FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

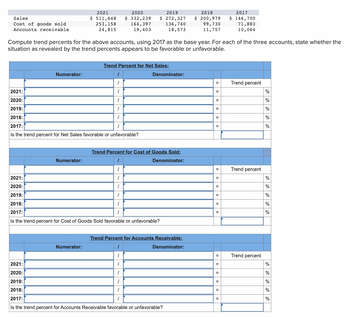

Transcribed Image Text:The image presents a financial analysis template used to compute trend percentages for sales, cost of goods sold, and accounts receivable from the years 2017 to 2021, using 2017 as the base year. Below is a transcription of the content:

### Table of Financial Data:

- **Sales:**

- 2021: $511,648

- 2020: $332,239

- 2019: $272,327

- 2018: $200,979

- 2017: $146,700

- **Cost of Goods Sold:**

- 2021: $253,158

- 2020: $164,397

- 2019: $136,740

- 2018: $99,730

- 2017: $71,883

- **Accounts Receivable:**

- 2021: $24,815

- 2020: $19,403

- 2019: $18,573

- 2018: $11,757

- 2017: $10,064

The text instructs to compute trend percentages for each category using 2017 as the base year. For each category, you are asked to determine whether the trend is favorable or unfavorable.

### Trend Percent Calculation Sections:

1. **Trend Percent for Net Sales:**

- Spaces provided to calculate the trend percent for each year from 2017 to 2021 as a percentage of the 2017 sales value.

- A prompt asking: "Is the trend percent for Net Sales favorable or unfavorable?"

2. **Trend Percent for Cost of Goods Sold:**

- Spaces provided to calculate the trend percent for each year from 2017 to 2021 as a percentage of the 2017 cost of goods sold value.

- A prompt asking: "Is the trend percent for Cost of Goods Sold favorable or unfavorable?"

3. **Trend Percent for Accounts Receivable:**

- Spaces provided to calculate the trend percent for each year from 2017 to 2021 as a percentage of the 2017 accounts receivable value.

- A prompt asking: "Is the trend percent for Accounts Receivable favorable or unfavorable?"

### Explanation of Tables:

Each section includes a structured table to fill in the calculations. The "Numerator" column represents the value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data are taken from the financial statements of Coronado Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 (a1) Compute for each year the accounts receivable turnover. At the end of 2020, accounts receivable (net) was $465,000. (Round answers to 1 decimal place, e.g. 1.6.) Accounts receivable turnover eTextbook and Media Save for Later (a2) 2022 2021 $525,000 $500,000 4,100,000 3,184,500 Average collection period 2022 times 2022 days 2021 2021 times Compute for each year the average collection period. At the end of 2020, accounts receivable (net) was $465,000. (Use 365 days for calculation. Round answers to 1 decimal place, e.g. 1.6.) Assistance Used Attempts: unlimited days Submit Answerarrow_forward3. Complete the below table to calculate the balance sheet data in trend percents with 2017 as base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2019, 2018 and 2017 2019 2018 2017 Assets Current assets % % 100.00 % Long-term investments 100.00 Plant assets, net 100.00 Total assets % % 100.00 % Liabilities and Equity Current liabilities % % 100.00 % Common stock 100.00 Other paid-in capital 100.00 Retained earnings 100.00 Total liabilities and equity % % 100.00 % see picturesarrow_forwardComputing rate of return on total assets Barot’s 2018 financial statements reported the following items—with 2017 figures given for comparison: Net income for 2018 was $3,910, and interest expense was $240. Compute Barot’s rate of return on total assets for 2018. (Round to the nearest percent.)arrow_forward

- a. Compute the current ratio for the current year. (Abbreviations used: STI = Short-term investments. Round your answer to two decimal places, X.XX.) Current ratio More Info a. Current ratio b. Cash ratio c. Acid-test ratio d. Inventory turnover e. Days' sales in inventory f. Days' sales in receivables g. Gross profit percentage Print Done Choose from any list or enter any number in the input fields a Financial Statements Balance Sheet: Cash Short-term Investments Net Accounts Receivables Merchandise Inventory Prepaid Expenses Total Current Assets Total Current Liabilities Income Statement: Net Credit Sales Cost of Goods Sold $ Current Year Preceding Year 15,000 $ 11,000 56,000 64,000 13,000 159,000 132,000 465,000 317,000 29,000 27,000 94,000 82,000 7,000 239,000 89,000arrow_forwardCompute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were $1,910. Stockholders' equity-common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal place e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.) (a) (b) Inventory turnover (c) (d) (e) (f) Current ratio (g) Profit margin Return on assets Return on common stockholders' equity Debt to assets ratio Times interest earned 2022 1.67 2 7.73 :1 times % % % % times 2021 1.79 2 4.42 :1 times de % % % % timesarrow_forwardCompute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable. Sales Cost of goods sold Accounts receivable Numerator: Numerator: 2024 $ 628,449 322,959 30,417 Numerator: 1 ( ( 2024: 2023: 2022: 2021: 2020: Is the trend percent for Net Sales favourable or unfavourable? Trend Percent for Net Sales: 2023 $ 408,084 209,773 23,750 } ( } 2022 2021 $ 334,495 $ 232, 288 173,642 22,846 Denominator: Trend Percent for Cost of Goods Sold: S Denominator: } } 1 1 1 2024: 2023: 2022: 2021: 2020: Is the trend percent for Cost of Goods Sold favourable or unfavourable? 1 Trend Percent for Accounts Receivable: Denominator: 1 2024: 1 2023: 1 2022: } 2021: 1 2020: 1 Is the trend percent for Accounts Receivable favourable or unfavourable? 119,917 13,589 || II II II = 11 "I = Trend percent = 111111 = = = 11 = = = 2020 $ 170,800 87,108 11,683 Trend percent…arrow_forward

- Husemann Co.'s assets include notes receivable from customers. During fiscal 2019, the amount of notes receivable averaged $525,000, and the interest rate of the notes averaged 4.2%. b-2. Prepare a horizontal model to show the collection of this amount. (Use amounts with + for increases and amounts with – for decreases.)arrow_forwardSales Cost of goods sold Accounts receivable 2021: 2020: 2018: 2018: 2021: 20:20: Compute trend percents for the above accounts, using 2017 as the bese year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Numerator: 2021: 2020: 2018: 2018: 2821 $ 553,453 284, 861 26,808 Numerator: Numerator: T 2017: Is the trend parcent for Net Sales favorable or unfavorable? I Trend Perent for Net Bales: I } J 2828 J I 184,986 21,060 2018: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Cost of Goods Bold: Denominator: 2019 $ 295,790 154,003 20,232 T " I Denominator: Trend Perent for Accounts Receivable: Denominator: 2018 $ 283,903 185,586 11,893 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? 11 11 "H |||||| 11 11 11 2817 $ 148,000 75,939 10,170 11 Trend percent Trend parcant Trend percent aan | 20arrow_forwardThe following data are taken from the financial statements of Colby Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 Accounts Receivable turnover Average collection period (b) 2022 $550,000 2022 2021 4,300,000 4,000,000 7.9 times $540,000 2021 7.5 times 46.2 days 48.7 days What conclusions about the management of accounts receivable can be drawn from the accounts receivable turnover and the average collections period.arrow_forward

- Compute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable. Sales Cost of goods sold Accounts receivable Numerator: 2024 $ 754,236 372,126 36,731 Numerator: 1 2023 $ 499,494 246,502 29,121 Trend Percent for Net Sales: 1 1 1 1 1 1 2024: 2023: 2022: 2021: 2020: Is the trend percent for Net Sales favourable or unfavourable? 2022 $394,857 196,780 27,127 Prev Denominator: Trend Percent for Cost of Goods Sold: 1 Denominator: 5 of 8 2021 $ 265,005 131,752 15,529 = Next > 2020 $ 196,300 96,187 13,407 Trend percent % % % % %arrow_forwardThe following is select financial statement information from Vortex Computing: Year Net Credit Sales Ending Accounts Receivable 2018 $1,557,200 $398,000 2019 $1,755,310 $444,400 2020 $1,865,170 $500,780 Compute the accounts receivable turnover ratios and the number of days’ sales in receivables ratios for 2019 and 2020 (round answers to two decimal places): 2019 Accounts Receivable Turnover = ["", "", "", ""] times. 2019 Days' Sales in Receivables = ["", "", "", ""] days. 2020 Accounts Receivable Turnover = ["", "", "", ""] times. 2020 Days' Sales in Receivables = ["", "", "", ""] days.arrow_forwardThe following select financial statement information from Candid Photography. CANDID PHOTOGRAPHY Year Net Credit Sales Ending Accounts Receivable 2017 $2,988,000 $1,290,450 2018 2019 3,750,860 4,000,350 1,345,600 1,546,550 Compute the accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What is the Average Accounts Receivable? What is the Net Credit Sales that would be used? What is the Accounts Relievable Turnover? what is the Days in Receivable Ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education