Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Am. 134.

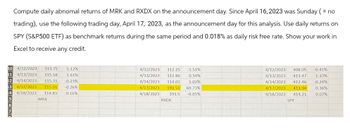

Transcribed Image Text:Compute daily abnomal returns of MRK and RXDX on the announcement day. Since April 16, 2023 was Sunday (= no

trading), use the following trading day, April 17, 2023, as the announcement day for this analysis. Use daily returns on

SPY (S&P500 ETF) as benchmark retums during the same period and 0.018% as daily risk free rate. Show your work in

Excel to receive any credit.

10 4/12/2023 113.75

11 4/13/2023 115.58

12 4/14/2023 115.31 -0.23%

13 4/17/2023 115.01 -0.26%

4 4/18/2023 114.83

1.12%

1.61%

4/12/2023 112.25 -1.51%

4/13/2023 112.86 0.54%

4/14/2023 114.01 1.02%

4/17/2023 193.51 69.73%

4/12/2023 408.05 -0.41%

4/13/2023 413.47 1.33%

-0.16%

4/18/2023 193.5 -0.01%

4/14/2023 412.46 -0.24%

4/17/2023

4/18/2023 414.21

413.94 0.36%

0.07%

MRX

RXDX

SPY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Time 1 2 3 12 4 14 (Click on the icon in order to copy its contents into a spreadsheet.) How would you interpret the meaning of the annual rates of return? Asman $9 11 Salinas $30 27 32 36 The rate of return you would have earned on Asman stock from time 1 to time 2 is %. (Round to two decimal places.)arrow_forward(Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Time Asman $9 11 Salinas $31 2 3 4 10 13 28 32 36 (Click on the icon in order to copy its contents into a spreadsheet.) How would you interpret the meaning of the annual rates of return? The rate of return you would have earned on Asman stock from time 1 to time 2 is The rate of return you would have earned on Asman stock from time 2 to time 3 is The rate of return you would have earned on Asman stock from time 3 to time 4 is The rate of return you would have earned on Salinas stock from time 1 to time 2 is The rate of return you would have earned on Salinas stock from time 2 to time 3 is The rate of return you would have earned on Salinas stock from time 3 to time 4 is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.)…arrow_forward3. Excel Question. Download the monthly NASDAQ prices (1985-2023) from Brightspace.What is the simple arithmetic average return over this period?What would have been your annualized HPR if you invested (reinvesting the proceeds)over this period? Disregard the question above because I cant attach the entire excel file but i will attach a screenshot. Please just tell me and explain to me which column do i use to find the arithmetic average return for this period and also how to calculate the annualized HPR over this period. I am just confused which column and which numbers to use.arrow_forward

- The most recent estimate of the daily volatility of an asset is 1.75% and the price of the asset at the close of trading yesterday was $50.00. The parameter (1-x ) in the Exponentially Weighted Moving Average (EWMA) model is 0.20. Suppose that the price of the asset at the close of trading today is $55.00. Calculate how this will cause the volatility to be updated by the EWMA model.arrow_forwardMeasuring risk and rate return) Given the following holding-period returns, calculate the average return for the market. Month Champ Inc. Market 1 2.8% 1.8% 2 3.2% 1.2% 3 9.0% 11.0% 4 -2.6% -1.0% 5 -2.9% -4.7% 6 12.0% 8.0% answer is 2.72%arrow_forward1. Using the factor beta estimates and the monthly expected return estimates in the table shown here, calculate the risk premium of General Electric stock (ticker: GE) using the FFC factor specification. (Annualize your result by multiplying by 12.) GE's CAPM beta over the same time period was 1.02. How does the risk premium you would estimate from the CAPM compare? FACTOR FACTOR AVERAGE MONTHLY RETURN GE'S BETAS MKT SMB HML 0.68 0.20 0.35 PR1YR 0.64 0.67 0.48 0.36 -0.70arrow_forward

- solve for annualized log-return and annualized volatility of log returns. Last end of day value was $83,251.44. 72 days of dates for average. Average daily log-return Annualized log-return -0.255% Standard deviation on daily log-returns 3.001% Annualized volatility of log-returns Risk-free rate (QUOTE) 91-day T-bill Price ($) 0.020% 99.994 Effective Annual Yield 0.020% th Risk-free rate (in continuous time) fo Sharpe Ratio (annual) 8.485% Risk Returnarrow_forwardAssignant. How to use real Dato to draw the Efficient Frontier? Step: Choose 2 Stocks collect Date for 1 year (daily) Prices Colorlate Returns (daily returns) Pt+1 - Pt Pt R 7,41 STEP 2 6 。Comporte the Expected Return for each stock E(R) = Average Return = Σ Ri - • Compte Risk (6;) => √2 (2:-R)2 R mpute the CORR between the 2 stocks Compute Comply for cov) forarrow_forward(Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Time Asman Salinas 1 $10 $30 2 12 27 3 11 32 4 13 34 (Click on the icon in order to copy its contents into a spreadsheet.) How would you interpret the meaning of the annual rates of return? Question content area bottom Part 1 The rate of return you would have earned on Asman stock from time 1 to time 2 is enter your response here%. (Round to two decimal places.)arrow_forward

- You are given the three EPS estimates and the following estimates related to the market earnings multiple: EPS D/E Nominal RFR Risk premium ROE One shoul✓ -Select- a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ underweight overweight Consensus intrinsic market value: $ b. Assuming that the S&P Industrials Index at the beginning of the year was priced at 2,050, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): Rate of return (pessimistic scenario): Rate of return (consensus scenario): Assuming your required rate of return is equal to the consensus,…arrow_forwardSuppose that S = $100, K = $100, r = 0.08, σ = 0.30, δ = 0, and T = 1. Construct a standard two-period binomial stock price tree using the method in Chapter 10. consider stock price averages computed by averaging the 6-month and 1-year prices. What are the possible arithmetic and geometric averages after 1 year? Construct a binomial tree for the average. How many nodes does it have after 1 year? (Hint: While the moves ud and du give the same year-1 price, they do not give the same average in year 1.) What is the price of an Asian arithmetic average price call? What is the price of an Asian geometric average price call?arrow_forwardCan the answer be given in excel format...arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education