International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi, may get assistance to verify my answers I wrote on my notebook. Thank you.

Transcribed Image Text:Carambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger

Wayne estimates that Carambola will generate a free cash flow of 10 million Honduran lempiras (Lp) next year (2022), and that this free cash flow will continue to grow at a constant rate of

7.5% per annum indefinitely.

A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's

free cash flow in that year. The current spot exchange rate is Lp24.89 = $1.00, but the Honduran inflation rate is expected to remain at a relatively high rate of 14.5% per annum compared to

the U.S. dollar inflation rate of only 3.5% per annum. Slinger Wayne expects to earn at least a 22.5% annual rate of return on international investments like Carambola.

a. What is Carambola worth if the Honduran lempira were to remain fixed over the three-year investment period?

b. What is Carambola worth if the Honduran lempira were to change in value over time according to purchasing power parity?

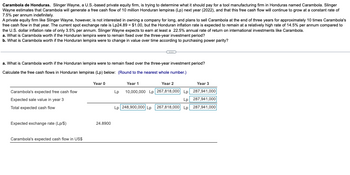

a. What is Carambola worth if the Honduran lempira were to remain fixed over the three-year investment period?

Calculate the free cash flows in Honduran lempiras (Lp) below: (Round to the nearest whole number.)

Carambola's expected free cash flow

Expected sale value in year 3

Total expected cash flow

Expected exchange rate (Lp/$)

Carambola's expected cash flow in US$

Year 0

24.8900

Year 1

Year 2

Year 3

Lp 10,000,000 Lp 267,818,000 Lp 287,941,000

Lp 287,941,000

Lp 248,900,000 Lp 267,818,000 Lp 287,941,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Carambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger Wayne estimates that Carambola will generate a free cash flow of 12 million Honduran lempiras (Lp) next year, and that this free cash flow will continue to grow at a constant rate of 7.0% per annum indefinitely. A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp15.8194/$, but the Honduran inflation rate is expected to remain at a relatively high rate of 15.0% per annum compared to the U.S. dollar inflation rate of only 2.5% per annum. Slinger Wayne expects to earn at least a 21% annual rate of return on international investments like Carambola. a. What is Carambola worth if the Honduran lempira were to…arrow_forwardProblem 18-5 (algorithmic) E Question Help Doohicky Devices. Doohickey Devices, Inc., manufactures design components for personal computers. Until the present, manufacturing has been subcontracted to other companies, but for reasons of quality control Doohicky has decided to manufacture the components itself in Asia. Analysis has narrowed the choice to two possibilities, Penang, Malaysia, and Manila, the Philippines. At the moment only the summary of expected, after-tax, cash flows displayed in the popup table, E, is available. Although most operating outflows would be in Malaysian ringgit or Philippine pesos, some additional U.S. dollar cash outflows would be necessary, as shown in the above popup table. The Malaysia ringgit currently trades at RM3.7447/$ and the Philippine peso trades at Ps48.34/$. Doohicky expects the Malaysian ringgit to appreciate 1.9% per year against the dollar, and the Philippine peso to depreciate 5.1% per year against the dollar. If the weighted average cost…arrow_forwardCarambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger Wayne estimates that Carambola will generate a free cash flow of 10 million Honduran lempiras (Lp) next year, and that this free cash flow will continue to grow at a constant rate of 8.5% per annum indefinitely. A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp14.3439/$, but the Honduran inflation rate is expected to remain at a relatively high rate of 15.0% per annum compared to the U.S. dollar inflation rate of only 3.0% per annum. Slinger Wayne expects to earn at least a 22.5% annual rate of return on international investments like Carambola. a. What is Carambola worth if the Honduran lempira were to…arrow_forward

- both A & B please.arrow_forwardNonearrow_forwardA fin-tech firm is considering devising a new payment system. The initial cost for developing this system will be $20 million today. Once the system development is completed, in one year, the system will be sold to a major bank for $25 million. Assume that both the development of the system and the sale of the project for $25 million are certain. The firm can pay $20 million of investment entirely using its own cash. Or the firm can also raise funds to finance part of the investment by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%. What is the NPV of this project if the fin-tech firm invests its own money and does not issue the new security? What is the NPV if the firm issues the new security? Briefly explain your answer by comparing the NPVsarrow_forward

- You have been asked to analyze the net present value of building a bridge in Asia. You estimate that building the bridge will cost you $50 million up front and that it will generate $4 million in cash flows next year via toll collection and that these cash flows will grow 10% a year for the following four years (Years 2-5). After year 5, you expect the cash flows to continue to grow at the inflation rate (2%). Assuming a cost of capital of 8%, what is the NPV of this project to you? Would you recommend taking on this project and why?arrow_forwardThe firm Lando expects cash flows in one year's time of $90 million if the economy is in a good state or $40 million if it is in a bad state. Both states are equally likely. The firm also has a debt with a face value of $65 million due in one year. Lando is considering a new project that would require an investment of $30 million today and would result in a cash flow in one year's time of $47 million in the good state of the economy or $32 million in the bad state. Investors are all risk-neutral and the risk-free rate is zero. (a) What are the expected values of the firm's equity and debt without the new project? Lando can finance the project by issuing new debt of $30 million. If the firm goes bankrupt the new debt will have a lower priority for repayment than the firm's existing debt. (b) If the new project is accepted, what will be the value of the firm's cash flow in each state after paying the original debtholders? What payment must Lando promise to…arrow_forwardBaghibenarrow_forward

- OpenDoor Cafe is considering opening a new food court in a major US city. The initial investment is expected to be $11,550,000. The projected cash flows are $3,410,000 in years one and two, $2,220,000 in year three, $1,990,000 in year four, and $4,485,000 on year five. What is this project's internal rate of return? 18.03% 10.61% 12.70% 6.95%arrow_forward2. Vacation Resorts Inc. (VRI) is interested in developing a new hotel in Spain. The company estimates that the hotel would require an initial investment of $32 million. VRI expects that the hotel will prodoce positive cash flows of $5.25 million a year at the end of each of the next 20 years. The project's cost of capital is 14%. While VRI expects the cash flows to be $5.25 million a year, it recognizes that the cash flows could, in fact, be much higher or lower, depending on whether the Spanish government imposes a large hotel tax. One year from now, VRI will know whether the tax will be imposed. There is a 25% chance that the tax will be imposed, in which case the annual cash flows will be only $4.2 million. At the same time, there is a 75% chance that the tax will not be imposed, in which case the annual cash flows will be $5.6 million. VRI is deciding whether to proceed with the hotel today or to wait I year to find out whether the tax will be imposed. If VRI waits a year, the…arrow_forwardMicheal’s Machinery is a German multinational manufacturing company. Currently, Micheal’s financial planners are considering undertaking a 1-year project in the United States. The project's expected dollar-denominated cash flows consist of an initial investment of $2000 and a cash inflow the following year of $2400. Micheal’s estimates that its risk-adjusted cost of capital is 12%. Currently, 1 U.S. dollar will buy 0.7 Germany. In addition, 1-year risk-free securities in the United States are yielding 6.5%, while similar securities in Germany’s are yielding 4.5%. If this project was instead undertaken by a similar U.S.-based company with the same risk-adjusted cost of capital, what would be the net present value and rate of return generated by this project? Round your answers to two decimal places. What is the expected forward exchange rate 1 year from now? Round your answer to two decimal places. If Micheal undertakes the project, what is the net present value and rate of return of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT