Please read all instructions carefully.

The following additions were made this year:

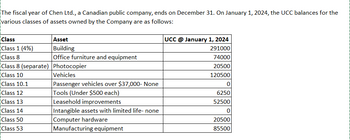

1. On September 15, 2024, a convertible is acquired at a cost of $66000 for use by the Vice President of the Company as a passenger vehicle.

2. Some new furniture was purchased at a cost of $15500.

3. On May 1, 2024, Chen Ltd. pays $121000 to enter a franchise agreement. The life of the franchise is 15 years.

4. On November 3, 2024, $161000 of class 53 manufacturing equipment was purchased.

5. On January 1, 2024, $43000 of leasehold improvements were made.

6. New computer hardware was purchased for $18500.

The following disposals were made this year:

1. The photocopier in the separate class 8 was disposed of for $5750. It was original purchased for $30,000.

2. Some old furniture was sold for proceeds of $8000. It was originally purchased for $12500.

3. Some computer hardware was sold for $8000. It was originally purchased on sale for $3650.

4. Some tools (from class 12) were sold for proceeds of $9600. The original cost of these tools was $12,000.

Other notes & information:

1. The Company leases a building for $15,000 per year that houses a portion of its manufacturing operations. The lease was negotiated on January 1, 2019 and has an original term of 10 years. There is one renewal option on the lease, for a period of two years. The company made $84,000 of leasehold improvements immediately after signing the lease. No further improvements were made until the current year.

2. It is the policy of the Company to deduct maximum CCA in all years.

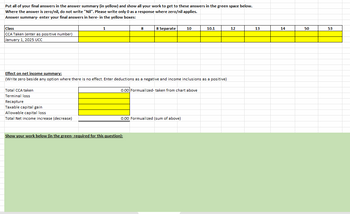

Required: Calculate the maximum 2024 CCA that can be taken on each class of assets, the January 1, 2025 UCC balance for each class, and any other 2024 inclusions or deductions resulting from the information provided in the problem. So use the template of the second screenshot to show answes, and calculations.

Step by stepSolved in 2 steps with 6 images

- At December 31, 2023, Sandhill Corp's general ledger includes the following account balances: Copyrights $52500 Deposits with advertising agency (will be used to promote goodwill) 43000 Discount on bonds payable 74000 Excess of cost over fair value of identifiable net assets of acquired subsidiary 589500 Trademarks 106000 In the preparation of Sandhill's balance sheet as of December 31, 2023, what should be reported as total intangible assets? O $158500 O $748000 $791000 O $822000arrow_forwardThe general ledger of Sunland Corporation as of December 31, 2021, includes the following accounts: Copyrights $ 56000 Deposits with advertising agency (will be used to promote goodwill) 33000 Discount on bonds payable 76000 Excess of cost over fair value of identifiable net assets of Acquired subsidiary 540000 Trademarks 71000 In the preparation of Sunland's balance sheet as of December 31, 2021, what should be reported as total intangible assets? $644000. $611000. $667000. $700000.arrow_forwardPresented below are the financial balances for the BonGiovi Company and the TerensCompany as of December 31, 2017, immediately before BonGiovi acquired Terens. Also included are the fair values for Terens Company's net assets at that date (thousands of US$). BonGiovi BV31.12.2017 Terens BV 31.12.2017 Terens FV 31.12.2017Cash 870 240 240Receivables 660 600 600Inventory 1,230 420 580Land 1,800 260 250Buildings (Net) 1,800…arrow_forward

- 5 On December 31, 2024, the end of the fiscal year, California Microtech Corporation completed the sale of its semiconductor business for $15 million. The semiconductor business segment qualifies as a component of the entity according to GAAP. Consider the following additional information. 2 points eBook Print References The book value of the assets of the segment at the time of the sale was $12 million. The loss from operations of the segment during 2024 was $4.5 million. Pretax income from other continuing operations for the year totaled $6.6 million. . The income tax rate is 25%. . · ● Prepare the lower portion of the 2024 income statement beginning with income from continuing operations before income taxes. Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example, $4,000,000 rather than $4. CALIFORNIA MICROTECH CORPORATION Partial Income Statement For the Year Ended December 31, 2024 Income from continuing…arrow_forwardAction, Inc. acquired the following assets and assumed the related liabilities of Slacker Corp. in a transaction completed on February 16, 2023: Accounts receivable, net Inventories Property, plant & equipment Non-amortizable intangible assets Carrying value for Slacker Current liabilities Noncurrent liabilities $ 11,000 $ 50,000 $ 100,000 $ 200,000 Fair Value $ 10,000 $ 50,000 $ 150,000 $ 225,000 $ (40,000) $(200,000) $ (40,000) $(200,000) Action paid $205,000 in cash for all of the above from Slacker. a) Determine if Action must record any goodwill. Show any calculations. b) Record the acquisition in Action's general journal on Feb. 16, 2023. Show: any calculations. c) Prepare any adjusting entry for amortization required as of the fiscal year end, December 31, 2023. If no amortization is required, explain why.arrow_forward☐ Compute the investment to be recorded at the date of acquisition. A) $1,750. B) $1,755. C) $1,725. CASE 1 Presented below are the financial balances for the BonGiovi Company and the Terens Company as of December 31, 2017, immediately before BonGiovi acquired Terens. Also included are the fair values for Terens Company's net assets at that date (thousands of US$). D) $1,760. E) $1,765. Compute consolidated inventory immediately following the acquisition. BonGiovi Book Value 31.12.2017 Terens Book Value 31.12.2017 Terens Fair Value 31.12.2017 Cash 870 240 240 A) $1,650. Receivables 660 600 600 Inventory 1,230 420 580 B) $1,810. Land 1,800 260 250 C) $1,230. Buildings (Net) 1,800 540 650 Equipment (net) 660 380 400 Accounts Payable (570) (240) (240) Accrued expenses (270) (60) (60) D) $580. E) $1,830. Long term Liabilities (2,700) (1,020) (1,120) Common Stock (1,980) ($20par) Common Stock ($5 (420) par) Additional paid in (210) (180) capital B) $1,800. Retained earnings (1,170) (480)…arrow_forward

- Oz Corporation has the following assets at year-end: Patents (net), 26,000; Land, 50,000; Buildings, 175,000; Accumulated Depreciation: Buildings, 57,500; Investment in Held-to-Maturity Bonds, 12,000; Equipment, 95,000; and Accumulated Depreciation: Equipment, 25,000. Prepare the property, plant, and equipment section of Ozs year-end balance sheet.arrow_forwardInformation concerning Tully Corporation's intangible assets is asfollows:a. On January 1, 2019, Tully signed an agreement to operate as afranchisee of Rapid Copy Service Inc. for an initial franchise fee of$85,000. Of this amount, $25,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $15,000each beginning January 1, 2020. The agreement provides that thedown payment is not refundable and no future services arerequired of the franchisor. The present value at January 2, 2019, ofthe 4 annual payments discounted at 14% (the implicit rate for a loan of this type) is $43,700. The agreement also provides that 5%of the revenue from the franchise must be paid to the franchisorannually. Tully's revenue from the franchise for 2019 was $900,000.Tully estimates the useful life of the franchise to be 10 years. b. Tully incurred $78,000 of experimental and development costs inits laboratory to develop a patent, which was granted on January 2, 2019. Legal…arrow_forwardSubject: acountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning