Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

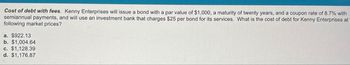

Transcribed Image Text:Cost of debt with fees. Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 8.7% with

semiannual payments, and will use an investment bank that charges $25 per bond for its services. What is the cost of debt for Kenny Enterprises at

following market prices?

a. $922.13

b. $1,004.64

c. $1,128.39

d. $1,176.87

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cost of debt with fees. Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 10.8% with semiannual payments, and will use an investment bank that charges $30 per bond for its services. What is the cost of debt for Kenny Enterprises at the following market prices? a. $931.44 b. $1,013.16 c. $1,102.27 d. $1,152.27 ..... a. What is the cost of debt for Kenny Enterprises at a market price of $931.44? |% (Round to two decimal places.)arrow_forwardCost of debt with fees. Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 11.2% with semiannual payments, and will use an investment bank that charges $30 per bond for its services. What is the cost of debt for Kenny Enterprises at the following market prices? a. $979.18 b. $1,009.76 c. $1,111.03 d. $1,147.97 a. What is the cost of debt for Kenny Enterprises at a market price of $979.18? ☐ % (Round to two decimal places.)arrow_forwardCost of debt with fees. Kenny Enterprises will issue a bond with a par value of$1,000, a maturity of twenty years, and a coupon rate of8.0%with semiannual payments, and will use an investment bank that charges$25per bond for its services. What is the cost of debt for Kenny Enterprises at the following market prices? a.$920b.$1,000c.$1,080d.$1,173arrow_forward

- Cost of debt. Kenny Enterprises has just issued a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 10.5% with semiannual payments. What is the cost of debt for Kenny Enterprises if the bond sells at the following prices? What do you notice about the price and the cost of debt? a. b. $1,000.00 c. $1,036.72 d. $1,161.82 $977.21arrow_forwardCost of debt. Kenny Enterprises has just issued a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 10.2% with semiannual payments. What is the cost of debt for Kenny Enterprises if the bond sells at the following prices? What do you notice about the price and the cost of debt? a. $938.10 b. $1,000.00 c. $1,041.98 d. $1,187.22 ..... a. What is the cost of debt for Kenny Enterprises if the bond sells at $938.10? % (Round to two decimal places.)arrow_forwardCost of debt. Kenny Enterprises has just issued a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 10.7% with semiannual payments. What is the cost of debt for Kenny Enterprises if the bond sells at the following prices? What do you notice about the price and the cost of debt? a. $967.34 b. $1,000.00 c. $1,045.83 d. $1, 189.10% (Round to two decimal places.)arrow_forward

- Cost of debt with fees Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.6% with semiannual payments, and will use an investment bank that charges $20 per bond for its services. What is the cost of debt for Kenny Enterprises at the following market prices? a. $959.56 b. $992.39 c. $1,060.96 d. $1,144.77 ACCES a. What is the cost of debt for Kenny Enterprises at a market price of $959.56? % (Round to two decimal places.)arrow_forwardIf the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratioarrow_forwardUse the following information about IGI security dealer. Market yields are in parenthesis, and amounts are in millions. Assets Liabilities and Equity Cash $10 Overnight Repos $170 1 month T-bills (7.05%) 75 Subordinated debt 3 month T-bills (7.25%) 75 7-year fixed rate (8.55% 150 2 year T-notes (7.50%) 50 8 year T-notes (8.96%) 100 5 year munis (floating rate) (8.20% reset every 6 months) 25 Equity 15…arrow_forward

- Doha plc has some surplus funds that it wishes to invest in bonds. The company requires a return of 15% on bonds, and the finance director has asked you to analyse whether it should invest in either of the following bonds that are available:Company A: Expected profit 12% bonds, redeemable at par at the end of two more years, with a current market value of QAR 95 per QAR 100 bondCompany B: Expected profit 8% bonds, redeemable at QAR110 at the end of two more years, with a current market value of QAR 95 per QAR 100 bonda. Calculate the expected value (price) of the two bonds and evaluate if either offer an appropriate return for Doha Plc.b. Critically evaluate what would be the impact on the price of bonds if Doha Plc reduces their required return.c. Critically evaluate and discuss the factors that should be considered by the directors of a company when choosing whether to use debt or equity finance for a new projectd. Recently one director has attended a finance conference, on their…arrow_forwardI want to correct answer accountingarrow_forwardYou are analyzing the cost of debt for a firm. You know that the firm’s 14-year maturity, 6.60 percent coupon bonds are selling at a price of $825.00. The bonds pay interest semiannually. If these bonds are the only debt outstanding, answer the following questions: What is the current YTM of the bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning