FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

![[The following information applies to the questions displayed below.]

Selected comparative financial statements of Korbin Company follow.

Sales

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

Total expenses

Income before taxes

Income tax expense

Net income

Assets

Current assets

Long-term investments

Plant assets, net

Total assets

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31

Liabilities and Equity

Current liabilities.

Common stock

2021

$402,722

242,439

160,283

57,187

36,245

93,432

66,851

12,434

$ 54,417

KORBIN COMPANY

Comparative Balance Sheets

Other paid-in capital

Retained earnings

Total liabilities and equity

December 31

2021

2020

$308,518

$26,516

64,000

8,000

83,100

$ 181,616

194,058

114,460

42,575

27,150

69,725

44,735

9,171

$ 35,564

2020

$ 42,119

$62,930

0

600

118,686

108,149

$ 181,616 $150,868

$ 22,479

64,000

8,000

56,389

$150,868

2019

$ 214,100

137,024

77,076

28,261

17,770

46,031

31,045

6,302

$ 24,743

2019

$ 56,304

4,670

64,020

$ 124,994

$21,874

46,000

5,111

52,009

$124,994](https://content.bartleby.com/qna-images/question/dc860f7d-8144-482b-af65-d08d28366106/5aeb7cf3-5c8f-499a-8d99-07aa46cdb56a/9vun9fm_thumbnail.jpeg)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Selected comparative financial statements of Korbin Company follow.

Sales

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

Total expenses

Income before taxes

Income tax expense

Net income

Assets

Current assets

Long-term investments

Plant assets, net

Total assets

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31

Liabilities and Equity

Current liabilities.

Common stock

2021

$402,722

242,439

160,283

57,187

36,245

93,432

66,851

12,434

$ 54,417

KORBIN COMPANY

Comparative Balance Sheets

Other paid-in capital

Retained earnings

Total liabilities and equity

December 31

2021

2020

$308,518

$26,516

64,000

8,000

83,100

$ 181,616

194,058

114,460

42,575

27,150

69,725

44,735

9,171

$ 35,564

2020

$ 42,119

$62,930

0

600

118,686

108,149

$ 181,616 $150,868

$ 22,479

64,000

8,000

56,389

$150,868

2019

$ 214,100

137,024

77,076

28,261

17,770

46,031

31,045

6,302

$ 24,743

2019

$ 56,304

4,670

64,020

$ 124,994

$21,874

46,000

5,111

52,009

$124,994

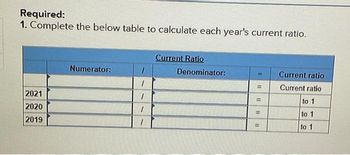

Transcribed Image Text:Required:

1. Complete the below table to calculate each year's current ratio.

2021

2020

2019

Numerator:

1

1

1

1

Current Ratio

Denominator:

=

=

11

11

=

II

Current ratio

Current ratio

to 1

to 1

to 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide me the solution with explanation of d,e,f and Garrow_forwardWhat is meant by Authorized and issued captial?arrow_forwardChoose the term that best describes static data? O Static data does not change once it is created. O Static data may change after it is recorded. O Static data is like a website. O Static data is very difficult to record.arrow_forward

- can you please write your solution out and not use excel.arrow_forwardCan you please enter the information clearly without so many spaces? The information is hard to read.arrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education