FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Calculate the Sales Growth of the most recent year. Enter answer as decimal (not percent. Example: .1234 is ok, 12.34% is not ok).

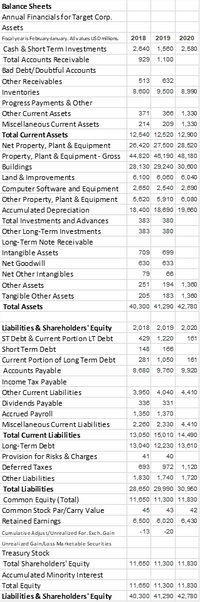

Transcribed Image Text:Balance Sheets

Annual Financials for Target Corp.

Assets

Fiscalyearis February-lanuary. Allvalues USD milios.

2018

2019

2020

Cash & Short Term Investments

2,840 1,580

2,580

Total Accounts Receivable

929 1,100

Bad Debt/Doubtful Accounts

Other Receivables

513

832

Inventories

8,600 9,500

8,990

Progress Payments & Other

Other Current Assets

371

368

1,330

Miscellaneous Current Assets

214

209

1,330

Total Current Assets

12,540 12,520 12,900

Net Property, Plant & Equipment

26,420 27,500 28,520

Property, Plant & Equipment- Gross 44,820 46, 190 48, 180

Buildings

Land & Improvements

28,130 29,240 30,000

6,100 6,060

6,040

Computer Software and Equipment

2,650 2,540

2,890

Other Property, Plant & Equipment

5,620 5,910

6,080

Accumulated Depreciation

18,400 18,690 19,680

Total Investments and Advances

383

380

Other Long-Term Investments

383

380

Long-Term Note Receivable

Intangible Assets

Net Goodwill

709

899

830

в33

Net Other Intangi ble

79

68

Other Assets

251

194

1,300

Tangible Other Assets

205

183

1,360

Total Assets

40,300 41,290 42,780

Liabilities & Shareholders' Equity

ST Debt & Current Portion LT Debt

2,018 2,019

2,020

429

1,220

181

Short Term Debt

148

166

Current Portion of Long Term Debt

Accounts Payable

281

1,050

181

8,880 9,780

9,920

Income Tax Payable

Other Current Liabilities

3,950 4,040

4,410

Dividends Payable

336

331

Accrued Payroll

1,350 1,370

Miscellaneous Current Liabilities

2,260 2,330

4.410

Total Current Liabilities

13,050 15,010 14,490

Long-Term Debt

Provision for Risks & Charges

13,040 12,230 13,610

41

40

Deferred Taxes

693

972

1,120

Other Liabilities

1,830 1,740

1,720

Total Liabilities

28,850 29,990 30,950

Common Equity (Total)

11,850 11,300 11,830

Common Stock Par/Carry Value

45

43

42

Retained Earnings

8,500 8,020

8,430

-13

-20

Cumulative Adjus t/Unrealized For. Exch. Gain

Unrealized Gain/Loss Ma rketable Securities

Treasury Stock

Total Shareholders' Equity

11,850 11,300 11,830

Accumulated Minority Interest

Total Equity

11,650 11,300 11,830

Liabilities & Shareholders' Equity

40,300 41,290 42,780

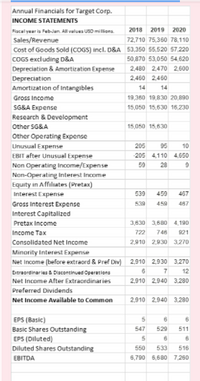

Transcribed Image Text:Annual Financials for Target Corp.

INCOME STATEMENTS

Fiscal year is FebJan. All values USD millions.

2018

2019

2020

Sales/Revenue

72,710 75,360 78,110

Cost of Goods Sold (COGS) incl. D&A 53,350 55,520 57,220

COGS excluding D&A

50,870 53,050 54,620

Depreciation & Amortization Expense

2,480 2,470 2,600

Depreciation

2,460 2,460

Amortization of Intangibles

14

14

Gross Income

19,360 19,830 20,890

SG&A Expense

15,050 15,630 16,230

Research & Development

Other SG&A

15,050 15,630

Other Operating Expense

Unusual Expense

EBIT after Unusual Expense

205

95

10

-205 4,110 4.650

Non Operating Income/Expense

Non-Operating Interest Income

Equity in Affiliates (Pretax)

59

28

9

Interest Expense

539

459

467

Gross Interest Expense

Interest Capitalized

539

459

487

Pretax Income

3,630 3,680 4,190

Income Tax

722

748

921

Consolidated Net Income

2,910 2,930 3,270

Minority Interest Expense

Net Income (before extraord & Pref Div) 2,910 2,930 3,270

Ertraordinaries & Discontinued Operations

7

12

Net Income After Extraordinaries

2.910 2,940 3,280

Preferred Dividends

Net Income Available to Common

2,910 2,940 3,280

EPS (Basic)

Basic Shares Outstanding

EPS (Diluted)

Diluted Shares Outstanding

547

529

511

6

550

533

516

EBITDA

6,790 6,680 7,260

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare a horizontal analysis of Nebraska Technologies's income statements. For decreases or negative numbers use a minus sign. Round percentages to one decimal place. Year 1 Increase (Decrease) Percent Favorable/Unfavorable 1 2 3 4 5 6 7 Sales Wage expense Rent expense Utilities expense Total operating expenses Net income Year 2 $158,400.00 $80,000.00 28,000.00 30,000.00 $138,000.00 $162,500.00 $92,500.00 30,000.00 25,000.00 $147,500.00 $20,400.00 $15,000.00arrow_forwardRequired: 1. Complete the following columns for each item in the comparative financial statements (Negative answers shoul be indicated by a minus sign. Round percentage answers to 2 decimal places, i.e., 0.1243 should be entered as 12.43.): Increase (Decrease) Year 2 over Year 1 Amount Percentage Statement of earnings: Sales revenue Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings $ 45,770 38,650 7,120 4,020 3,100 1,050 $ 2,050 Statement of financial position: Cash (4,720) Accounts receivable (net) (4,220) Inventory 6,200 Property, plant, and equipment (net) 6,380 $ 3,640 Current liabilities (3,840) Long-term debt 3,530 Common shares 0 Retained earnings 3,950 $ 3,640arrow_forwardThe fitted regression is Sales = 920 - 27.5 Price. (0-1) If Price = 1, what is the prediction for Sales? (Round your answer to 1 decimal place.) Sales (a-2) Choose the correct statement. A decrease in price decreases sales. O An increase in price increases sales. O An increase in price decreases sales. (b) If Price = 23, what is the prediction for Sales? (Round your answer to the nearest whole number.) Sales (c) Choose the right option. The intercept is meaningful as sales will be maximized when price is zero. O The intercept is not meaningful as a zero price is both unrealistic and unobserved.arrow_forward

- If Year 1 sales equal $830, Year 2 sales equal $913, and Year 3 sales equal $1130, the percentage to be assigned for Year 2 in a trend analysis, assuming that Year 1 is the base year, is 110%. 136%. 91%. 124%. eTextbook and Mediaarrow_forwardExpress the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Reason for Income Decline in Net Statement Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales 2$ 750,000 $ 690,000 Cost of goods sold 560,000 288,800 Gross profit 190,000 401,200 Operating expenses 129,200 219,200 Net income $ 60,800 $ 182,000 Income Statement Reason for Decline in Net Income >arrow_forwardThe comparative financial statements of Seward, Inc. include the following data: Current Year Prior Year Income Statement Net Sales Revenue $142,000 $112,000 Cost of Goods Sold 61,000 53,000 Operating Expenses Interest Expense 40, 200 33,200 4,700 4,700 Income Tax Expense 6, 200 29,900 5,200 Net Income 15,900 Balance Sheet Current Assets 127,000 107,000 Plant, Property and Equipment, Net Current Liabilities 110,000 117,000 51,000 44,000 49,000 131,000 224,000 49,000 Long-Term Liabilities Shareholders' Equity Total Liabilities & Shareholders' Equity 137,000 237,000 Which of the following would be shown on Seward's horizontal analysis when calculating percentage changes from t current year? Multiple Choicearrow_forward

- Express the following comparative income statements in common-size percents. C esponsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. Note: Round your percentage answers to 1 decimal place. Sales Cost of goods sold Gross profit Operating expenses Net Income GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year % 100.0 Current Year S $ $ 740,000 568,100 171,900 128,000 43,900 Prior Year $ $ $ 690,000 291,000 399,000 226,400 172,600 Prior Year % Reason for Decline in Not Ingarrow_forwardCompute increases (decreases) in percents for both Years 6 and 7 by entering all the missing data in the table below. Analyze and interpret any significant results revealed from this trend analysis.arrow_forwardExpress the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. Note: Round your percentage answers to 1 decimal place. GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales $ 725,000 100.0 $ 665,000 Cost of goods sold 562,700 1.0 291,000 Gross profit 162,300 0.4 374,000 Operating expenses 129,200 268,400 Net income 33,100 $ 105,600 Income Statement Reason for Decline in Net Income >arrow_forward

- The analysis of Inventory Turnover Ratio is as follows: 2015: 4.34 2016: 3.15 2017: 4.76 2018: 2.94 2019: 5.32 a. What is the trend analysis for that Inventory Turnover Ratio and why it is increasing/decreasing?arrow_forwardCalculate a base-weighted and current- weighted index. Years 1 is base and year 2 is current. Number of units bought Price paid per unit ($) Item 7. Year 1Year 2Year 1Year 2 A 121 141 $9 $10 B 149 163 $21 $23 C 173 182 $26 $27 D 194 103 $31 $33arrow_forwardRahularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education