0 4arrow_forwardOn August 1, 2021, Stucko Company borrowed $21,000 on an 8-month, 3%, short-term note payable. Which account will be credited on April 1, 2022, and for what amount? Stucko Company has a calendar year-end.arrow_forwardOn May 1, 2021, Nees Manufacturing lends $10,000 to Roberson Supply using a 9% note due in 12 months. Nees has a December 31 year-end. Calculate the amount of interest revenue Nees will report in its 2021 and 2022 income statements. a. 2021 = $300; 2022 = $600.b. 2021 = $600; 2022 = $300.c. 2021 = $900; 2022 = $0.d. 2021 = $0; 2022 = $900.arrow_forward

- On January 1, 2013, your brother's business obtained a 30-year amortized mortgage loan for $350,000 at a nominal annual rate of 7.35%, with 360 end-of-month payments. The firm can deduct the interest paid for tax purposes. What will the interest tax deduction be for 2016. Calculate using at least 4 decimal points and round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72 in the answer box provided. Group of answer choices $21,558.37 $28,001.11 $24,779.74 $22,797.36 $25,523.13arrow_forwardI need the interest expense.arrow_forwardNeed helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education