Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter D, Problem 8SE

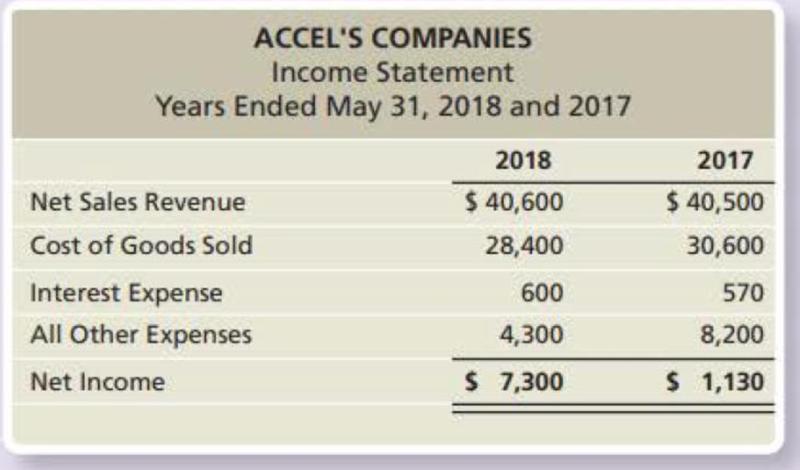

Accel’s Companies, a home improvement store chain, reported the following summarized figures:

Accel’s has 10,000 common shares outstanding during 2018.

Requirements

- 1. Compute the debt ratio and the debt to equity ratio at May 31, 2018, for Accel’s Companies.

- 2. Is Accel’s ability to pay its liabilities strong or weak? Explain your reasoning.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Win's Companies, a home improvement store chain, reported the following summanzed figures

E (Click the icon to view the income statement.)

E (Click the icon to view the balance sheets.)

Win's has 20,000 common shares outstanding during 2018.

Read the requirements

Requirement 1. Compute Win's Companies' current ratio at May 31, 2018 and 2017

Begin by selecting the formula to calculate Win's Companies' current ratio. Then enter the amounts and calcu ale the current ratio for 2018 and then 2017. (Round your answers to two decimal places, X.XX.)

Current ratio

(i Balance Sheets

Income Statement

Win's Companies

Win's Companies

Balance Sheet

Income Statement

May 31, 2018 and 2017

Years Ended May 31, 2018 and 2017

Assets

Liabilities

2018

2017

2018

2017

2018

2017

Net Sales Revenue

24

57 200 $

39,800

Cash

$.

2.300 $

1300 Total Current Liabilities

22,000 $

12,900

Cost of Goods Sold

22.500

25,500

12,200

11,300

Short-term Invesiments

29 000

13.000 Long-term Liabilities

Interest Expense

500

320…

The following balance sheet information (in $ millions) comes from the Annual Report to Shareholders of Merry International Incorporated for the 2024 fiscal year. The following additional information from an analysis

of Merry's financial position is available: Current ratio = 1.352272; Acid - test ratio = 0.5769817; Debt to equity ratio = 0.6063000. Required: Compute the missing amounts in the balance sheet. Note: Enter your

answers in millions of dollars. Round your intermediate and final answers to the nearest whole dollar. MERRY INTERNATIONAL INCORPORATED Balance Sheet At December 31, 2024 ($ in millions) Assets Current assets

\table[[Cash and cash equivalents,,510]. [Accounts and notes receivable]. [Inventory], [Other,, 460], [Total current assets], [Property and equipment, net,1,322,], [Intangible assets, net]. [Investments, 260,], [Notes and

other receivables, net,1,276,].[Other assets, 1, 152,]. [Total long-term assets], [Total assets]. [Liabilities and Shareholders' Equity],…

Use the following selected financial information for Cascabel Corporation to answer questions

Cascabel Corporation

Balance Sheet

December 31, 2015

Assets Liabilities and stockholders' equity

Current assets Current liabilities

Cash 2 Accounts payable 36

Short-term investments 10 Accrued liabilities 25

Accounts receivable 52 Total current liabilities 61

Inventory 57

Other current assets 8 Long-term debt 102

Total current assets 129 Total liabilities 163

Long-term assets Stockholders' equity

Net Plant 195 Common stock (10) 110

Retained earnings 51

Total stockholders'…

Chapter D Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. D - Prob. 1TICh. D - Prob. 2TICh. D - Prob. 3TICh. D - Prob. 4TICh. D - Prob. 5TICh. D - Prob. 6TICh. D - Prob. 7TICh. D - Prob. 8TICh. D - Prob. 9TICh. D - Prob. 10TI

Ch. D - Prob. 1QCCh. D - Prob. 2QCCh. D - Vertical analysis of Libertys balance sheet for...Ch. D - Prob. 4QCCh. D - Libertys inventory turnover during 2019 was...Ch. D - Prob. 6QCCh. D - Prob. 7QCCh. D - Prob. 8QCCh. D - Prob. 9QCCh. D - Prob. 10QCCh. D - Prob. 1RQCh. D - Prob. 2RQCh. D - Prob. 3RQCh. D - Prob. 4RQCh. D - Prob. 5RQCh. D - Prob. 6RQCh. D - Prob. 7RQCh. D - Prob. 8RQCh. D - Prob. 9RQCh. D - Prob. 10RQCh. D - Prob. 11RQCh. D - Prob. 12RQCh. D - Prob. 13RQCh. D - Prob. 1SECh. D - Verifine Corp. reported the following on its...Ch. D - Prob. 3SECh. D - Prob. 4SECh. D - Prob. 5SECh. D - Prob. 6SECh. D - Prob. 7SECh. D - Accels Companies, a home improvement store chain,...Ch. D - Prob. 9SECh. D - Prob. 10SECh. D - Prob. 11SECh. D - Prob. 12SECh. D - Prob. 13ECh. D - Prob. 14ECh. D - Prob. 15ECh. D - Refer to the data presented for Mulberry Designs,...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Micatin, Inc.s comparative income statement...Ch. D - Prob. 21ECh. D - Prob. 22ECh. D - Prob. 23APCh. D - Prob. 24APCh. D - Prob. 25APCh. D - Prob. 26APCh. D - Comparative financial statement data of Sanfield,...Ch. D - Prob. 28APCh. D - Prob. 29APCh. D - Prob. 30BPCh. D - Prob. 31BPCh. D - Prob. 32BPCh. D - Prob. 33BPCh. D - Prob. 34BPCh. D - Prob. 35BPCh. D - In its annual report, XYZ Athletic Supply, Inc....Ch. D - Prob. 38PCh. D - Lance Berkman is the controller of Saturn, a dance...Ch. D - Prob. 1EICh. D - Prob. 1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017. Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 22 Bank loans $ 22 Marketable securities 11 Accounts payable 80 Accounts receivable 111 Inventory 155 Total current assets $ 299 Total current liabilities $ 102 Fixed assets: Gross investment $ 251 Long-term debt 26 Less depreciation 71 Net worth (equity and retained earnings) 351 Net fixed assets $ 180 Total assets $ 479 Total liabilities and net worth $ 479 Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 32.0 Debt due within a year (bank…arrow_forwardThe comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Earnings per share. Return on common stockholders’ equity. Return on assets.arrow_forwardUse the following information for Short Exercises S15-6 through S15-10. Accel’s Companies, a home improvement store chain, reported the following summarized figures: Accel’s has 10,000 common shares outstanding during 2018. Evaluating current ratio Requirements Compute Accel’s Companies’ current ratio at May 31, 2018 and 2017. Did Accel’s Companies’ current ratio improve, deteriorate, or hold steady during 2018?arrow_forward

- At the end of the current year, the following information is available for both Pulaski Company and Scott Company. Pulaski Company Scott Company Total assets $ 860,000 $ 440,000 Total liabilities 360,000 240,000 Total equity 500,000 200,000 Required:1. Compute the debt-to-equity ratios for both companies.2. Which company has the riskier financing structure? Complete this question by entering your answers in the tabs below. Required 2 Compute the debt-to-equity ratios for both companies. Choose Numerator: / Choose Denominator: / Debt-to-Equity Ratio Pulaski Company / = Scott Company / =arrow_forwardPresented below are selected data from the balance sheet of Julian Company for 2024. The figures are expressed in millions. Total Current assets Property, plant, and equipment Other assets Total Current liabilities Total Long-term debt Total Stockholders' equity a. Determine the amount of total current assets for Julian's 2024 balance sheet. b. How much of Julian Company is financed by creditors? Also provide the percentage financed by creditors. c. How much of Julian Company is financed by stockholders? Also provide the percentage financed by stockholders. $? $12,325 $3,121 $1,278 $3,646 $11,677 Question 20 Lulu Enterprises began the year with total liabilities of $188,000 and total stockholders equity of $330,000. Using this information, answer each of the following independent questions. a) If Lulu's total assets increased by $50,000 and its total liabilities increased by $20,000 during the year, what was the amount of Lulu's stockholders' equity at the end of the year? b) If Lulu's…arrow_forwardFinney Corporation has the following data as of December 31, 2018: Compute the debt to equity ratio at December 31,2018. Total Current Liabilities $36,210 Total Stockholders' Equity $ ? Total Current Assets 32,670 Other Assets 33,500 Long-term Liabilities 204,970 Property, Plant, and Equipment, Net 330,610arrow_forward

- REQUIRED Use the information provided below to calculate the ratios for 2021 (expressed to two decimal places) that would reflect each of the following: The time taken by the company to settle its debts with trade suppliers The amount of debt that the company uses to finance its assets The operational effectiveness of the company before considering interest income,interest expense and company tax. What investors are willing to pay for the shares of the company with due considerationgiven to the profit generated by each share in the company. Comment on the FIVE (5) ratios of Oslo Limited as compared to the industry average provided in the additional information. INFORMATION The information given below was extracted from the books of Oslo Limited: OSLO LIMITED STATEMENT OF COMPREHENSIVE…arrow_forwardAnalyze your company’s liability section of the comparative balance sheets. Has the composition of current and long-term liabilities changed significantly over the period? Explain? Liabilities and Equity sections of Walmart's Balance Sheet As of January 31, (Amounts in millions) 2019 2018 LIABILITIES AND EQUITY Current liabilities: Short-term borrowings $ 5,225 $ 5,257 Accounts payable 47,060 46,092 Accrued liabilities 22,159 22,122 Accrued income taxes 428 645 Long-term debt due within one year 1,876 3,738 Capital lease and financing obligations due within one year 729 667 Total current liabilities 77,477 78,521 Long-term debt 43,520 30,045 Long-term capital lease and financing obligations 6,683 6,780 Deferred income taxes and other 11,981 8,354 Total liabilities 139,661 123,700arrow_forwardLizbeth Johnson, controller of Detroit Industries, a public company, is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Detroit’s financial statements. Below is selected financial information for the fiscal year ended March 31, 2021. Long-term debt Notes payable to banks, 12% .................................................... $ 4,000,000 4% convertible bonds payable ..................................................... 8,000,000 12% bonds payable...................................................................... 3,000,000 Total long-term debt.................................................................................. $15,000,000 Shareholders’ equity Preferred stock, 5% cumulative, $100 par value, 100,000 shares authorized, 50,000 shares issued and outstanding ....................................................................... $ 5,000,000 Common stock, $1 par, 10,000,000 shares authorized,…arrow_forward

- The below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017. Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 46 Bank loans $ 46 Marketable securities 23 Accounts payable 140 Accounts receivable 123 Inventory 215 Total current assets $ 407 Total current liabilities $ 186 Fixed assets: Gross investment $ 263 Long-term debt 38 Less depreciation 83 Net worth (equity and retained earnings) 363 Net fixed assets $ 180 Total assets $ 587 Total liabilities and net worth $ 587 Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 176.0 Debt due within a year (bank…arrow_forwardThe comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Times interest earned. Asset turnover. Debt to assets.arrow_forwardThe comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: 1- Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) Earnings per share. Return on common stockholders’ equity. Return on assets. Current. Acid-test. Accounts receivable turnover. Inventory turnover. Times interest earned. Asset turnover. Debt to assets. 2. Based on the ratios calculated, discuss briefly the improvement or lack thereof in financial position and operating results from 2020 to 2021 of Dubai Company.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License