Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

gpl

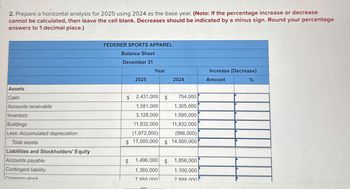

Transcribed Image Text:2. Prepare a horizontal analysis for 2025 using 2024 as the base year. (Note: If the percentage increase or decrease

cannot be calculated, then leave the cell blank. Decreases should be indicated by a minus sign. Round your percentage

answers to 1 decimal place.)

Assets

Cash

Accounts receivable

Inventory

Buildings

FEDERER SPORTS APPAREL

Balance Sheet

December 31

Year

Increase (Decrease)

2025

2024

Amount

%

$

2,431,000 $ 754,000

1,581,000

1,305,000

3,128,000

1,595,000

11,832,000

11,832,000

(1,972,000)

(986,000)

Less: Accumulated depreciation

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Contingent liability

Common stock

$ 17,000,000 $ 14,500,000

1,496,000 $ 1,856,000

$

1,360,000

1,100,000

7 888 000

7 888 0001

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardUsing these data from the comparative balance sheet of Ivanhoe Company, perform horizontal analysis. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 0 decimal places, e.g. 12%.) Increase or (Decrease) Dec. 31, 2022 Dec. 31, 2021 Amount Percentage Accounts receivable $ 487,200 $ 420,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal places. % Inventory $ 804,000 $ 670,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. % Total assets $3,237,600 $2,840,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. %arrow_forward

- Using these data from the comparative balance sheet of Ivanhoe Company, perform horizontal analysis. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 0 decimal places, e.g. 12%.) Increase or (Decrease) Dec. 31, 2022 Dec. 31, 2021 Amount Percentage Accounts receivable $ 487,200 $ 420,000 2$ Inventory $ 804,000 $ 670,000 $ Total assets $3,237,600 $2,840,000 eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer %24arrow_forwardA2 please help.....arrow_forwardSuppose McDonald's 2022 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities (a1) a. b. Compute the following values. C. $3,416.0 Interest expense 30,224.0 d. 2,988.0 16,191.0 Income taxes Net income $473.0 1,936.0 4,551.0 Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) Working capital. (Round to 1 decimal place, e.g. 5,275.5) Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) millions :1 % timesarrow_forward

- please help me understand why it was marked wrong.arrow_forwardSales Cost of goods sold Accounts receivable Numerator: 2021 $ 511,648 253,158 24,815 Numerator: Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. 2020 $ 332,239 164,397 19,403 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? Numerator: Trend Percent for Net Sales: 2019 $ 272,327 136,740 18,573 1 1 1 1 Denominator: Trend Percent for Cost of Goods Sold: 1 Denominator: 1 1 1 / 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Accounts Receivable: Denominator: 1 1 2021: 1 2020: 1 2019: 1 2018: 1 2017: 1 Is the trend percent for Accounts Receivable favorable or unfavorable? 2018 $ 200,979 99,730 11,757 = = = = = = = = = = = = = = = 2017 $ 146,700 71,883 10,064 = Trend percent Trend percent Trend percent % % % % % %…arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning