Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter D, Problem 16E

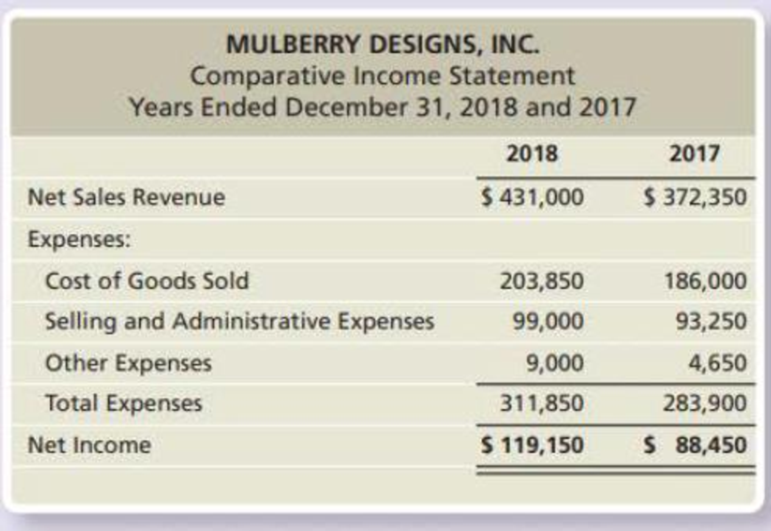

Refer to the data presented for Mulberry Designs, Inc. in Exercise E15-13.

Requirements

- 1. Prepare a comparative common-size income statement for Mulberry Designs, Inc. using the 2018 and 2017 data. Round percentages to one-tenth percent (three decimal places).

- 2. To an investor, how does 2018 compare with 2017? Explain your reasoning.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Requirements 1. Prepare a comparative common-size income statement for Mariner Designs, Inc. using the 2024 and 2023 data. Round percentages to one-tenth percent.

2. To an investor, how does 2024 compare with 2023 ? Explain your reasoning

Answer probably please ....

Calculate the following ratios for Avartar Sdn. Bhd. for years ended 31 March 2019 and 31 March 2018:

1) Gross profit percentage;

2) Net profit percentage (using profit before tax);

3) Return on capital employed;

4) Return on owners' equity; 5) Assets turnover;

Question 1

Mabel is a potter and sells her pottery at stalls that she rents in four tourist information centres

across the south of England.

Extracts from her financial statements for the years ended 31 December 2021 and 2020 are

shown below.

Statement of profit or loss for the year ended 31 December:

2021

28,900

|(16,500)

12,400

(3,800)

8,600

|(4,000)

4,600

2020

Revenue

27,200

(14,000)

13,200

(3,600)

9,600

Cost of sales

Gross profit

Operating expenses

Operating profit

Non-operating expenses

Net profit

9,600

Statement of financial position as at 31 December:

2021

Non-current assets

Current assets

Total assets

22,660

4,360

27,020

2020

20,920

3,750

24,670

Equity

Non-current liabilities

Current liabilities

Equity and liabilities

20,940

3,000

3,080

27,020

16,340

3,500

4,830

24,670

The following information is also relevant:

In July 2021 the rent on one of Mabel's stalls was increased significantly for the third time in

three years so she decided not to renew the annual contract. She sold…

Chapter D Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. D - Prob. 1TICh. D - Prob. 2TICh. D - Prob. 3TICh. D - Prob. 4TICh. D - Prob. 5TICh. D - Prob. 6TICh. D - Prob. 7TICh. D - Prob. 8TICh. D - Prob. 9TICh. D - Prob. 10TI

Ch. D - Prob. 1QCCh. D - Prob. 2QCCh. D - Vertical analysis of Libertys balance sheet for...Ch. D - Prob. 4QCCh. D - Libertys inventory turnover during 2019 was...Ch. D - Prob. 6QCCh. D - Prob. 7QCCh. D - Prob. 8QCCh. D - Prob. 9QCCh. D - Prob. 10QCCh. D - Prob. 1RQCh. D - Prob. 2RQCh. D - Prob. 3RQCh. D - Prob. 4RQCh. D - Prob. 5RQCh. D - Prob. 6RQCh. D - Prob. 7RQCh. D - Prob. 8RQCh. D - Prob. 9RQCh. D - Prob. 10RQCh. D - Prob. 11RQCh. D - Prob. 12RQCh. D - Prob. 13RQCh. D - Prob. 1SECh. D - Verifine Corp. reported the following on its...Ch. D - Prob. 3SECh. D - Prob. 4SECh. D - Prob. 5SECh. D - Prob. 6SECh. D - Prob. 7SECh. D - Accels Companies, a home improvement store chain,...Ch. D - Prob. 9SECh. D - Prob. 10SECh. D - Prob. 11SECh. D - Prob. 12SECh. D - Prob. 13ECh. D - Prob. 14ECh. D - Prob. 15ECh. D - Refer to the data presented for Mulberry Designs,...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Micatin, Inc.s comparative income statement...Ch. D - Prob. 21ECh. D - Prob. 22ECh. D - Prob. 23APCh. D - Prob. 24APCh. D - Prob. 25APCh. D - Prob. 26APCh. D - Comparative financial statement data of Sanfield,...Ch. D - Prob. 28APCh. D - Prob. 29APCh. D - Prob. 30BPCh. D - Prob. 31BPCh. D - Prob. 32BPCh. D - Prob. 33BPCh. D - Prob. 34BPCh. D - Prob. 35BPCh. D - In its annual report, XYZ Athletic Supply, Inc....Ch. D - Prob. 38PCh. D - Lance Berkman is the controller of Saturn, a dance...Ch. D - Prob. 1EICh. D - Prob. 1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following select financial statement information from Black Water Industries, compute the number of days sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries?arrow_forwardThe comparative financial statements of Global Technology are as follows: Review the worksheet RATIOA that follows these requirements. You have been asked to perform a ratio analysis of this company for 2012.arrow_forwardThe following select account data is taken from the records of Reese Industries for 2019. A. Use the data provided to compute net sales for 2019. B. Prepare a simple income statement for the year ended December 31, 2019. C. Compute the gross margin for 2019. D. Prepare a multi-step income statement for the year ended December 31, 2019.arrow_forward

- a) Based on the information provided, calculate the following ratios for the years ended 31December 2021 and 2020.You should give the formula for each ratio, in addition to your calculation.I. Gross profit marginII. Operating profit marginIII. Return on equityIV. Current ratioV. Gearing b) By comparing the financial information for years ended 31 December 2021 and 2020, andreviewing your ratio calculations, comment on the profitability, liquidity, and long-termsolvency of Mabel’s business over the past year. You should use the other information givento suggest reasons for any changes identified. c)If an investor was interested in buying Mabel’s business and was presented with theseresults, what further advice would you give them?arrow_forwardAnalyze the financial statements of the company to you in terms of:5) Profitability Ratio2020 Analysis BUT also compare with 2018 - 2019. Please show your solution on computation.arrow_forwardSolve and perform the different financial ratios using the financial statements of XYZ Company for the year 2021. 1. Current Ratio 2. Quick Ratio 3. Receivables Turnover 4. Inventory Turnover 5. Debt Ratio 6. Equity Ratio 7. Times Interest Earned 8. Gross Profit Margin 9. Operating Profit Margin 10. Net Profit Marginarrow_forward

- Use this data to compute the following ratios: 1.Current ratio (Dec 2020 )2.Acid-test Ratio (Dec 2020) 3.Accounts Receivable Turnover 4.Inventory Turnover 5.Return on Assets 6.Profit Margin on Sales 7.Return on Equity 8.Times Interest Earned b.Discuss the financial condition of ABC Company, Inc. based on what you learn from computing the ratios.arrow_forwardVII. Direction: Compute and interpret. The following comparative financial statements are provided by Avatar Industries. You were asked to compute the different financial ratios and provide your interpretations with regards to profitability, efficiency, liquidity and solvency of the company. Use the Answer Sheet template below to input your answer and solution. AVATAR INDUSTRIES AVATAR INDUSTRIES Comparative Statement of Financial Position For the years 2019 and 2018 Comparative Income Statement For the years 2019 and 2018 2019 2018 2019 2018 ASSETS Current Assets: Sales P200,000 P210,000 Cash & Cash Equivalent P65,000 P70,000 Sales Returns and Allowances 40,000 25,000 Accounts Receivable 40,000 35,000 Net Sales 160,000 185,000 Marketable Secuities 40,000 35,000 Cost of Goods Sold 100,000 115,625 Inventory 100,000 80,000 Gross Profit 60,000 69,375 Total Current Assets 220,000 200,000 160,000 P445,000 P380,000 245,000 Operating Expenses: Fixed Assets Selling Expenses 22,000 25,000 Total…arrow_forwardVII. Direction: Compute and interpret. The following comparative financial statements are provided by Avatar Industries. You were asked to compute the different financial ratios and provide your interpretations with regards to profitability, efficiency, liquidity and solvency of the company. Use the Answer Sheet template below to input your answer and solution. AVATAR INDUSTRIES AVATAR INDUSTRIES Comparative Statement of Financial Position For the years 2019 and 2018 Comparative Income Statement For the years 2019 and 2018 2019 2018 2019 2018 ASSETS Current Assets: Sales P200,000 P210,000 Cash & Cash Equivalent P65,000 P70,000 Sales Returns and Allowances 40,000 25,000 Accounts Receivable 40,000 35,000 Net Sales 160,000 185,000 Marketable Securities 40,000 35,000 Cost of Goods Sold 100,000 115,625 Inventory 100,000 80,000 Gross Profit 60,000 69,375 Total Current Assets 245,000 220,000 Operating Expenses: Fixed Assets 200,000 160,000 Selling Expenses 22,000 25,000 Total Assets P445,000…arrow_forward

- Use information from the balance sheet and income statement to calculate the following financial ratios and the market value added (MVA). (Whenever balance sheet numbers are used to calculate financial ratios, please ensure that you use the average of the 2019 and 2020 numbers in your calculation. To calculate MVA, you can assume that the average book value number for common stock and paid-in-surplus is the amount that the shareholders initially invested in the company.)arrow_forwardThe image uploaded is the calculation of Societe Generale Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardInstructions Using the financial statements and additional information, compute the following ratios for the El Camino Company for 2021. Show all computations. Computations 1. Current ratio 2. Return on common stockholders' equity 3. Price-earnings ratio 4. Inventory turnover 5. Accounts receivable turnover 6. Times interest earned 7. Profit margin 8. Days in inventory 9. Payout ratio 10. Return on assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License