Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

give answer without fail

Transcribed Image Text:+

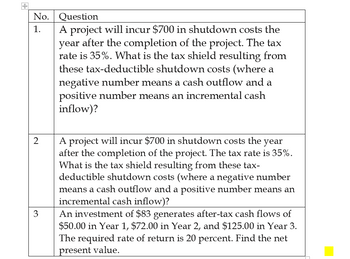

No. Question

1.

2

3

A project will incur $700 in shutdown costs the

year after the completion of the project. The tax

rate is 35%. What is the tax shield resulting from

these tax-deductible shutdown costs (where a

negative number means a cash outflow and a

positive number means an incremental cash

inflow)?

A project will incur $700 in shutdown costs the year

after the completion of the project. The tax rate is 35%.

What is the tax shield resulting from these tax-

deductible shutdown costs (where a negative number

means a cash outflow and a positive number means an

incremental cash inflow)?

An investment of $83 generates after-tax cash flows of

$50.00 in Year 1, $72.00 in Year 2, and $125.00 in Year 3.

The required rate of return is 20 percent. Find the net

present value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A project will incur $500 in shutdown costs the year after the completion of the project. The tax rate is 25%. What is the tax shield resulting from these tax-deductible shutdown costs (where a negative number means a cash outflow and a positive number means an incremental cash inflow)? Question 4Answer a. $-125 b. $-105 c. $105 d. $125arrow_forward+ No. Question 1. 2 3 A project will incur $700 in shutdown costs the year after the completion of the project. The tax rate is 35%. What is the tax shield resulting from these tax-deductible shutdown costs (where a negative number means a cash outflow and a positive number means an incremental cash inflow)? A project will incur $700 in shutdown costs the year after the completion of the project. The tax rate is 35%. What is the tax shield resulting from these tax- deductible shutdown costs (where a negative number means a cash outflow and a positive number means an incremental cash inflow)? An investment of $83 generates after-tax cash flows of $50.00 in Year 1, $72.00 in Year 2, and $125.00 in Year 3. The required rate of return is 20 percent. Find the net present value.arrow_forwardA project’s after-tax operating cash flow is $200,000 per year, with operating costs of $100,000 and depreciation of $20,000 per year. The firm’s marginal tax rate is 40%. What are the annual sales revenues from this project (rounded to the nearest dollar)? Select one: a. $200,000 b. $377,143 c. $394,286 d. $420,000 e. $640,000arrow_forward

- 15 A project will increase sales by $92,800 and cash expenses by $53,200. The project will cost $89,000 and be depreciated using straight-line depreciation to a zero book value over the 4-year life of the project. The tax rate is 35 percent. What is the operating cash flow of the project using the tax shield approach?arrow_forward1. Textron is considering a NEW project. The financial projections are as follows: Year 0 Year 1 24,000 7,000 Year 2 24,000 Year 3 Sales 24,000 Total Costs 7,000 7,000 Depreciation Capital Investment (or Cost of Equipment) Working Capital (Requirements/Levels) 10,000 10,000 10,000 40,000 2000 2500 1000 The Equipment will be sold at the end of Year 3 for 11,000. The relevant tax rate is 35%. Compute the cash flows for the project. Please select file(s) Select file(s)arrow_forwardYou are analyzing a project and have developed the following estimates. The depreciation is $47,900 a year and the tax rate is 21 percent. What is the worst-case operating cash flow? Unit sales Sales price per unit Variable cost per unit Fixed costs -$2,545 $11,145 $88,855 $27,556 O $63,937 Base-Case Lower Bound Upper Bound 9,800 12,800 $34 $24 $ 9,200 11,300 $ 39 $25 $ 9,700 $44 $26 $ 10,200arrow_forward

- what is the present value of the tax shield for the following project? the initial investment is $300,000. the project will last for 6 years, at which time the asset will be sold for $90,000. the asset will be depreciated on a declining balance basis at a rate of 20 percent. the firm's marginal tax rate is 40 percent. the firm's required rate of return is 8 percent a) 16,204.36 b) 82,539.68 c) 98,744.04 d) 66,335.32arrow_forwardmakaarrow_forwardS4arrow_forward

- ??arrow_forwardFarrow_forwardYou are analyzing a project and have developed the following estimates. The depreciation is $7,600 a year and the tax rate is 34 percent. What is the worst-case operating cash flow? Unit sales Sales price Variable cost Fixed costs TTT Base Case 3.100 $19 $12 $8.200 Lower Bound 2,500 $16 $10 $7.800 Upper Bound 3,400 $22 $14 $8.500 per unit O 1) -$1,311 O 2) -$641 3) $274 4) $1,206arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College