Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

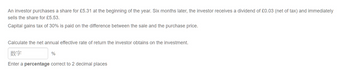

Transcribed Image Text:An investor purchases a share for £5.31 at the beginning of the year. Six months later, the investor receives a dividend of £0.03 (net of tax) and immediately

sells the share for £5.53.

Capital gains tax of 30% is paid on the difference between the sale and the purchase price.

Calculate the net annual effective rate of return the investor obtains on the investment.

数字

%

Enter a percentage correct to 2 decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the comission schedule from Company B shown in the table to find the annual rate of interest earned on the investment. (Note: commisions are rounded to the nearest cent.) An investor purchases 100 shares at $36.08 a share, holds the stock for 304 days, and then sells the stock for $49.31 a share. Assume a 360-day year. The annual rate of interest is %? (Round to three decimals)arrow_forwardAssume that at the beginning of the year, you purchase an investment for $6,500 that pays $95 annual income. Also assume the investment's value has increased to $7,050 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardCan you please help asaparrow_forward

- Provide answer general accountingarrow_forwardProvide correct answer general accountingarrow_forwardAssume you own shares in Walmart and that the company currently earns $6.80 per share and pays annual dividend payments that total $5.55 a share each year. Calculate the dividend payout for Walmart. Note: Enter your answer as a percent rounded to 2 decimal places. Dividend payout %arrow_forward

- You buy a share on 1 January for $35.18 and sell it on 31 December for $41.38. During the year you receive $2.30 in dividends from the share. What is your capital gain yield? a. -14.98% b. 14.98% c. 17.62% d. -17.62%arrow_forwardThe investor receives a dividendarrow_forwardFinancial accountingarrow_forward

- General Accounting questionarrow_forwardFinancial accounting questionsarrow_forwardFarris Inc. has perpetual preferred stock outstanding that sells for $38 a share and pays a dividend of $5.00 at the end of each year. What is the required rate of return? Round your answer to two decimal places. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT