Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct calculation

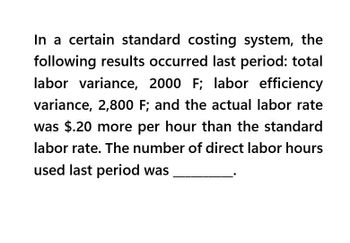

Transcribed Image Text:In a certain standard costing system, the

following results occurred last period: total

labor variance, 2000 F; labor efficiency

variance, 2,800 F; and the actual labor rate

was $.20 more per hour than the standard

labor rate. The number of direct labor hours

used last period was

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In a certain standard costing system, the following results occurred last period: total labor variance, 2000 F; labor efficiency variance, 2,800 F; and the actual labor rate was $.20 more per hour than the standard labor rate. The number of direct labor hours used last period was __.arrow_forwardIn a certain standard costing system, the following results occurred last period: total labor variance, 2800 F; labor efficiency variance, 3,700 F; and the actual labor rate was $0.45 more per hour than the standard labor rate.The number of direct labor hours used last period was __.arrow_forwardProvide Answerarrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardThe following data relate to direct labor costs for the current period: Standard costs 7,500 hours at $11.20 Actual costs 6,100 hours at $10.00 What is the direct labor rate variance? a. $23,000 unfavorable. b. $7,320 favorable. c. $23,000 favorable. d. $15,680 favorable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College