Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter D, Problem 27AP

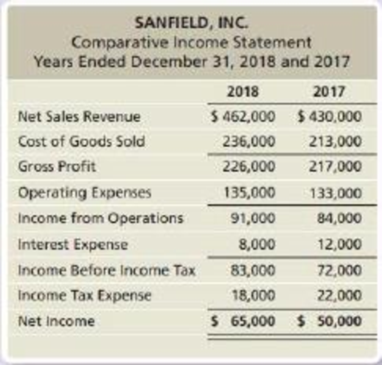

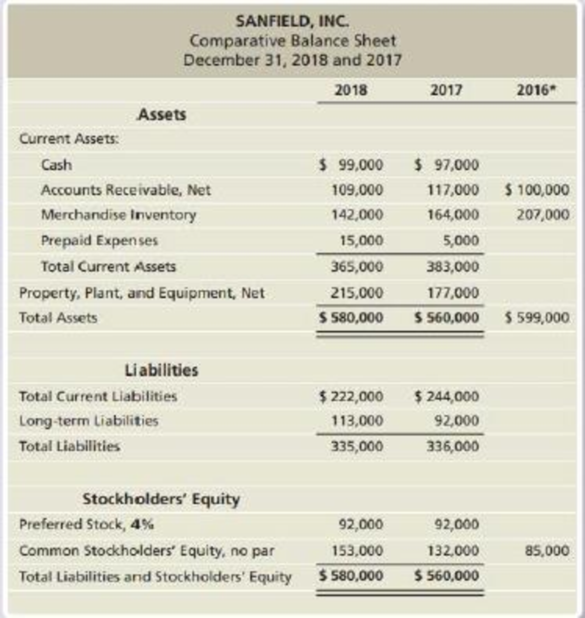

Comparative financial statement data of Sanfield, Inc. follow:

* Selected 2016 amounts

- 1. Market price of Sanfield’s common stock: $51.48 at December 31, 2018, and $37.08 at December 31, 2017.

- 2. Common shares outstanding: 16,000 on December 31, 2018 and 15,000 on December 31, 2017 and 2016.

- 3. All sales are on credit

Requirements

- 1. Compute the following ratios for 2018 and 2017:

- a.

Current ratio - b. Cash ratio

- c. Times-interest-earned ratio

- d. Inventory turnover

- e. Gross profit percentage

- f. Debt to equity ratio

- g.

Rate of return on common stockholders’ equity - h. Earnings per share of common stock

- i. Price/earnings ratio

- a.

- 2. Decide (a) whether Sanfield’s ability to pay debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Comparative financial statement data of Garfield, Inc. follow:

Market price of Garfield’s common stock: $69.36 at December 31, 2018, and $38.04 at December 31, 2017.

Common shares outstanding: 14,000 on December 31, 2018 and 12,000 on December 31, 2017 and 2016.

All sales are on credit.

Compute the following ratios for 2018 and 2017:

2018

2017

a. Current ratio

b. Cash ratio

c. Times-interest-earned ratio

d. Inventory turnover

e. Gross profit percentage

f. Debt to equity ratio

g. Rate of return on common stockholders’ equity

h. Earnings per share of common stock

i. Price/earnings ratio

Decide (a) whether Garfield’s ability to pay debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Using ratios to evaluate a stock investment

Comparative financial statement data of Garfield Inc. follow:

Market price of Garfield’s common stock:$69.36 at December 31 2018 and $38.04 at December 31, 2017.

Common shares outstanding 14, 000 on December 31, 2018 and 12,000 on December 31 2017 and 2016.

All sales are on credit.

Requirements

Compute the following ratios tor 2018 and 2017:

a. current ratio

b. Cash ratio

c. Times-interest-earned ratio

d. Inventory turnover

e. Gross profit percentage

f. Debt to equity ratio

g. Rate of return on common stockholder’s equity

h. Earnings per share of common stock

i. Price/earnings ratio

2. Decide (a) whether Garfield’s ability to pat debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Compute DuPont Analysis Ratios

Selected balance sheet and income statement information for Humana Inc., a health and well-being company, follows.

2018

2017

Company

($ millions) Ticker Revenue income Assets Assets

Humana Inc HUM $66,832 $11,603 $35,333 $37,098

2018

Compute the following 2018 ratios for Humana.

a. Return on equity (ROE)

$

$

Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE.

Numerator

Denominator

0 $

$

2018

Net 2018 2017 Stockholders' Stockholders'

0 $

♦

0

b. Profit margin (PM)

Note: 1. Select the appropriate numerator and denominator used to compute PM from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute PM.

Numerator

Denominator

0 $

◆

Equity

$20,081

0

ROE

0

PM

c. Financial leverage (FL)

Note: 1. Select the appropriate numerator and denominator used to compute FL from the drop-down menu options. 2. Enter the…

Chapter D Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. D - Prob. 1TICh. D - Prob. 2TICh. D - Prob. 3TICh. D - Prob. 4TICh. D - Prob. 5TICh. D - Prob. 6TICh. D - Prob. 7TICh. D - Prob. 8TICh. D - Prob. 9TICh. D - Prob. 10TI

Ch. D - Prob. 1QCCh. D - Prob. 2QCCh. D - Vertical analysis of Libertys balance sheet for...Ch. D - Prob. 4QCCh. D - Libertys inventory turnover during 2019 was...Ch. D - Prob. 6QCCh. D - Prob. 7QCCh. D - Prob. 8QCCh. D - Prob. 9QCCh. D - Prob. 10QCCh. D - Prob. 1RQCh. D - Prob. 2RQCh. D - Prob. 3RQCh. D - Prob. 4RQCh. D - Prob. 5RQCh. D - Prob. 6RQCh. D - Prob. 7RQCh. D - Prob. 8RQCh. D - Prob. 9RQCh. D - Prob. 10RQCh. D - Prob. 11RQCh. D - Prob. 12RQCh. D - Prob. 13RQCh. D - Prob. 1SECh. D - Verifine Corp. reported the following on its...Ch. D - Prob. 3SECh. D - Prob. 4SECh. D - Prob. 5SECh. D - Prob. 6SECh. D - Prob. 7SECh. D - Accels Companies, a home improvement store chain,...Ch. D - Prob. 9SECh. D - Prob. 10SECh. D - Prob. 11SECh. D - Prob. 12SECh. D - Prob. 13ECh. D - Prob. 14ECh. D - Prob. 15ECh. D - Refer to the data presented for Mulberry Designs,...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Micatin, Inc.s comparative income statement...Ch. D - Prob. 21ECh. D - Prob. 22ECh. D - Prob. 23APCh. D - Prob. 24APCh. D - Prob. 25APCh. D - Prob. 26APCh. D - Comparative financial statement data of Sanfield,...Ch. D - Prob. 28APCh. D - Prob. 29APCh. D - Prob. 30BPCh. D - Prob. 31BPCh. D - Prob. 32BPCh. D - Prob. 33BPCh. D - Prob. 34BPCh. D - Prob. 35BPCh. D - In its annual report, XYZ Athletic Supply, Inc....Ch. D - Prob. 38PCh. D - Lance Berkman is the controller of Saturn, a dance...Ch. D - Prob. 1EICh. D - Prob. 1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Debt Management and Short-Term Liquidity Ratios The following items appear on the balance sheet of Figgins Company at the end of 2018 and 2019: Required: Between 2018 and 2019, indicate whether Figgins debt to equity ratio increased or decreased. Also, indicate whether Figgins current ratio increased or decreased. Interpret these ratios.arrow_forwardRatio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forwardThe Jimenez Corporation’s forecasted 2020 financial statements follow, along with some industry average ratios. Calculate Jimenez’s 2020 forecasted ratios, compare them with the industry average data, and comment briefly on Jimenez’s projected strengths and weaknesses. Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2020 Jimenez Corporation: Forecasted Income Statement for 2020 Jimenez Corporation: Per Share Data for 2020 Notes: aIndustry average ratios have been stable for the past 4 years. bBased on year-end balance sheet figures. cCalculation is based on a 365-day year.arrow_forward

- Debt Management Ratios Glow Corporation provides annual and quarterly financial data to the public. For the years of 2018 and 2019. Glows financial data included the following account balances: Required: Determine whether the debt to equity ratio is increasing or decreasing and whether Glow should be concerned.arrow_forwardCompute DuPont Analysis Ratios Selected balance sheet and income statement information for Humana Inc., a health and well‑being company, follows. 2018 2017 2018 2018 Net 2018 2017 Stockholders’ Stockholders’ Company ($ millions) Ticker Revenue income Assets Assets Equity Equity Humana Inc HUM $66,610 $11,381 $35,111 $36,876 $19,859 $19,540 Compute the following 2018 ratios for Humana. a. Return on equity (ROE) Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE. Numerator Denominator ROE Answer Answer Answer Answer b. Profit margin (PM) Note: 1. Select the appropriate numerator and denominator used to compute PM from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute PM. Numerator Denominator PM Answer Answer Answer Answer c. Financial leverage…arrow_forwardCalculation and interpretation of ratios. Data for White Star Limited: Net operating profit after tax is $25 million (2018: $38 million). 1. Use the information above to calculate for 2019 and 2018: debt-to-equity ratio return on equity ratio earnings per share ratio.arrow_forward

- Instructions Using the financial statements and additional information, compute the following ratios for the El Camino Company for 2021. Show all computations. Computations 1. Current ratio 2. Return on common stockholders' equity 3. Price-earnings ratio 4. Inventory turnover 5. Accounts receivable turnover 6. Times interest earned 7. Profit margin 8. Days in inventory 9. Payout ratio 10. Return on assetsarrow_forwardCalculate the following ratios based on the upcoming data based on the 2021 year-end. 13.1 Current Ratio 13.2 Quick Ratio 13.3 Debt to Equity 13.4 Working Capital 13.5 Earnings per share 13.6 Accounts Receivable turnover 13.7 Inventory Turnover 13.8 Average Collection Period 13.9 Average Sale Period 13.10 Return on Common Shareholders’ Equity 2021 2020 Current Assets Cash 10,000 6,500 Accounts Receivable 5,000 7,000 Inventory 15,000 10,000 Prepaids 2,000 3,500 Marketable Securities 23,000 20,000 Total Current Assets…arrow_forwardIndustry Financial Ratios (2019)Quick ratio 1.0Current ratio 2.7Inventory turnover 7.0Total assets turnover 2.6Return on assets 9.1%Return on equity 18.2%Debt ratio 50.0%Gross Profit margin 20%Net Profit margin 3.5%P/E ratio 6.0RequiredCalculate Walton’s 2019 ratios, interpret and compare them with the industry averagedata, and comment briefly on Walton’s strengths and weaknesses.arrow_forward

- The comparative financial statements of Bettancort Inc. are as follows. The market price of Bettancort Inc. common stock was $71.25 on December 31, 2014. InstructionsDetermine the following measures for 2014, rounding to one decimal place:1. a.Working capital b. Current ratio c. Quick ratiod. Accounts receivable turnovere. Number of days' sales in receivablesf. Inventory turnoverg. Number of days' sales in inventoryh. Ratio of fixed assets to long-term liabilitiesi. Ratio of liabilities to stockholders’ equityj. Number of times interest charges are earnedk. Number of times preferred dividends are earned2. a. Ratio of net sales to assetsb. Rate earned on total assetsc. Rate earned on stockholders' equityd. Rate earned on common stockholders' equitye. Earnings per share on common stockf. Price-earnings ratiog. Dividends per share of common stockh. Dividend yieldarrow_forwardFind the following financial ratios for LVMH Moet Hennessy Louis Vuitton SA (use year-end figures rather than average values where appropriate) (Round your answers to 2 decimal places (e.g., 32.16).) : 2015 2016 Short-term solvency ratios: Current ratio Quick ratio Cash ratio Asset utilization ratios: Total asset turnover Inventory turnover Receivables turnover Long-term solvency ratios: Total debt ratio Debt–equity ratio Equity multiplier Times interest earned ratio Profitability ratios: Profit margin % % Return on assets % % Return on equity % %arrow_forwardRequired:a. Calculate the following ratios for Sweets plc for 2021 and 2020, showing the formulas and workings:1- ROCE2- ROE3- Earnings per share4- Net profit margin5- Asset turnover6- Stock holding days7- Debtors collection period8- Current ratio9- Gearing ratio10- Interest coverarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License