Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter D, Problem 20E

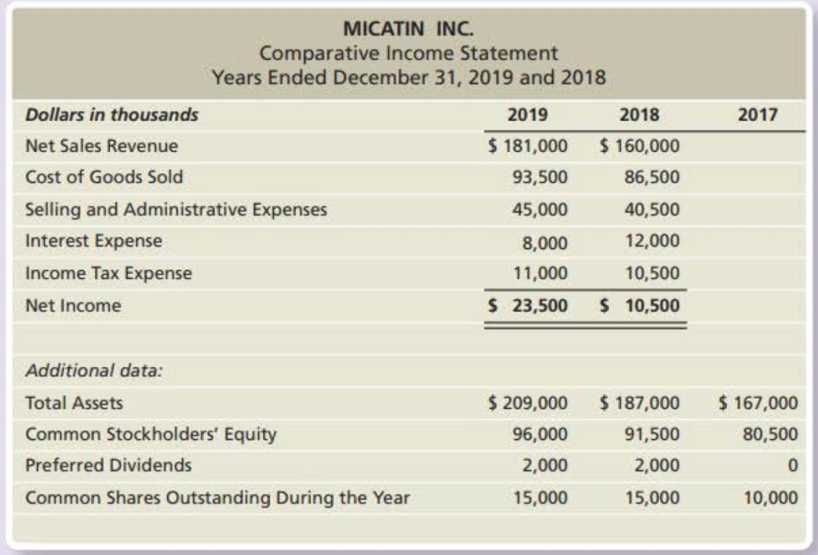

Micatin, Inc.’s comparative income statement follows. The 2l07 data are given as needed.

Requirements

- 1. Calculate the profit margin ratio for 2019 and 2018.

- 2. Calculate the

rate of return on total assets for 2019 and 2018. - 3. Calculate the asset turnover ratio for 2019 and 2018.

- 4. Calculate the rate of return on common stockholders’ equity for 2019 and 2018.

- 5. Calculate the earnings per share for 2019 and 2018.

- 6. Calculate the 2019 dividend payout on common stock, Assume dividends per share for common stock are equal to $1.13 per share.

- 7. Did the company’s operating performance improve or deteriorate during 2019?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Income statement and balance sheet data for The Athletic Attic are provided below.Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. c. Current ratio. b. Inventory turnover ratio. d. Debt to equity ratio. 2. Calculate the following profitability ratios for 2021 and 2022: a. Gross profit ratio. c. Profit margin. b. Return on assets. d. Asset turnover. 3. Based on the ratios calculated, determine whether overall risk and profitability improved from 2021 to 2022.

Using the fiscal year end 2020 annual report for General Mills, Inc. and the figures from the 2020 annual report as noted below, calculate the financial ratios for 2020 and 2019 indicated using the EXCEL template provided:1. Gross profit percentage2. Return on sales3. Asset turnover 4. Return on assets5. Return on common stockholders’ equity6. Current ratio7. Quick ratio8. Operating-cash-flow-to-current-liabilities ratio9. Accounts receivable turnoverTotal assets 2020 = $30,806.7Total stockholders’ equity 2020 = $8,349.5Total current liabilities 2020 = $7,491.5Accounts receivable 2020 = $1,615.1Inventory 2020 = $1,426.3Year-end closing stock price May 2020 = $58.80Year-end closing stock price May 2019 = $53.56

To calculate averages use (current year balance + poor year balance) / 2) Round percentages to 1 decimal place; round other answers to 2 decimal places.

a) Based on the information provided, calculate the following ratios for the years ended 31December 2021 and 2020.You should give the formula for each ratio, in addition to your calculation.I. Gross profit marginII. Operating profit marginIII. Return on equityIV. Current ratioV. Gearing

b) By comparing the financial information for years ended 31 December 2021 and 2020, andreviewing your ratio calculations, comment on the profitability, liquidity, and long-termsolvency of Mabel’s business over the past year. You should use the other information givento suggest reasons for any changes identified.

c)If an investor was interested in buying Mabel’s business and was presented with theseresults, what further advice would you give them?

Chapter D Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. D - Prob. 1TICh. D - Prob. 2TICh. D - Prob. 3TICh. D - Prob. 4TICh. D - Prob. 5TICh. D - Prob. 6TICh. D - Prob. 7TICh. D - Prob. 8TICh. D - Prob. 9TICh. D - Prob. 10TI

Ch. D - Prob. 1QCCh. D - Prob. 2QCCh. D - Vertical analysis of Libertys balance sheet for...Ch. D - Prob. 4QCCh. D - Libertys inventory turnover during 2019 was...Ch. D - Prob. 6QCCh. D - Prob. 7QCCh. D - Prob. 8QCCh. D - Prob. 9QCCh. D - Prob. 10QCCh. D - Prob. 1RQCh. D - Prob. 2RQCh. D - Prob. 3RQCh. D - Prob. 4RQCh. D - Prob. 5RQCh. D - Prob. 6RQCh. D - Prob. 7RQCh. D - Prob. 8RQCh. D - Prob. 9RQCh. D - Prob. 10RQCh. D - Prob. 11RQCh. D - Prob. 12RQCh. D - Prob. 13RQCh. D - Prob. 1SECh. D - Verifine Corp. reported the following on its...Ch. D - Prob. 3SECh. D - Prob. 4SECh. D - Prob. 5SECh. D - Prob. 6SECh. D - Prob. 7SECh. D - Accels Companies, a home improvement store chain,...Ch. D - Prob. 9SECh. D - Prob. 10SECh. D - Prob. 11SECh. D - Prob. 12SECh. D - Prob. 13ECh. D - Prob. 14ECh. D - Prob. 15ECh. D - Refer to the data presented for Mulberry Designs,...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Micatin, Inc.s comparative income statement...Ch. D - Prob. 21ECh. D - Prob. 22ECh. D - Prob. 23APCh. D - Prob. 24APCh. D - Prob. 25APCh. D - Prob. 26APCh. D - Comparative financial statement data of Sanfield,...Ch. D - Prob. 28APCh. D - Prob. 29APCh. D - Prob. 30BPCh. D - Prob. 31BPCh. D - Prob. 32BPCh. D - Prob. 33BPCh. D - Prob. 34BPCh. D - Prob. 35BPCh. D - In its annual report, XYZ Athletic Supply, Inc....Ch. D - Prob. 38PCh. D - Lance Berkman is the controller of Saturn, a dance...Ch. D - Prob. 1EICh. D - Prob. 1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following select financial statement information from Black Water Industries, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries?arrow_forwardCompare the following for the year 2019, 2020 and 2021 for the Acer Company: analysis in words incl. total assets, short term assets, long-term assets, non-current assets, return on assets, equity, equity growth or decrease over the years, Price-Earning ratio, liabilities.arrow_forwardLiverton Co.’s income statement for the year ended 31 March 2019 and statements of financial position at 31 March 2019 and 2018 were as follows in the images. Calculate for the financial year ended 31 March 2019 and, where possible, for 31 March 2018, the following ratios: i) Gross profit marginii) Assets usageiii) Current ratioiv) Acid testv) Inventories holding periodvi) Debt to Equity ratioarrow_forward

- Calculate the following profitability ratios for 2018 and 2019. a. Gross profit ratio b. Return on assets c. Profit margin d. assets turnoverarrow_forwardByers Company presents the following condensed income statement for 2019 and condensed December 31, 2019, balance sheet: Compute the following ratios for Byers ( round all computations to two decimals): ( 1) earnings per share, ( 2) gross profit margin, ( 3) operating profit margin, ( 4) net profit margin, ( 5) total asset turnover, ( 6) return on assets, (7) return on common equity, (8) receivables turnover (in days), and (9 ) interest coverage.arrow_forwardUsing the financiaql statements of Top Glove Corporation Berhad for the year 2020, provide and comment on the following: Calculate the profitability, liquidity and effiency ratios of the Top Glove Corporation Berhad company (use the following ratios: gross profit margin, net profit margin, return on capital employed, quick ratio, current ratio, accounts receivable turnover, accounts payables turnover, inventory turnover) for the year 2019 and 2020.arrow_forward

- Question 1 Mabel is a potter and sells her pottery at stalls that she rents in four tourist information centres across the south of England. Extracts from her financial statements for the years ended 31 December 2021 and 2020 are shown below. Statement of profit or loss for the year ended 31 December: 2021 28,900 |(16,500) 12,400 (3,800) 8,600 |(4,000) 4,600 2020 Revenue 27,200 (14,000) 13,200 (3,600) 9,600 Cost of sales Gross profit Operating expenses Operating profit Non-operating expenses Net profit 9,600 Statement of financial position as at 31 December: 2021 Non-current assets Current assets Total assets 22,660 4,360 27,020 2020 20,920 3,750 24,670 Equity Non-current liabilities Current liabilities Equity and liabilities 20,940 3,000 3,080 27,020 16,340 3,500 4,830 24,670 The following information is also relevant: In July 2021 the rent on one of Mabel's stalls was increased significantly for the third time in three years so she decided not to renew the annual contract. She sold…arrow_forwarda) Calculate on the following ratios for AZ Trading for 2020 and 2021: i. Debt-to-equity ratio ii. Net profit margin iii. Current ratio iv. Inventory turnover ratio b) Provide comments in terms of liquidity, profitability, efficiency and solvency based on the computed ratios in (a) above. c) List THREE (3) objectives of ratio analysis.arrow_forwardInstructions Using the financial statements and additional information, compute the following ratios for the El Camino Company for 2021. Show all computations. Computations 1. Current ratio 2. Return on common stockholders' equity 3. Price-earnings ratio 4. Inventory turnover 5. Accounts receivable turnover 6. Times interest earned 7. Profit margin 8. Days in inventory 9. Payout ratio 10. Return on assetsarrow_forward

- As part of your analysis, you are required to investigate Micron Industries’ cash flows and selected ratios.Required: Using the financial statement provided on page 1: (a) Compute the following ratios for Micron Industries for 2018 and 2019:i. Return on Equity using Du Pont Identity ii. Earnings Per Share (EPS) iii. Price/Earning (P/E) Ratio iv. Book Value Per Share v. Market-to-Book Ratio (b) Calculate the following for 2019:i. Operating Cash Flowii. Net Capital Spending iii. Change in Net Working Capital iv. Cash Flow from Assets v. Cash Flow to Creditors vi. Cash Flow to Stockholdersarrow_forwardAnswer probably please .... Calculate the following ratios for Avartar Sdn. Bhd. for years ended 31 March 2019 and 31 March 2018: 1) Gross profit percentage; 2) Net profit percentage (using profit before tax); 3) Return on capital employed; 4) Return on owners' equity; 5) Assets turnover;arrow_forwardHello! look at the attached images and answee the following points: (a) Calculate ratios for the year ended 31 December 2021 (showing your workings) for Primrose Plc, equivalent to those provided above. Return on year-end capital employed Net asset turnover Gross profit margin Net profit margin Current ratio Closing inventory holding period Trade receivables’ collection period viii. Trade payables’ payment period Dividend yield Dividend cover (b) Analyse the financial performance and position of Primrose Plc for the year ended 31 December 2021 compared to 31 December 2020. (c) Explain the uses and the general limitations of ratio analysis. Thank you a lot!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License